- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

Shenzhen Transsion Holdings And 2 High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

Amidst a backdrop of cooling labor markets and rising stock indices, small-cap stocks have been leading the charge, with technology sectors particularly buoyed by optimism surrounding artificial intelligence. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience in adapting to evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Rakovina Therapeutics | 40.75% | 16.49% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Shenzhen Transsion Holdings (SHSE:688036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Transsion Holdings Co., Ltd. is a company that manufactures and sells smart devices primarily in Africa and other international markets, with a market cap of CN¥81.97 billion.

Operations: Transsion Holdings focuses on manufacturing and selling smart devices across Africa and other international markets. The company operates with a market capitalization of CN¥81.97 billion, leveraging its extensive reach in emerging markets to drive sales.

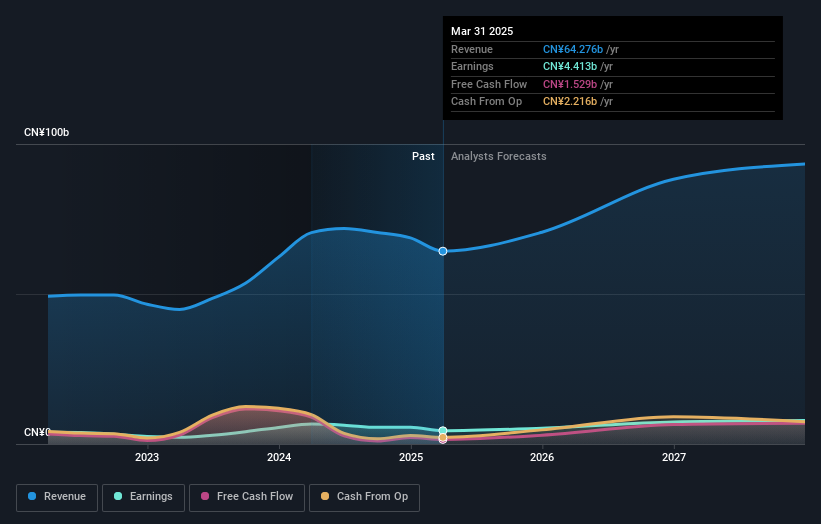

Shenzhen Transsion Holdings, navigating a challenging tech landscape, reported a notable dip in quarterly revenue from CNY 17.44 billion to CNY 13.00 billion year-over-year, with net income also decreasing significantly to CNY 490.09 million. Despite these setbacks, the company's projected earnings growth stands at an optimistic 22.1% annually over the next three years, outpacing its recent negative earnings growth of -33.5%. This resilience is underscored by a robust forecasted Return on Equity of 26.2%, signaling potential for recovery and growth amidst market adversities.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Transsion Holdings.

Understand Shenzhen Transsion Holdings' track record by examining our Past report.

OFILM Group (SZSE:002456)

Simply Wall St Growth Rating: ★★★★☆☆

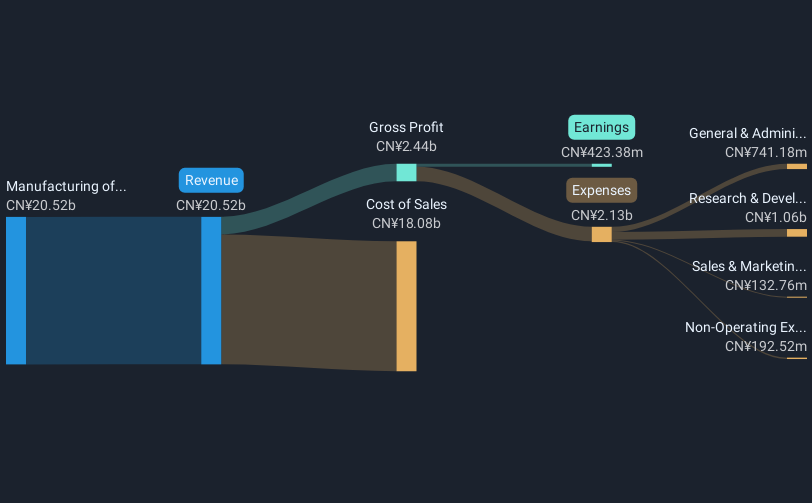

Overview: OFILM Group Co., Ltd. is involved in the development, production, and operation of optoelectronic devices and related components both in China and internationally, with a market cap of approximately CN¥39.55 billion.

Operations: OFILM Group Co., Ltd. primarily focuses on the manufacturing of optics and optoelectronic components, generating a revenue of CN¥20.67 billion from this segment.

Despite a challenging quarter with a net loss of CNY 58.95 million, OFILM Group's commitment to innovation is evident in its R&D efforts, which remain robust relative to revenue. The company reported an 18.1% annualized revenue growth and forecasts an impressive earnings growth of 80.7% per year, underscoring its potential in the tech sector despite current setbacks. With significant investments in technology and a strategic focus on emerging markets, OFILM appears poised for recovery and long-term growth as it adapts to industry dynamics and evolving consumer demands.

- Dive into the specifics of OFILM Group here with our thorough health report.

Evaluate OFILM Group's historical performance by accessing our past performance report.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

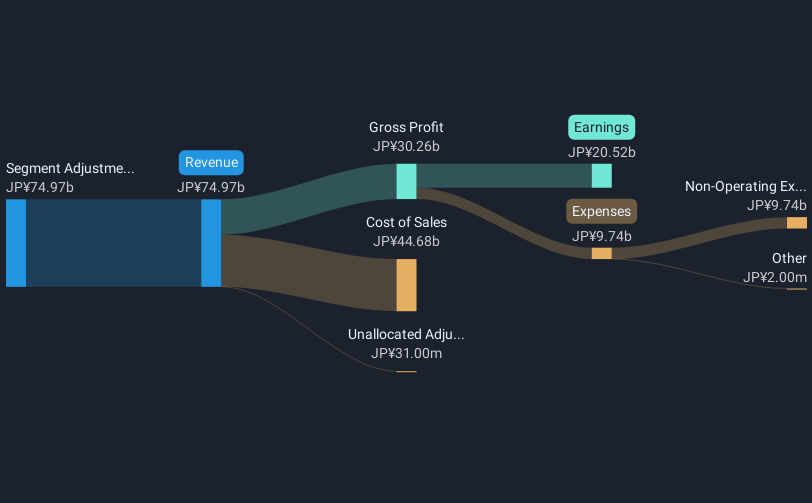

Overview: Kakaku.com, Inc., with a market cap of ¥507.28 billion, operates in Japan offering purchase support and restaurant review services among other activities through its subsidiaries.

Operations: The company generates revenue primarily from its Kakaku.Com segment, contributing ¥23.65 billion, and Tabelog segment, adding ¥33.47 billion. The Kyujin Box and Incubation segments also contribute to the overall revenue with ¥13.36 billion and ¥8.04 billion respectively.

Kakaku.com's strategic amendments to its bylaws, aimed at enhancing governance flexibility, underscore its proactive approach amidst a dynamic tech landscape. With a robust earnings forecast growth of 9.8% per year and revenue expected to climb by 10.2% annually, the company is poised above the Japanese market average. These figures are complemented by significant R&D investments which have consistently aligned with revenue growth, ensuring sustained innovation and competitiveness in its sector. Recent financial guidance revisions reflect stronger-than-anticipated performances in key business segments like Tabelog and Kyujin Box, projecting an optimistic fiscal outlook that could potentially reshape its market standing.

- Click here and access our complete health analysis report to understand the dynamics of Kakaku.com.

Gain insights into Kakaku.com's historical performance by reviewing our past performance report.

Key Takeaways

- Gain an insight into the universe of 746 Global High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002456

OFILM Group

Engages in the design, research, development, production, and sale of optoelectronic products and technologies in Mainland China and internationally.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion