- Japan

- /

- Interactive Media and Services

- /

- TSE:3989

Sharingtechnology, Inc.'s (TSE:3989) 26% Price Boost Is Out Of Tune With Earnings

Sharingtechnology, Inc. (TSE:3989) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 5.8% isn't as attractive.

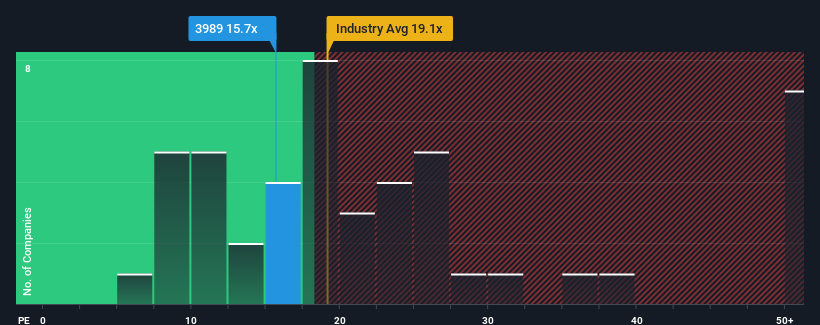

Since its price has surged higher, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider Sharingtechnology as a stock to potentially avoid with its 15.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Sharingtechnology could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Sharingtechnology

Is There Enough Growth For Sharingtechnology?

There's an inherent assumption that a company should outperform the market for P/E ratios like Sharingtechnology's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 664% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 11% over the next year. With the market predicted to deliver 10% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that Sharingtechnology's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Sharingtechnology shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sharingtechnology currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Sharingtechnology you should know about.

You might be able to find a better investment than Sharingtechnology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3989

Sharingtechnology

Provides matching services between stores and users in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.