- Japan

- /

- Interactive Media and Services

- /

- TSE:3979

It's Down 34% But Uluru.Co.,Ltd. (TSE:3979) Could Be Riskier Than It Looks

The Uluru.Co.,Ltd. (TSE:3979) share price has fared very poorly over the last month, falling by a substantial 34%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

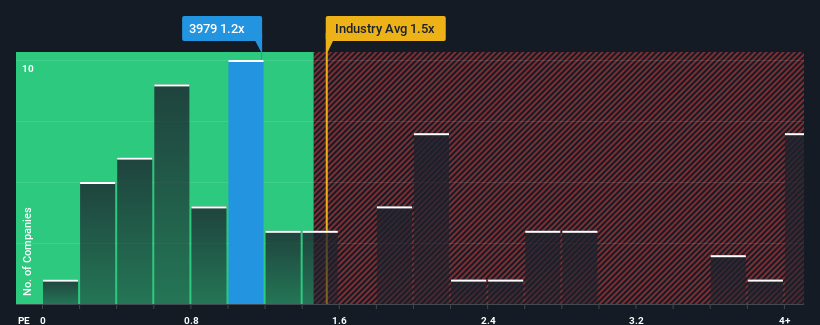

Although its price has dipped substantially, it's still not a stretch to say that Uluru.Co.Ltd's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Interactive Media and Services industry in Japan, where the median P/S ratio is around 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Uluru.Co.Ltd

How Uluru.Co.Ltd Has Been Performing

Revenue has risen firmly for Uluru.Co.Ltd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Uluru.Co.Ltd's earnings, revenue and cash flow.How Is Uluru.Co.Ltd's Revenue Growth Trending?

Uluru.Co.Ltd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 84% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this information, we find it interesting that Uluru.Co.Ltd is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Uluru.Co.Ltd's P/S?

Uluru.Co.Ltd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't quite envision Uluru.Co.Ltd's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Uluru.Co.Ltd (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3979

Uluru.Co.Ltd

Provides crowd generated, business process outsourcing (BPO), and crowdsourcing services in Japan.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives