- Japan

- /

- Interactive Media and Services

- /

- TSE:3491

High Growth Tech in Asia Featuring Three Standout Stocks

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and broader economic uncertainties, the Asian tech sector remains a focal point for investors seeking high-growth opportunities amidst fluctuating market sentiment. In this environment, identifying standout stocks involves assessing companies that not only demonstrate innovative capabilities but also possess robust fundamentals to weather potential volatility.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 28.39% | 33.59% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

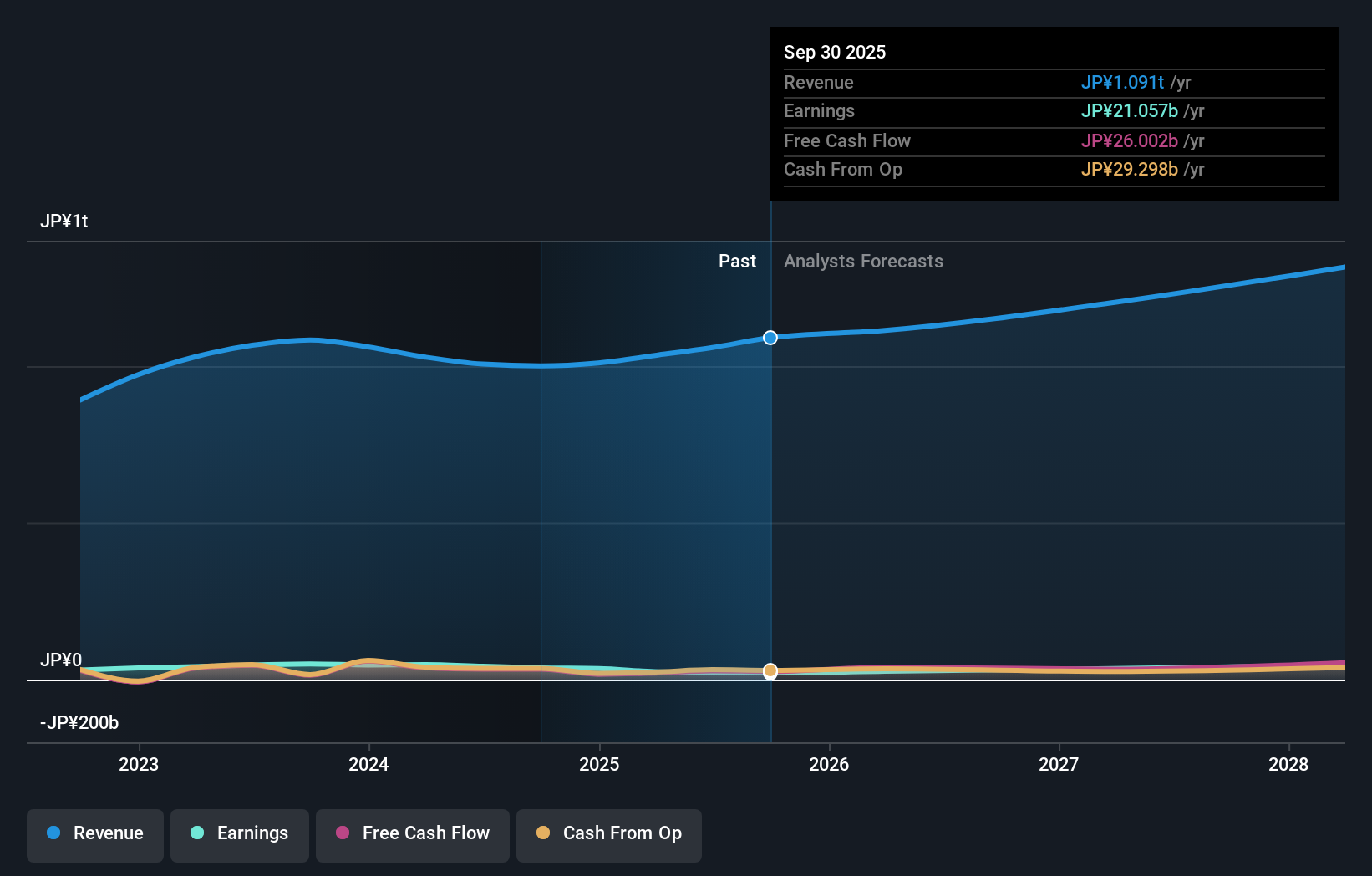

Macnica Holdings (TSE:3132)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Macnica Holdings, Inc. is engaged in the import, sale, and export of electronic components in Japan with a market capitalization of ¥418.73 billion.

Operations: Macnica Holdings generates revenue primarily from its Integrated Circuits, Electronic Devices and Other Businesses segment, amounting to ¥929.52 billion, and its Cybersecurity and Other IT Solutions Business segment, which contributes ¥161.19 billion.

With an expected annual earnings growth of 30%, Macnica Holdings demonstrates robust potential in the tech sector, notably outpacing the Japanese market average of 8.2%. Despite a challenging past year with earnings contraction by 43.8% and a dip in profit margins from 3.7% to 1.9%, the company's commitment to innovation is evident in its R&D spending trends, which are crucial for maintaining competitiveness in high-tech industries. Recent strategic moves, including mergers and sustained dividends, underscore Macnica's proactive approach to growth and shareholder engagement amidst fluctuating market conditions. These factors collectively suggest that while facing short-term hurdles, Macnica is strategically poised for recovery and long-term advancement.

- Click here to discover the nuances of Macnica Holdings with our detailed analytical health report.

Evaluate Macnica Holdings' historical performance by accessing our past performance report.

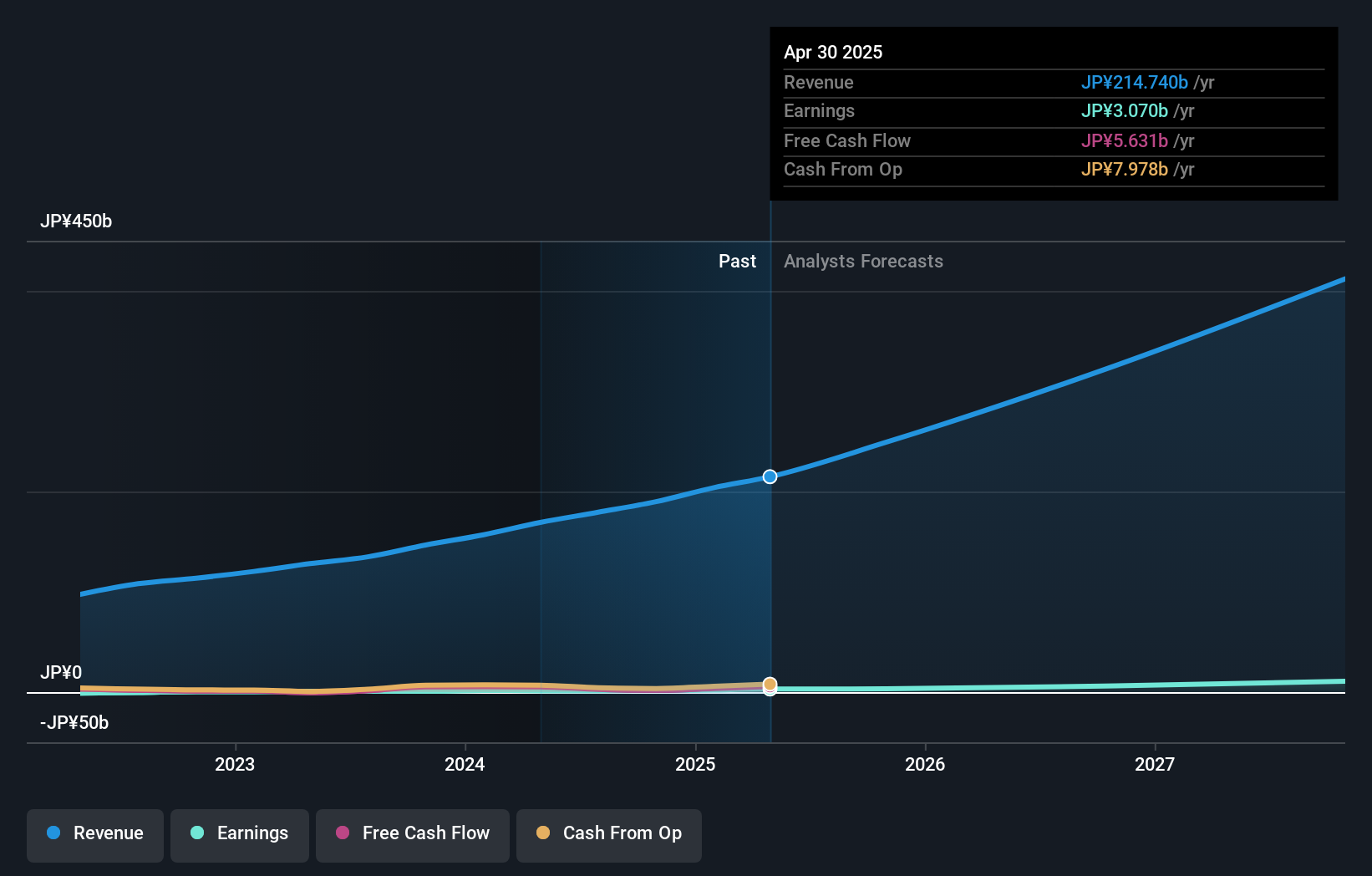

GA technologies (TSE:3491)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GA technologies Co., Ltd. operates a real estate brokerage platform with a market capitalization of ¥86.06 billion.

Operations: The company generates revenue primarily through its RENOSY Marketplace, which accounts for ¥220.48 billion, and ITANDI segment, contributing ¥6.29 billion. The real estate brokerage platform focuses on these key segments to drive its business operations.

GA Technologies has shown a remarkable trajectory in the high-growth tech sector in Asia, with its revenue and earnings expanding by 21.7% and 26.4% annually, respectively. This performance is significantly ahead of Japan's market averages, indicating robust growth potential. The company’s recent decision to initiate dividends, with a forecast year-end payout of JPY 8 per share, reflects its strong financial health and commitment to shareholder returns. Moreover, GA Technologies' strategic focus on AI and technology-driven platforms like RENOSY Marketplace and ITANDI not only underscores its innovative edge but also aligns with industry shifts towards digital solutions that promise sustained growth and market relevance.

- Click here and access our complete health analysis report to understand the dynamics of GA technologies.

Gain insights into GA technologies' past trends and performance with our Past report.

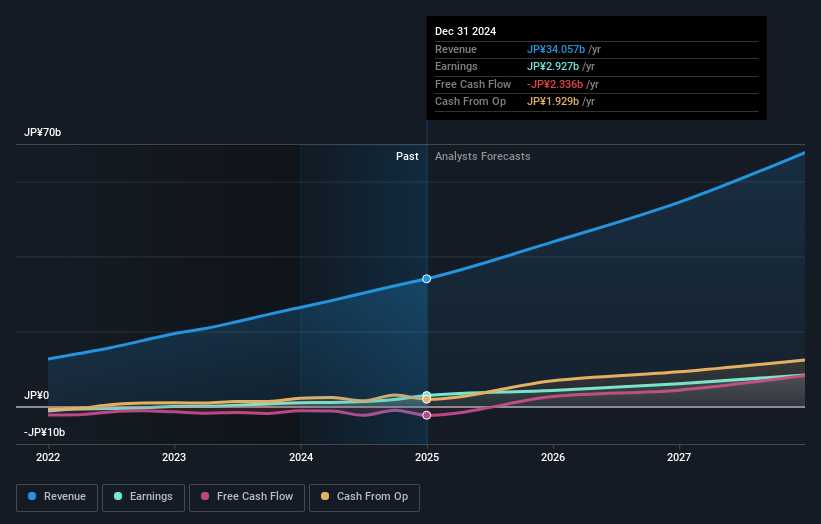

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Appier Group, Inc. is an AI-native SaaS company operating in Japan and internationally, with a market capitalization of ¥115.08 billion.

Operations: The company focuses on AI SaaS solutions, generating revenue primarily from its AI SaaS Business segment, which reported ¥40.52 billion.

Appier Group's strategic integration of Agentic AI across its product lines, including the launch of eight AI Agents, marks a significant enhancement in digital marketing solutions. This innovation is designed to optimize ROI through predictive insights and industry best practices, which are crucial for advertisers aiming to achieve efficient and scalable outcomes. With a revenue growth forecast at 19.7% per year and earnings expected to surge by 31.6% annually, Appier is not only advancing its technological base but also outpacing average market growth rates significantly. The company’s R&D focus is evident from its latest offerings that promise to redefine customer engagement through data-driven intelligence, positioning it well within Asia’s competitive high-growth tech landscape.

- Unlock comprehensive insights into our analysis of Appier Group stock in this health report.

Review our historical performance report to gain insights into Appier Group's's past performance.

Seize The Opportunity

- Click this link to deep-dive into the 194 companies within our Asian High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3491

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.