As global markets react to the recent U.S. election results, small-cap stocks have captured investor attention, with the Russell 2000 Index leading gains despite not reaching record highs. The market's optimism is fueled by expectations of growth-friendly policies and a favorable economic environment, making it an intriguing time to explore potential opportunities in lesser-known stocks. In this context of heightened market activity and evolving economic conditions, identifying undiscovered gems involves looking for companies that demonstrate strong fundamentals and resilience amidst changing fiscal policies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bank MNC Internasional | 11.85% | 4.80% | 43.63% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Create Technology & ScienceLtd (SZSE:000551)

Simply Wall St Value Rating: ★★★★★★

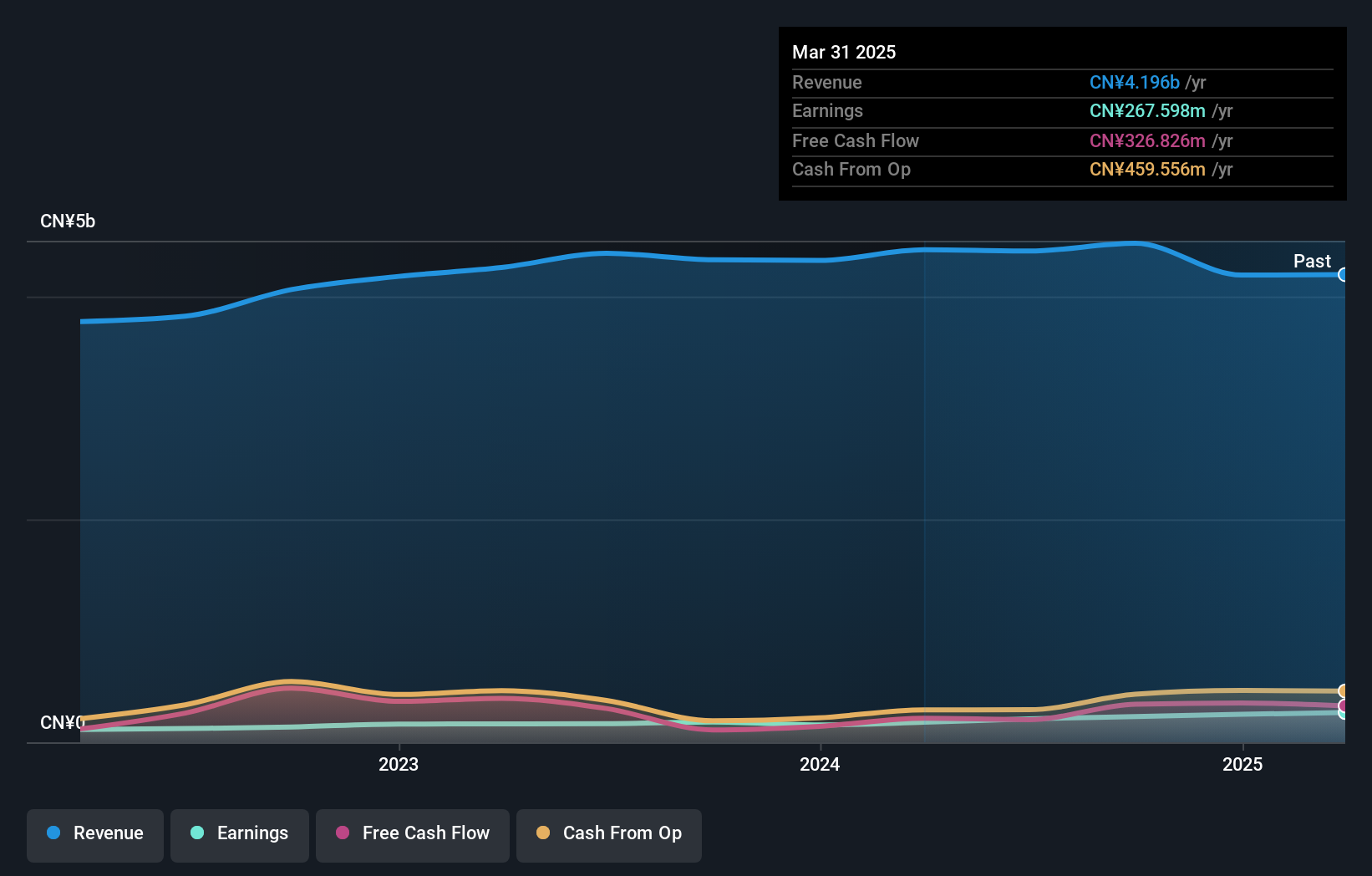

Overview: Create Technology & Science Co., Ltd. is involved in the manufacturing, engineering, and sale of precision machinery and environmental protection equipment both in China and internationally, with a market capitalization of CN¥5.38 billion.

Operations: The company generates its revenue primarily from the sale of precision machinery and environmental protection equipment. It operates both domestically in China and internationally, contributing to its financial performance.

Create Technology & Science Ltd. demonstrates promising growth with a 26.9% earnings increase over the past year, surpassing the Machinery industry's -0.4%. The company shows financial prudence, reducing its debt-to-equity ratio from 24.1% to 15.5% in five years and maintaining a price-to-earnings ratio of 24.2x, which is below the CN market average of 36.3x. Recent changes include amendments to its articles and board appointments, suggesting strategic shifts ahead. In recent reports, net income rose to CNY 211 million from CNY 137 million last year for nine months ending September, reflecting robust operational performance amidst industry challenges.

IG Port (TSE:3791)

Simply Wall St Value Rating: ★★★★★★

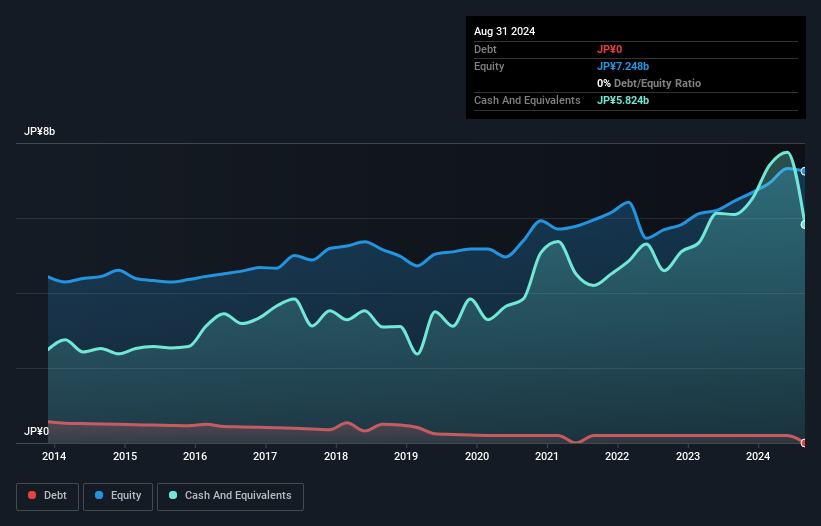

Overview: IG Port, Inc., along with its subsidiaries, is an animation production company that operates both in Japan and internationally, with a market cap of ¥40.94 billion.

Operations: IG Port generates revenue primarily from animation production, with a reported market cap of ¥40.94 billion. The company's financials reveal a focus on maintaining efficient operations to support its international and domestic business activities.

IG Port, a nimble player in the entertainment sector, has shown robust earnings growth of 23.7% over the past year, outpacing the industry's -10.6%. The company boasts high-quality earnings and remains debt-free, eliminating concerns about interest coverage. With a forecasted annual earnings growth of 23%, IG Port's financial health seems solid. Its recent addition to the S&P Global BMI Index highlights its growing prominence in the industry. Despite these positives, investors should be aware of its highly volatile share price over recent months, which could impact short-term investment decisions.

- Delve into the full analysis health report here for a deeper understanding of IG Port.

Understand IG Port's track record by examining our Past report.

Keiyo Bank (TSE:8544)

Simply Wall St Value Rating: ★★★★☆☆

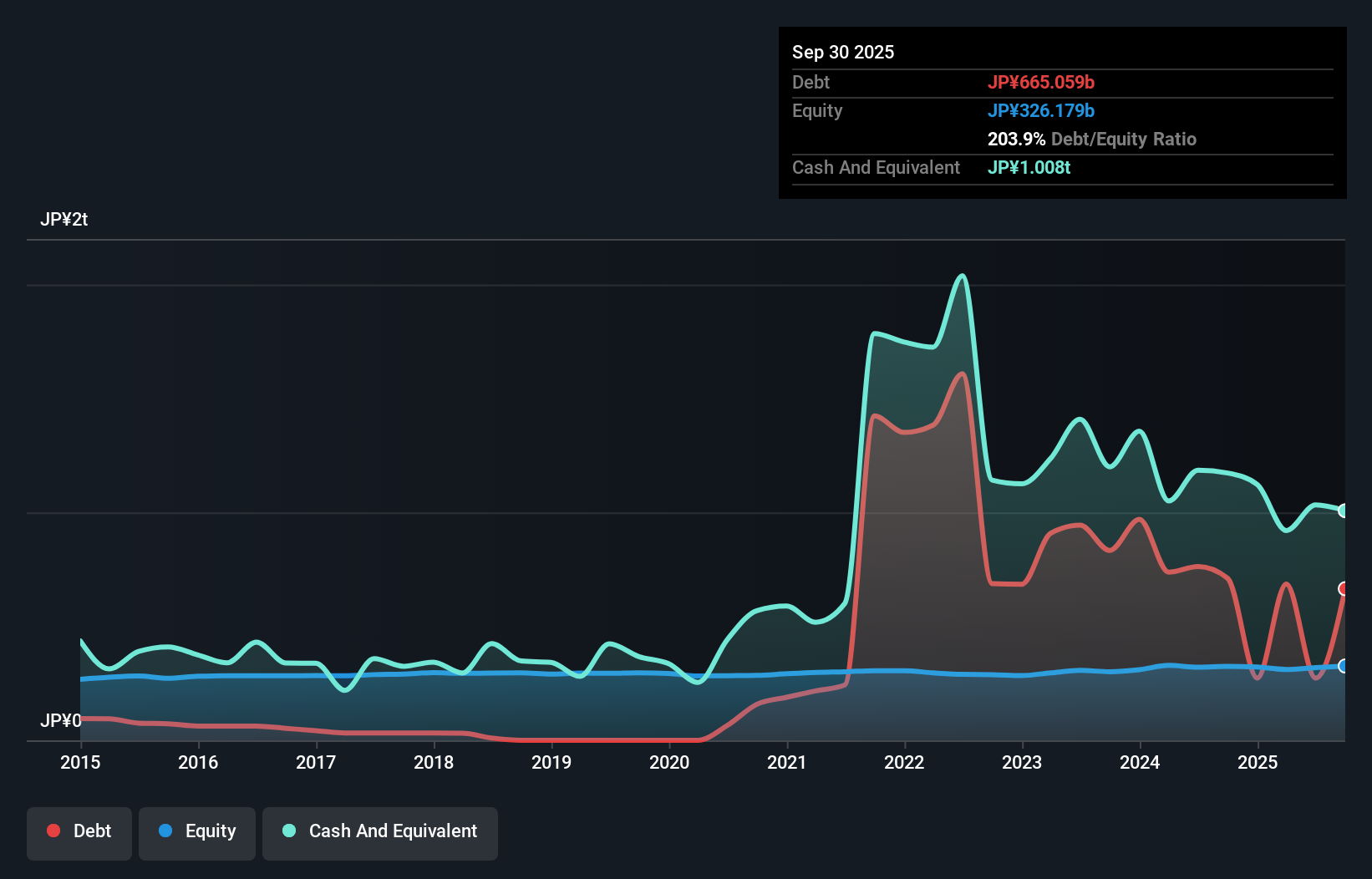

Overview: The Keiyo Bank, Ltd. provides a range of banking products and services to individual, corporate, and business customers in Japan with a market capitalization of ¥91.49 billion.

Operations: Keiyo Bank generates revenue primarily through interest income from loans and advances, alongside fees from various banking services. The bank's cost structure includes interest expenses on deposits and borrowings, as well as operational costs related to its service offerings. Notably, the net profit margin has shown variation over recent periods, reflecting changes in both revenue streams and cost management strategies.

Keiyo Bank, with assets totaling ¥6,639.5 billion and equity of ¥324.2 billion, offers a compelling profile in the banking sector. Deposits stand at ¥5,575.3 billion against loans of ¥4,239.3 billion, suggesting a solid deposit base that constitutes 88% of its liabilities—a low-risk funding strategy. The bank's earnings surged by 33.8% over the past year, outpacing industry growth rates significantly and indicating high-quality past earnings performance despite an insufficient allowance for bad loans at 1.3%. Trading at nearly half its estimated fair value enhances its appeal as an investment opportunity in today's market context.

- Navigate through the intricacies of Keiyo Bank with our comprehensive health report here.

Examine Keiyo Bank's past performance report to understand how it has performed in the past.

Taking Advantage

- Click this link to deep-dive into the 4671 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keiyo Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8544

Keiyo Bank

Offers various banking products and services to individual, corporate, and business customers in Japan.

Solid track record and good value.