- Japan

- /

- Entertainment

- /

- TSE:3659

NEXON (TSE:3659): Valuation in Focus Following Dividend Boost, Buyback, and Upgraded Outlook

Reviewed by Simply Wall St

NEXON (TSE:3659) has announced a significant share buyback along with a plan to double its year-end dividend. Together with new earnings guidance, these moves reinforce the company's confidence in its strategy and operations.

See our latest analysis for NEXON.

Momentum has been strong for NEXON’s shares, with a 19.7% share price return over the past month and a standout 62.4% gain year-to-date. This rally has been matched by an impressive 76.9% total shareholder return over the past 12 months. These results highlight growing investor enthusiasm following shareholder-friendly moves and upgraded guidance, even as most of the market has remained cautious.

If you’re interested in what’s capturing market interest lately, now’s the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares already experiencing a substantial rally and bold shareholder returns announced, the key question now is whether NEXON’s current price leaves room for further upside or if the market has already factored in the company’s future growth.

Most Popular Narrative: 14.8% Overvalued

Compared to NEXON's last close at ¥3,727, the narrative sets its fair value at ¥3,246.78. This suggests the current market enthusiasm may be running ahead of fundamentals and future growth projections.

The strong reliance on legacy titles like MapleStory and Dungeon & Fighter, despite recent surges from updates and content expansions, leaves Nexon exposed to player fatigue and revenue concentration risk. This concentration may compress future top-line growth if new IPs or markets underperform.

Curious what’s driving this red-hot valuation call? The narrative hinges on bold profit growth, ambitious expansion plans, and a sharp shift in margin assumptions. Want to see what key numbers they’re betting on to support a price above today’s lofty level? Find out what’s under the hood of this forecasted value now.

Result: Fair Value of ¥3,246.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued success in revitalizing franchises and strong results from global expansion could easily propel Nexon's performance well beyond current expectations.

Find out about the key risks to this NEXON narrative.

Another View: Multiples Suggest Mixed Signals

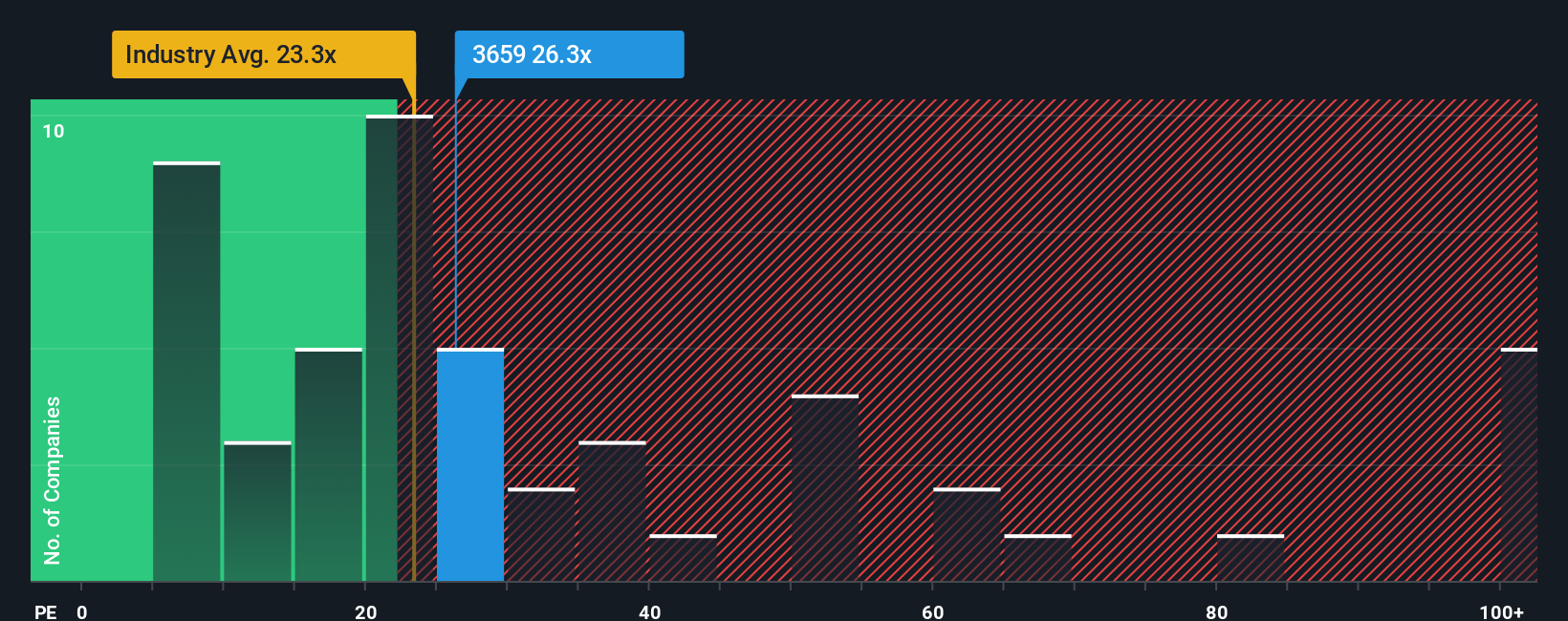

While the narrative-based valuation points to NEXON being overvalued, a look at the company's price-to-earnings ratio (26.2x) offers a nuanced picture. It is pricier than the industry average of 20x, but less expensive than the peer average of 33.9x. The fair ratio sits at 31.8x, suggesting some market optimism could still be justified. How much should investors rely on these relative signals versus future growth assumptions?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NEXON Narrative

If you see the story differently or want to dive into the details yourself, you can build your own view from scratch in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NEXON.

Ready to Seize More Winning Opportunities?

Don’t let exceptional ideas slip away. The Simply Wall Street Screener is your shortcut to finding smart investment ideas beyond NEXON. Make your next move count and be among the first to spot tomorrow’s market winners.

- Uncover value by reviewing these 924 undervalued stocks based on cash flows that the market might be overlooking. These may offer the potential for strong future returns.

- Tap into rapid growth stories with these 26 AI penny stocks that are shaping tomorrow’s technology landscape, fueled by innovation and cutting-edge developments.

- Secure steady income possibilities when you check out these 14 dividend stocks with yields > 3% with yields greater than 3%, attracting investors seeking reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3659

NEXON

Produces, develops, distributes, and services PC online and mobile games in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success