Despite an already strong run, IG Port, Inc. (TSE:3791) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 150% in the last year.

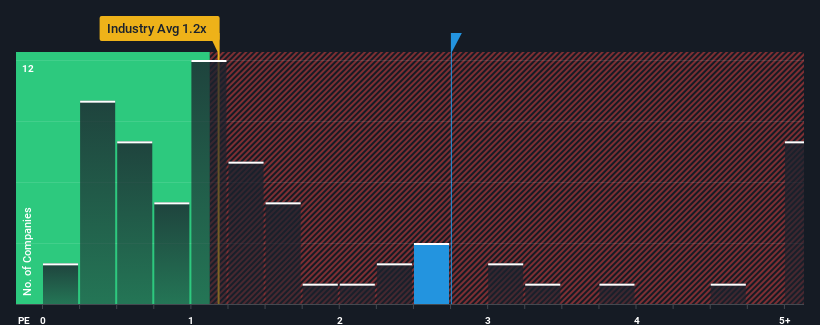

Since its price has surged higher, when almost half of the companies in Japan's Entertainment industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider IG Port as a stock probably not worth researching with its 2.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for IG Port

What Does IG Port's Recent Performance Look Like?

IG Port hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on IG Port will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

IG Port's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.5%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.5% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 16% as estimated by the two analysts watching the company. With the rest of the industry predicted to shrink by 0.5%, that would be a fantastic result.

With this in consideration, we understand why IG Port's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What We Can Learn From IG Port's P/S?

IG Port shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of IG Port's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

And what about other risks? Every company has them, and we've spotted 1 warning sign for IG Port you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3791

IG Port

Operates as an animation production company in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives