High Growth Tech Stocks Including Wiit And Two More Top Picks

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility driven by tariff uncertainties and mixed economic indicators, the tech sector remains a focal point for investors seeking high growth opportunities. In this environment, identifying promising tech stocks involves assessing their resilience to external pressures and potential for innovation-driven expansion, as exemplified by companies like Wiit and others in the industry.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1216 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiit S.p.A. is a company that offers cloud services to businesses both in Italy and internationally, with a market capitalization of €473.54 million.

Operations: Wiit S.p.A. specializes in delivering cloud services to businesses across Italy and internationally. The company generates revenue primarily through its comprehensive cloud solutions, catering to a diverse range of business needs.

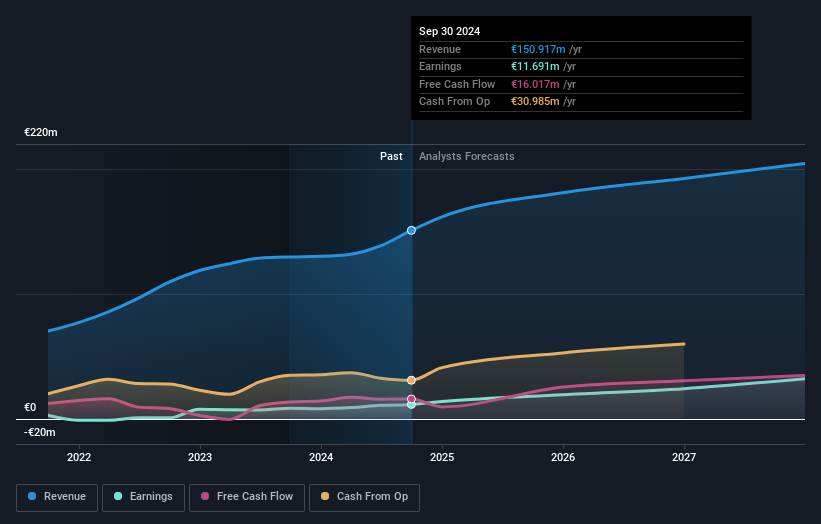

Wiit's strategic positioning in the tech sector is underscored by its robust earnings growth of 35.4% over the past year, outpacing the IT industry average of 22.7%. This performance is bolstered by an impressive forecast for revenue and earnings growth at annual rates of 7.4% and 28%, respectively, both metrics surpassing broader market averages. Particularly notable is Wiit's projected Return on Equity, expected to reach a high of 46.9% in three years, indicating efficient management and profitable reinvestment strategies. Despite challenges in covering interest payments with earnings, Wiit maintains positive free cash flow and a trajectory that suggests significant potential within the high-growth tech landscape.

- Click to explore a detailed breakdown of our findings in Wiit's health report.

Review our historical performance report to gain insights into Wiit's's past performance.

Akatsuki (TSE:3932)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Akatsuki Inc. operates in the game, comic, and other sectors mainly in Japan, with a market cap of ¥44.41 billion.

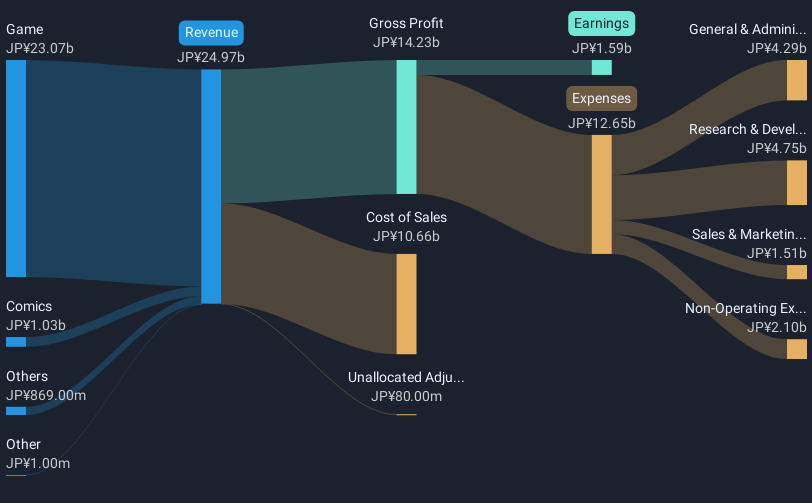

Operations: The company's primary revenue stream is from its game segment, generating ¥23.07 billion, followed by the comic segment with ¥1.03 billion. The focus on gaming highlights its significant role in the overall revenue model.

Akatsuki has demonstrated a remarkable trajectory in the tech sector, with its earnings surging by 172.3% over the past year, starkly outperforming the Entertainment industry's decline of 27.1%. This growth is complemented by an aggressive R&D investment strategy, where R&D expenses have escalated to represent a significant portion of revenue, positioning Akatsuki well for sustained innovation and market competitiveness. Additionally, the company's recent earnings release highlighted a robust annualized revenue growth rate of 14.4%, promising continued upward momentum in its financial performance. With such dynamic growth indicators coupled with strategic reinvestments in technology development, Akatsuki is poised to maintain its ascendancy within high-growth tech sectors.

- Take a closer look at Akatsuki's potential here in our health report.

Examine Akatsuki's past performance report to understand how it has performed in the past.

Cineplex (TSX:CGX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc., along with its subsidiaries, functions as an entertainment and media company both in Canada and internationally, with a market cap of CA$671.65 million.

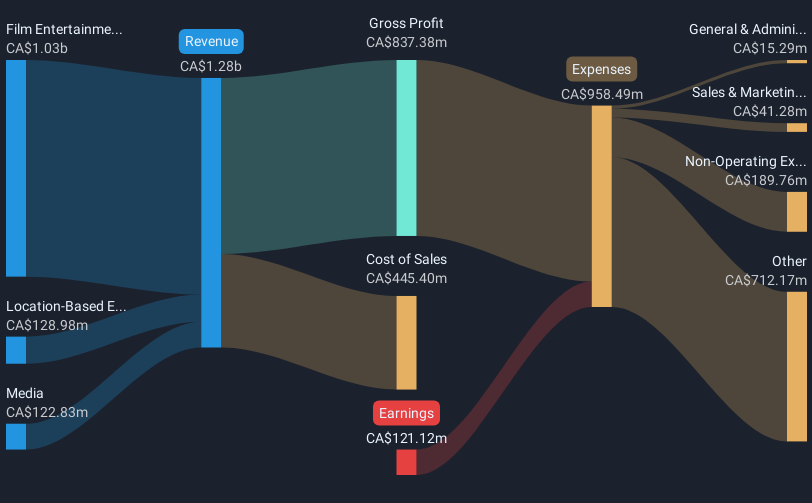

Operations: With a market cap of CA$671.65 million, the company generates revenue primarily from Film Entertainment and Content (CA$1.03 billion), followed by Location-Based Entertainment (CA$128.98 million) and Media (CA$122.83 million).

Cineplex, traditionally known for its cinema operations, is strategically expanding into entertainment complexes like The Rec Room and Playdium locations, enhancing its revenue streams and market presence. In December 2024 alone, box office revenues surged to $64.8 million, marking significant growth from previous years. This growth trajectory is supported by an innovative approach to integrating dining and entertainment under one roof, which not only attracts a diverse customer base but also boosts engagement levels across various demographics. With recent expansions creating hundreds of local jobs and introducing new premium experiences that accounted for 42% of November's box office revenue, Cineplex is effectively transforming its business model to adapt to evolving consumer preferences in the entertainment industry.

- Delve into the full analysis health report here for a deeper understanding of Cineplex.

Assess Cineplex's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1216 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:WIIT

Wiit

Provides cloud services for various businesses in Italy and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives