- Japan

- /

- Entertainment

- /

- TSE:2432

What DeNA Co., Ltd.'s (TSE:2432) 26% Share Price Gain Is Not Telling You

DeNA Co., Ltd. (TSE:2432) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 126% in the last year.

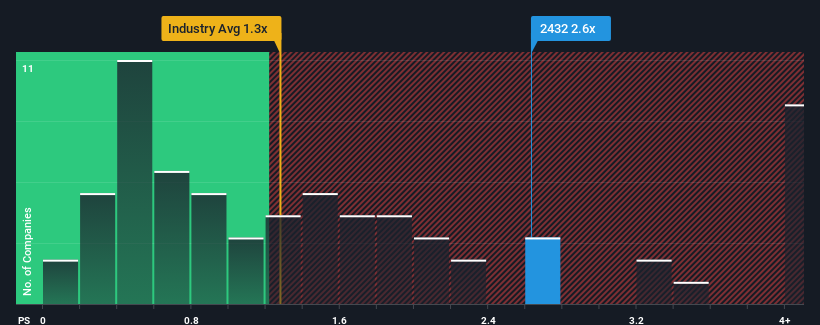

Following the firm bounce in price, you could be forgiven for thinking DeNA is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in Japan's Entertainment industry have P/S ratios below 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for DeNA

What Does DeNA's P/S Mean For Shareholders?

There hasn't been much to differentiate DeNA's and the industry's retreating revenue lately. Perhaps the market is expecting the company to reverse its fortunes and beat out a struggling industry in the future, elevating the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DeNA.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as DeNA's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. The last three years don't look nice either as the company has shrunk revenue by 3.2% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.8% each year during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 12% per annum growth forecast for the broader industry.

With this information, we find it concerning that DeNA is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in DeNA's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that DeNA currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with DeNA, and understanding should be part of your investment process.

If you're unsure about the strength of DeNA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2432

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives