Dentsu (TSE:4324): Examining Valuation as Investors Debate the Next Move

Reviewed by Simply Wall St

Most Popular Narrative: 3.5% Overvalued

The most widely followed narrative suggests Dentsu Group is currently trading above its estimated fair value, despite future growth catalysts on the horizon.

Dentsu's stepped-up internal investment in data, technology, and AI-driven platforms is expected to strengthen its offering in high-growth digital advertising and data-driven marketing. This could expand its addressable market and support long-term revenue growth and client retention.

What is really behind this valuation call? Analysts are building their case on bold changes in future earnings, margins, and where the business bets its chips for growth. The critical assumptions may surprise you, especially if you are expecting a typical rebound story. Want to decode the numbers and see what is driving this price target? Dive into the full analysis to discover what could set Dentsu’s next chapter apart.

Result: Fair Value of ¥3,070 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent challenges in Dentsu’s international business and continued reliance on Japan could quickly shift analyst optimism and reset market expectations.

Find out about the key risks to this Dentsu Group narrative.Another View: What Do Market Comparisons Suggest?

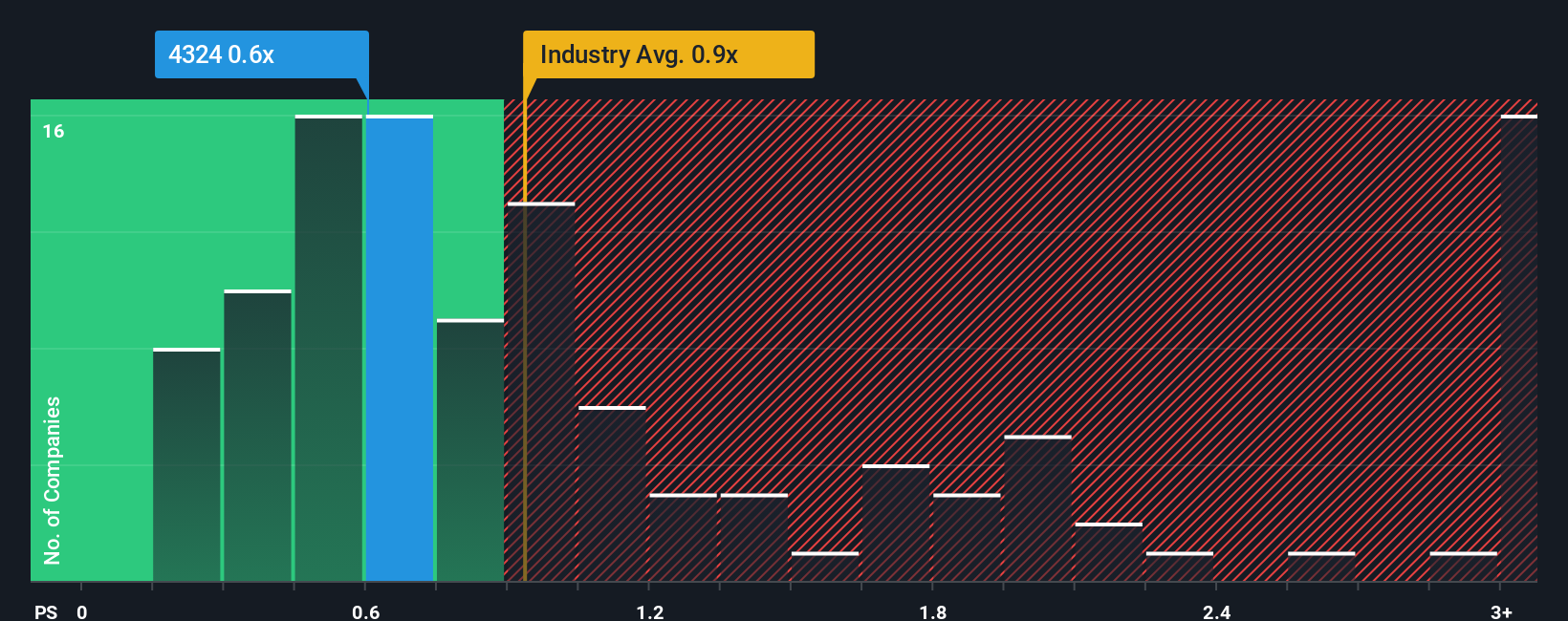

While analysts argue Dentsu Group is slightly overvalued on future growth, a look at its price-to-sales ratio paints a more optimistic picture. This measure suggests the company is attractively valued when compared with the wider industry. Could this pricing signal hidden opportunity, or is it just a value trap?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Dentsu Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Dentsu Group Narrative

If you see things differently or want to dig into the numbers on your own terms, it’s quick and easy to create your own perspective. Do it your way.

A great starting point for your Dentsu Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Upgrade your strategy by tracking companies leading the charge in tomorrow’s markets using our hand-picked selections below.

- Spot high potential by scanning for penny stocks with strong financials. These combine solid financials with affordable entry points for risk-tolerant investors.

- Secure tax-friendly income streams by reviewing dividend stocks with yields > 3%, which offer strong dividend yields and consistent payout histories.

- Fuel your portfolio’s growth momentum by targeting breakthroughs with AI penny stocks, highlighting companies at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4324

Dentsu Group

Operates in the advertising business in Japan, the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives