- China

- /

- Auto Components

- /

- SHSE:600182

Uncovering Hidden Potential With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, small-cap stocks have shown resilience with notable gains in indices like the S&P MidCap 400 and Russell 2000. In this environment of cautious optimism, identifying stocks with hidden potential can be particularly rewarding for investors looking to capitalize on emerging opportunities within underappreciated sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Commercial Bank International P.S.C | 0.33% | 5.59% | 28.69% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

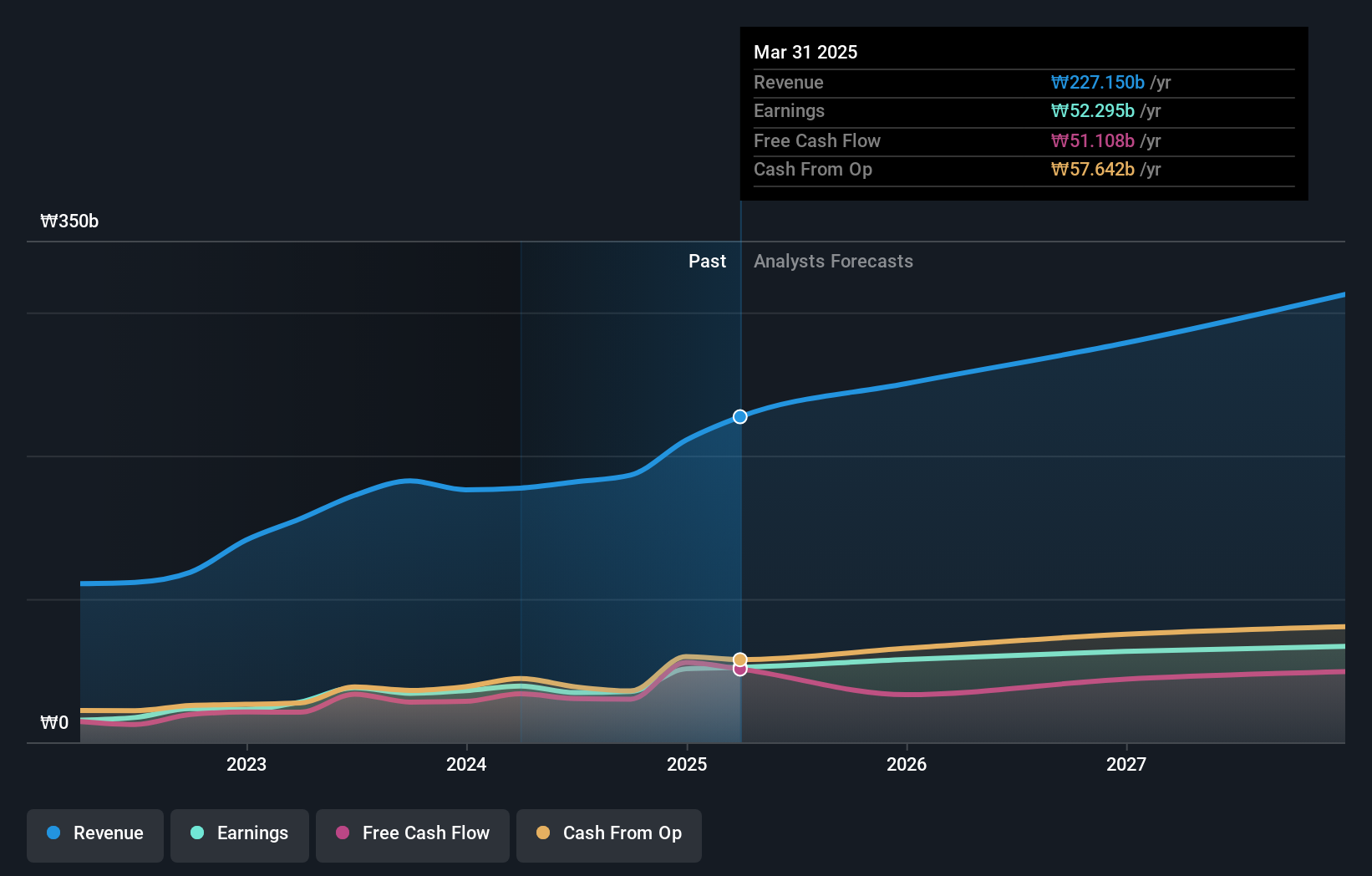

VITZROCELLLtd (KOSDAQ:A082920)

Simply Wall St Value Rating: ★★★★★★

Overview: VITZROCELL Co., Ltd. is involved in the production and sale of lithium batteries in South Korea, with a market capitalization of approximately ₩614.94 billion.

Operations: The company's primary revenue stream is from its battery business, generating approximately ₩186.45 billion.

Vitzrocell Ltd. showcases a promising profile with a price-to-earnings ratio of 17.4x, which is below the Electrical industry average of 20.9x, suggesting potential undervaluation. Over the past five years, earnings have grown at an impressive rate of 18% annually, and its debt-to-equity ratio has significantly decreased from 0.7% to 0.2%, indicating improved financial stability. Recent earnings reports highlight sales growth to KRW 48,793 million for Q3 compared to KRW 44,085 million last year and net income rising to KRW 8,137 million from KRW 7,366 million previously—demonstrating robust performance despite not outpacing industry growth rates recently.

- Delve into the full analysis health report here for a deeper understanding of VITZROCELLLtd.

Gain insights into VITZROCELLLtd's past trends and performance with our Past report.

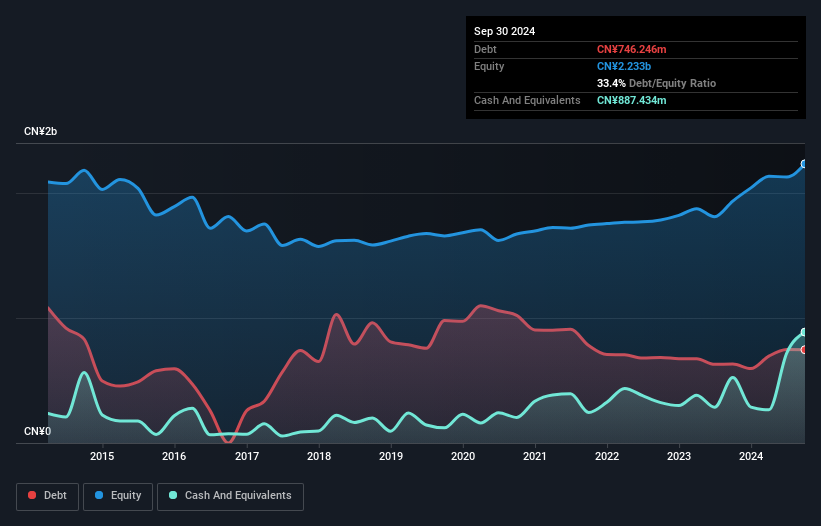

Giti Tire (SHSE:600182)

Simply Wall St Value Rating: ★★★★★★

Overview: Giti Tire Corporation is involved in the production and sale of automobile tires, with a market capitalization of CN¥5.61 billion.

Operations: Giti Tire Corporation generates revenue primarily from its rubber manufacturing segment, amounting to CN¥4.52 billion.

Giti Tire has been making notable strides, with recent earnings showing a significant leap in sales to CNY 3.42 billion from CNY 3.07 billion the previous year, while net income rose to CNY 156 million from CNY 130 million. The company is trading at a compelling value, about 43.9% below its estimated fair value, and boasts high-quality earnings with a strong interest coverage ratio of 30.9 times EBIT over interest payments. Additionally, Giti's debt-to-equity ratio improved significantly over five years from 59.1% to 33.4%, indicating prudent financial management and positioning it for future growth opportunities in the auto components sector.

- Get an in-depth perspective on Giti Tire's performance by reading our health report here.

Assess Giti Tire's past performance with our detailed historical performance reports.

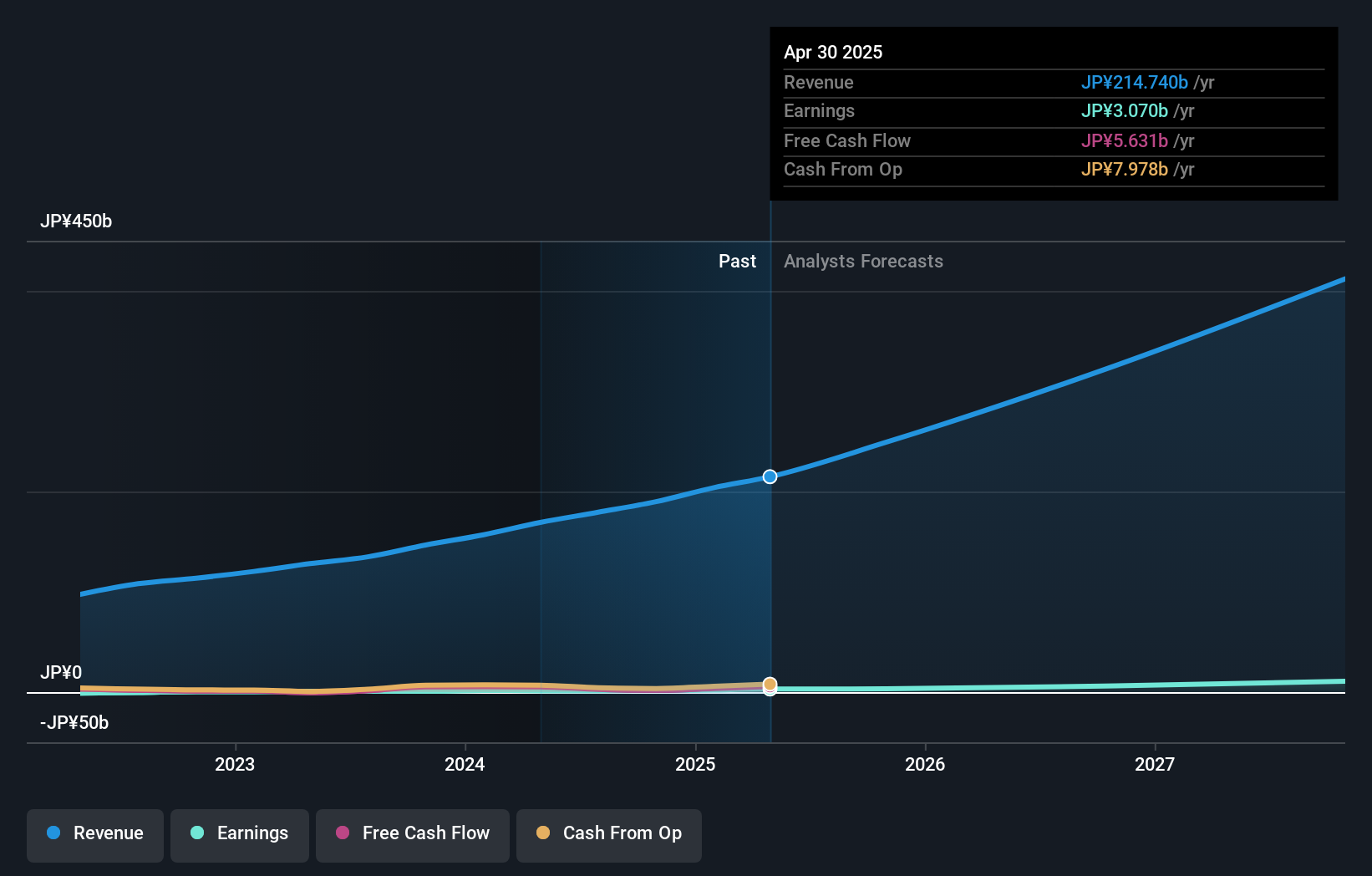

GA technologies (TSE:3491)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GA technologies Co., Ltd. operates a real estate brokerage platform with a market capitalization of ¥59.47 billion.

Operations: The primary revenue streams for GA technologies are the RENOSY Marketplace, generating ¥184.78 billion, and ITANDI, contributing ¥4.51 billion.

GA Technologies is making strides with its RENOSY platform, expanding into the US real estate market. This move aligns with their recent earnings growth of 82%, outpacing industry averages. Their debt to equity ratio has risen to 100% over five years, yet a net debt to equity ratio of 17% remains satisfactory. The company forecasts JPY 248 billion in net sales for fiscal year ending October 2025, alongside JPY 3 billion profit attributable to owners. Levered free cash flow saw a boost recently at ¥5,517 million as of January 2024, indicating positive operational momentum despite past fluctuations.

- Dive into the specifics of GA technologies here with our thorough health report.

Explore historical data to track GA technologies' performance over time in our Past section.

Summing It All Up

- Get an in-depth perspective on all 4655 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600182

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives