- Japan

- /

- Entertainment

- /

- TSE:3635

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by volatile earnings reports and mixed economic signals, global markets have shown considerable fluctuations, with major indices like the Nasdaq Composite and S&P MidCap 400 experiencing sharp highs followed by declines. Amidst this backdrop of uncertainty, dividend stocks present a compelling option for investors seeking stability and income, as they can offer consistent returns even when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.99% | ★★★★★★ |

Click here to see the full list of 2040 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

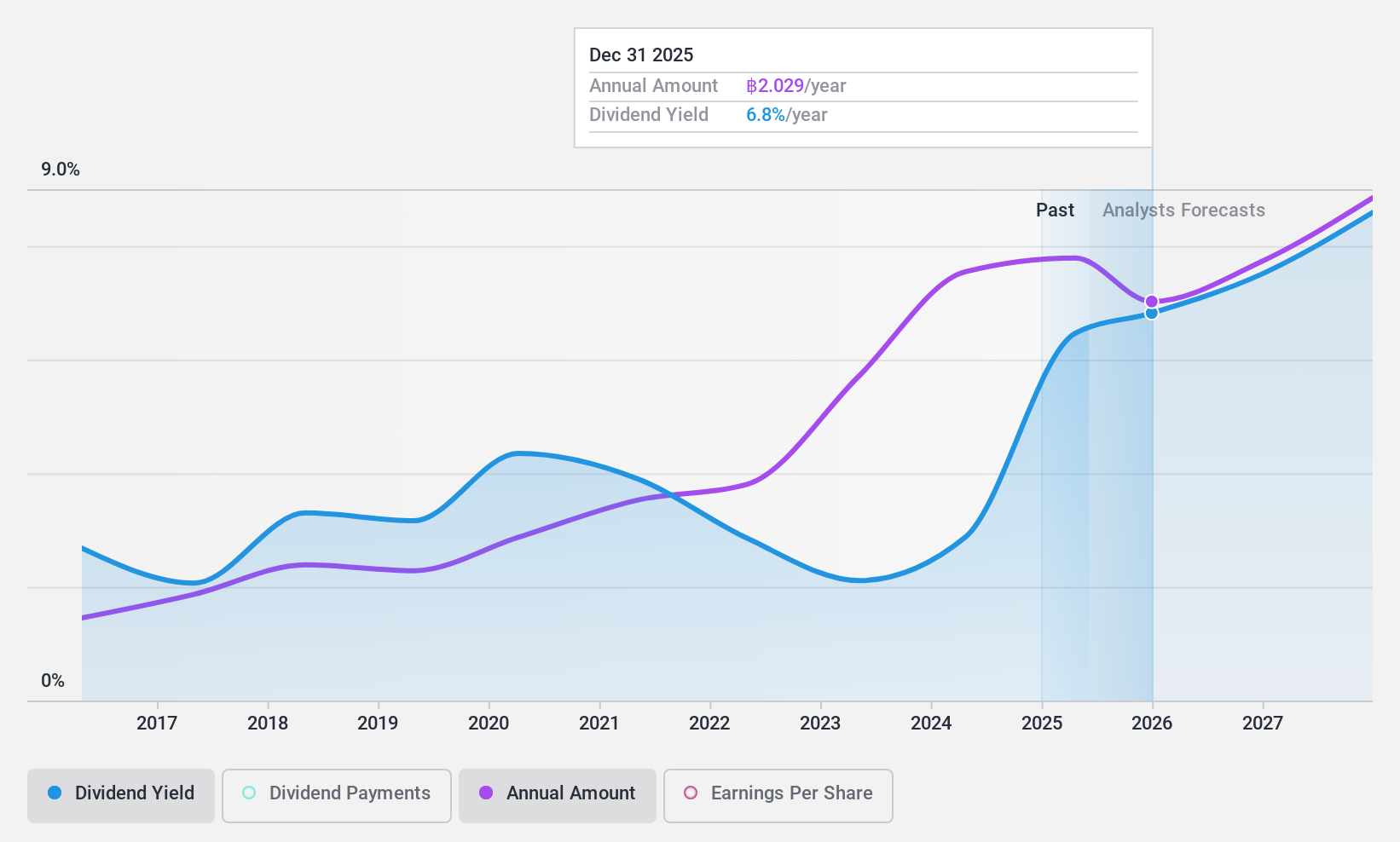

Sappe (SET:SAPPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sappe Public Company Limited, along with its subsidiaries, manufactures and distributes health food and beverage products across Asia, Europe, the United States, and other international markets with a market cap of THB21.25 billion.

Operations: Sappe Public Company Limited generates its revenue primarily from Health Drinking Products, amounting to THB6.42 billion, and Coconut Products, contributing THB357.15 million.

Dividend Yield: 3.2%

Sappe's dividend payments have been reliable and growing over the past decade, yet they are not well-covered by cash flows due to a high cash payout ratio of 116.7%. Despite stable earnings growth and trading below estimated fair value, Sappe's dividend yield of 3.16% is low compared to top-tier market payers in Thailand. The recent dissolution of an indirect joint venture aligns with strategic goals but doesn't impact operations or dividends directly.

- Click here to discover the nuances of Sappe with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Sappe is priced lower than what may be justified by its financials.

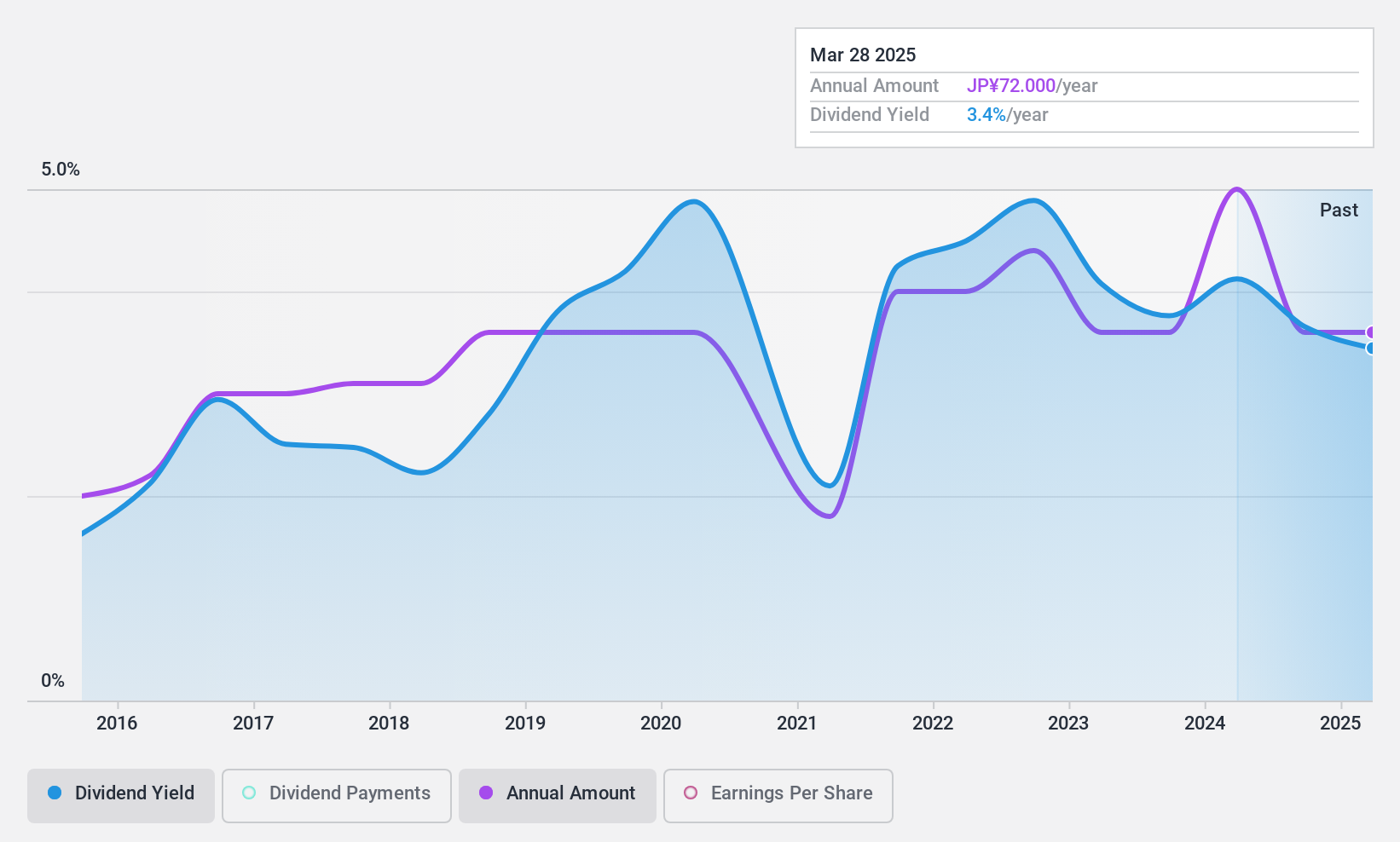

Koei Tecmo Holdings (TSE:3635)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Koei Tecmo Holdings Co., Ltd. is an entertainment company that operates globally, including in Japan, North America, Europe, and Asia, with a market cap of ¥497.92 billion.

Operations: Koei Tecmo Holdings Co., Ltd. generates revenue from several segments, including Entertainment at ¥75.04 billion, Amusement at ¥4.05 billion, and Immovable Properties at ¥1.20 billion.

Dividend Yield: 3%

Koei Tecmo Holdings offers a reliable dividend yield of 3.04%, though it falls short compared to the top tier in Japan's market. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 51.7% and 43.6%, respectively. Despite stable dividend growth over the past decade, future earnings are expected to decline slightly, which may impact long-term dividend sustainability. Trading at a favorable P/E ratio of 15.1x enhances its relative value appeal.

- Navigate through the intricacies of Koei Tecmo Holdings with our comprehensive dividend report here.

- According our valuation report, there's an indication that Koei Tecmo Holdings' share price might be on the cheaper side.

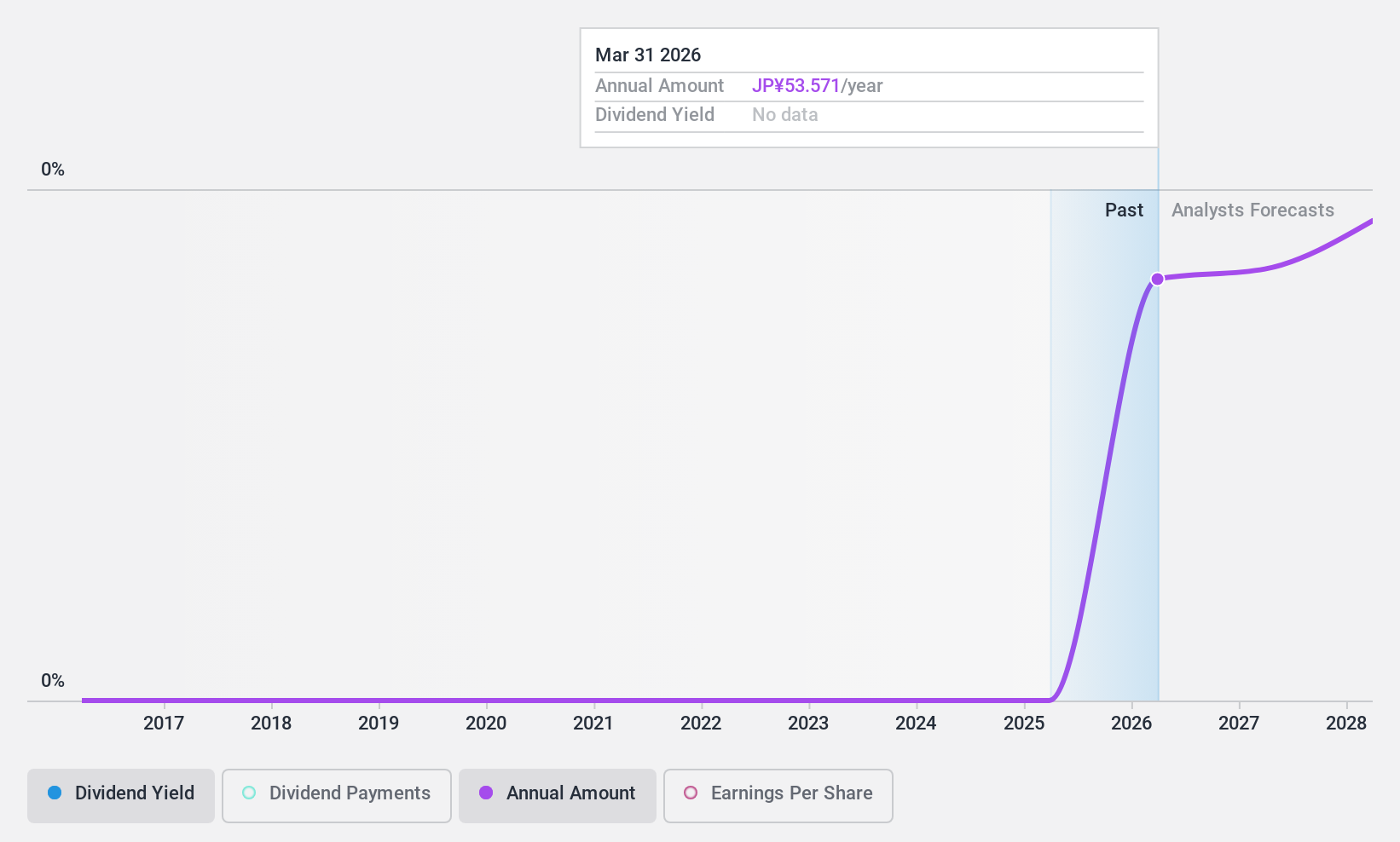

Yutaka GikenLtd (TSE:7229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yutaka Giken Co., Ltd. is a manufacturer and seller of automobile parts with operations in Japan, North America, China, Asia, and other international markets, and has a market cap of ¥28.54 billion.

Operations: Yutaka Giken Co., Ltd.'s revenue is derived from its operations in China (¥79.78 billion), North America (¥69.40 billion), Asia (¥36.34 billion), and Japan (¥43.07 billion).

Dividend Yield: 3.7%

Yutaka Giken Ltd. has experienced dividend growth over the past decade, yet its payments have been volatile and unreliable. Despite a low payout ratio of 17.6%, indicating strong earnings coverage, and a cash payout ratio of 6.6%, ensuring solid cash flow support, its dividend yield of 3.74% is slightly below Japan's top tier. The stock trades significantly below estimated fair value, but the unstable dividend track record poses a concern for long-term investors.

- Click to explore a detailed breakdown of our findings in Yutaka GikenLtd's dividend report.

- Our valuation report here indicates Yutaka GikenLtd may be undervalued.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 2040 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koei Tecmo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3635

Koei Tecmo Holdings

Operates as an entertainment company in Japan, North America, Europe, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives