- Japan

- /

- Entertainment

- /

- TSE:3932

High Growth Tech Stocks Including Stemmer Imaging With Potential Growth

Reviewed by Simply Wall St

As global markets navigate a period of heightened volatility, with small-cap stocks underperforming and inflation concerns persisting, investors are closely examining the potential for growth within the tech sector. In such an environment, identifying high-growth tech stocks requires careful consideration of their innovation capabilities and resilience to economic shifts, making them appealing prospects amid broader market uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.58% | 61.86% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stemmer Imaging AG offers machine vision technology solutions for various industrial and non-industrial applications globally, with a market capitalization of €344.50 million.

Operations: Stemmer Imaging AG generates revenue primarily from its machine vision technology segment, with reported earnings of €113.27 million. The company focuses on providing solutions across diverse industrial and non-industrial sectors worldwide.

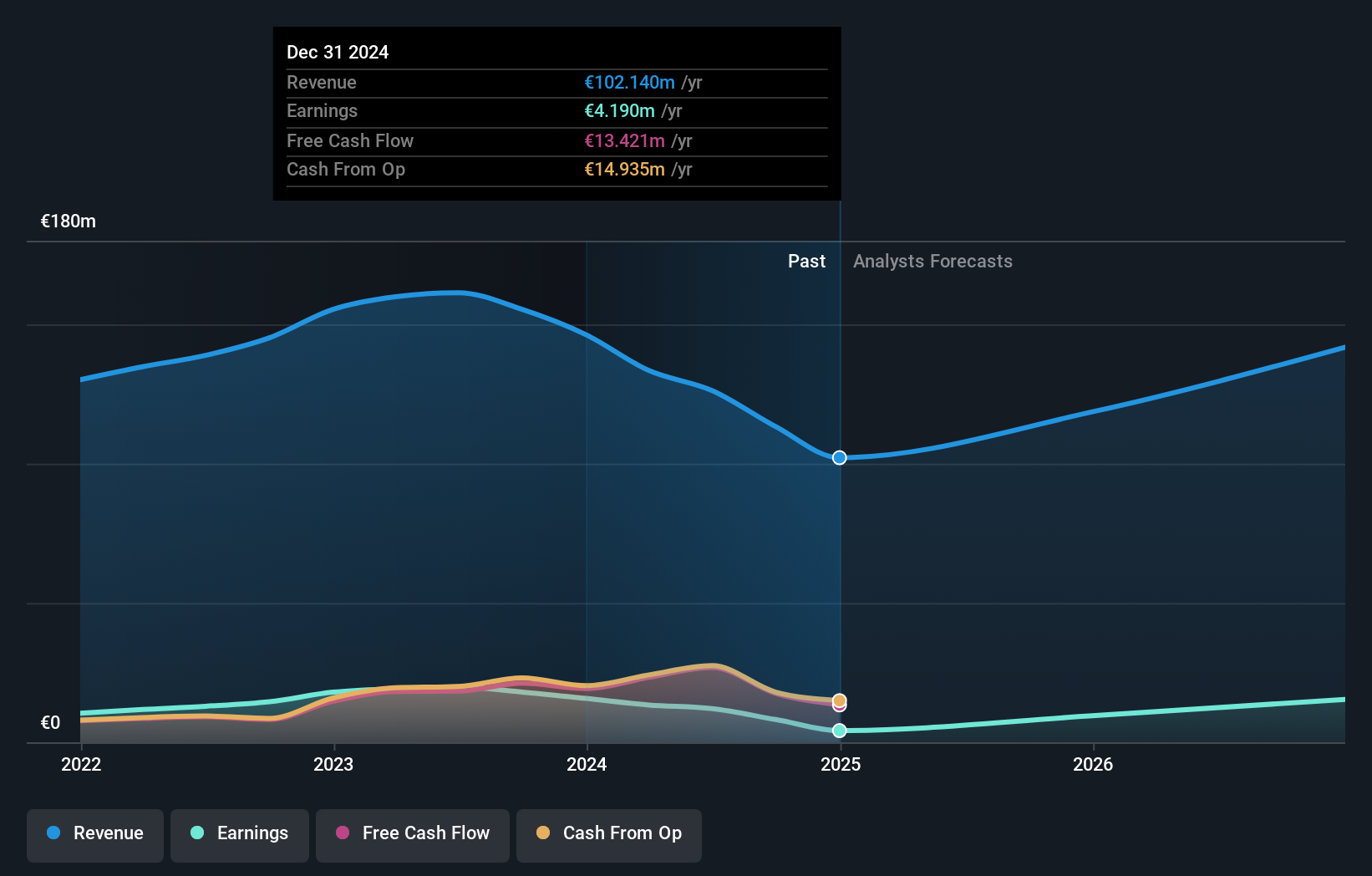

Stemmer Imaging, navigating through a transformative phase with a recent M&A activity, shows robust potential amidst challenges. The company's revenue growth at 9.1% annually is outpacing the German market's 5.5%, reflecting strong market adaptability. However, earnings have seen a significant contraction with a past year decrease of 54.7%, starkly contrasting its industry's average decline of 17.4%. Despite these hurdles, Stemmer is poised for substantial earnings recovery, projected at an impressive annual growth rate of 49%. This rebound is supported by strategic acquisitions and the potential delisting move to streamline operations and enhance shareholder value following MiddleGround Management’s takeover bid offering €48 per share—a premium indicative of confidence in Stemmer’s future trajectory.

Akatsuki (TSE:3932)

Simply Wall St Growth Rating: ★★★★☆☆

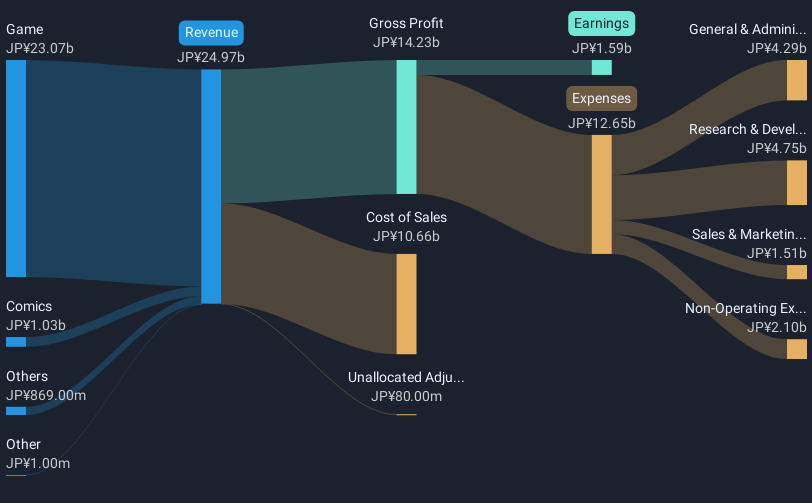

Overview: Akatsuki Inc. operates in the game, comic, and other business sectors primarily in Japan, with a market capitalization of ¥40.72 billion.

Operations: The company's primary revenue stream is from its game segment, generating ¥23.07 billion, followed by comics at ¥1.03 billion. The game segment significantly contributes to the overall revenue model.

Akatsuki's trajectory in the tech sector is underscored by a robust annual revenue growth of 14.4%, significantly outpacing the Japanese market average of 4.3%. This growth is complemented by an impressive earnings increase of 172.3% over the past year, starkly surpassing its industry's decline. Central to its financial strategy, Akatsuki has been aggressively investing in R&D, allocating funds that bolster innovation—evident from their recent enhancements in mobile gaming and digital entertainment platforms. These strategic moves not only reflect Akatsuki’s adaptability but also position it well for sustained future growth amidst evolving market demands.

- Click to explore a detailed breakdown of our findings in Akatsuki's health report.

Examine Akatsuki's past performance report to understand how it has performed in the past.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

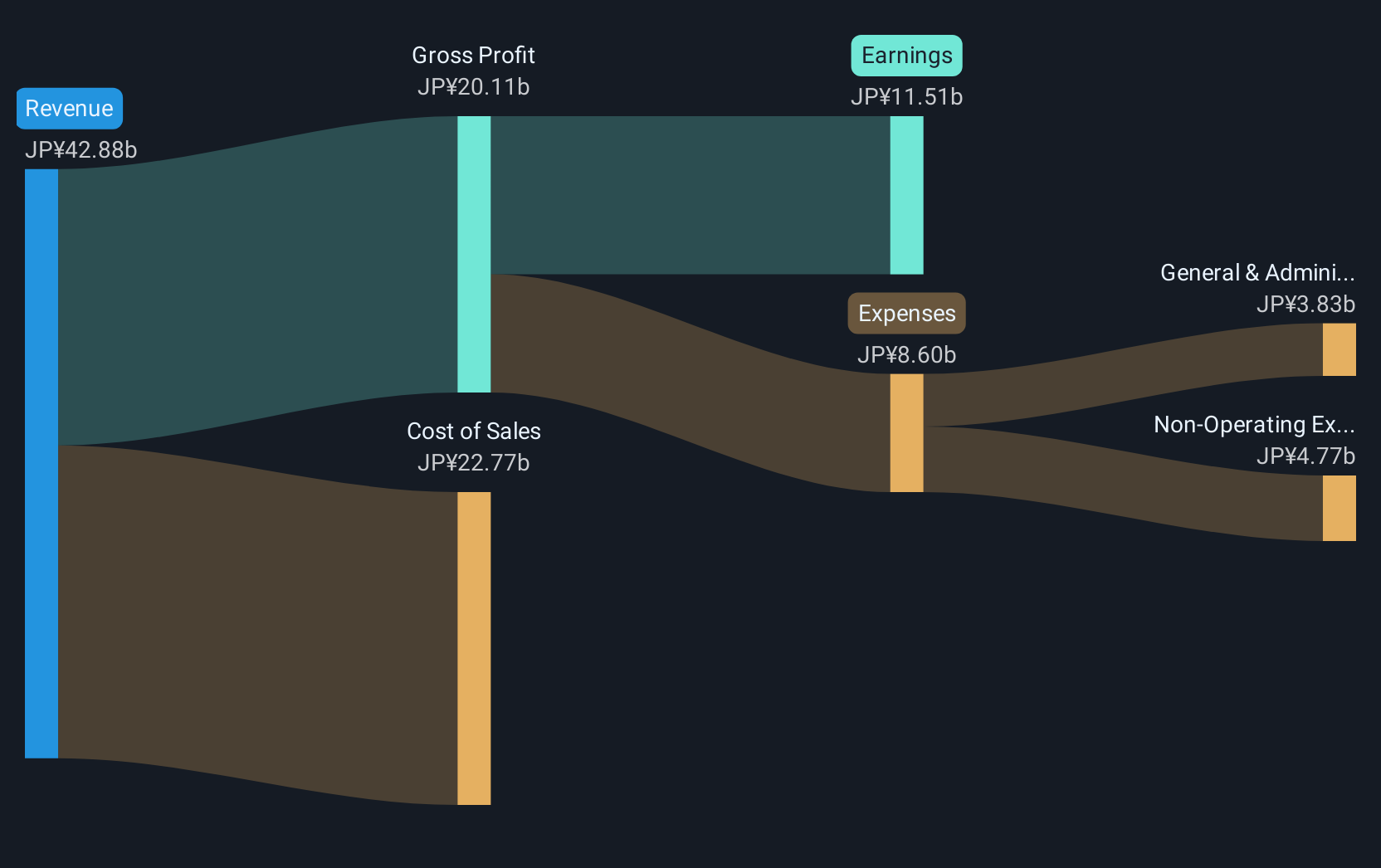

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market cap of ¥166.55 billion.

Operations: ANYCOLOR Inc. generates revenue through its entertainment operations both domestically and internationally, focusing on digital content and media services. The company is involved in producing and distributing a variety of entertainment content, which contributes significantly to its financial performance.

ANYCOLOR Inc. continues to make significant strides in the tech industry with a robust annual revenue growth of 13.1%, outperforming the average market growth rate of 4.3%. The company’s commitment to innovation is evident from its R&D spending, which has been strategically increased to fuel advancements in its core technologies and services. Impressively, ANYCOLOR's earnings have surged by 8.5% over the past year, surpassing the Entertainment industry's average decline of -7%. This financial vigor is complemented by an anticipated earnings growth of 13.2% per annum, showcasing a promising trajectory ahead for ANYCOLOR amidst competitive market dynamics and evolving technological demands.

- Take a closer look at ANYCOLOR's potential here in our health report.

Review our historical performance report to gain insights into ANYCOLOR's's past performance.

Make It Happen

- Navigate through the entire inventory of 1223 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3932

Akatsuki

Engages in the game, comic, and other businesses primarily in Japan.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives