- China

- /

- Entertainment

- /

- SZSE:002343

High Growth Tech Stocks To Explore In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in major indexes and a notable divergence between growth and value stocks, investors are keenly observing the latest economic indicators and geopolitical developments. With growth shares significantly outperforming their value counterparts, particularly in sectors like consumer discretionary, communication services, and information technology, identifying high-growth tech stocks with strong fundamentals becomes crucial for those looking to capitalize on these trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

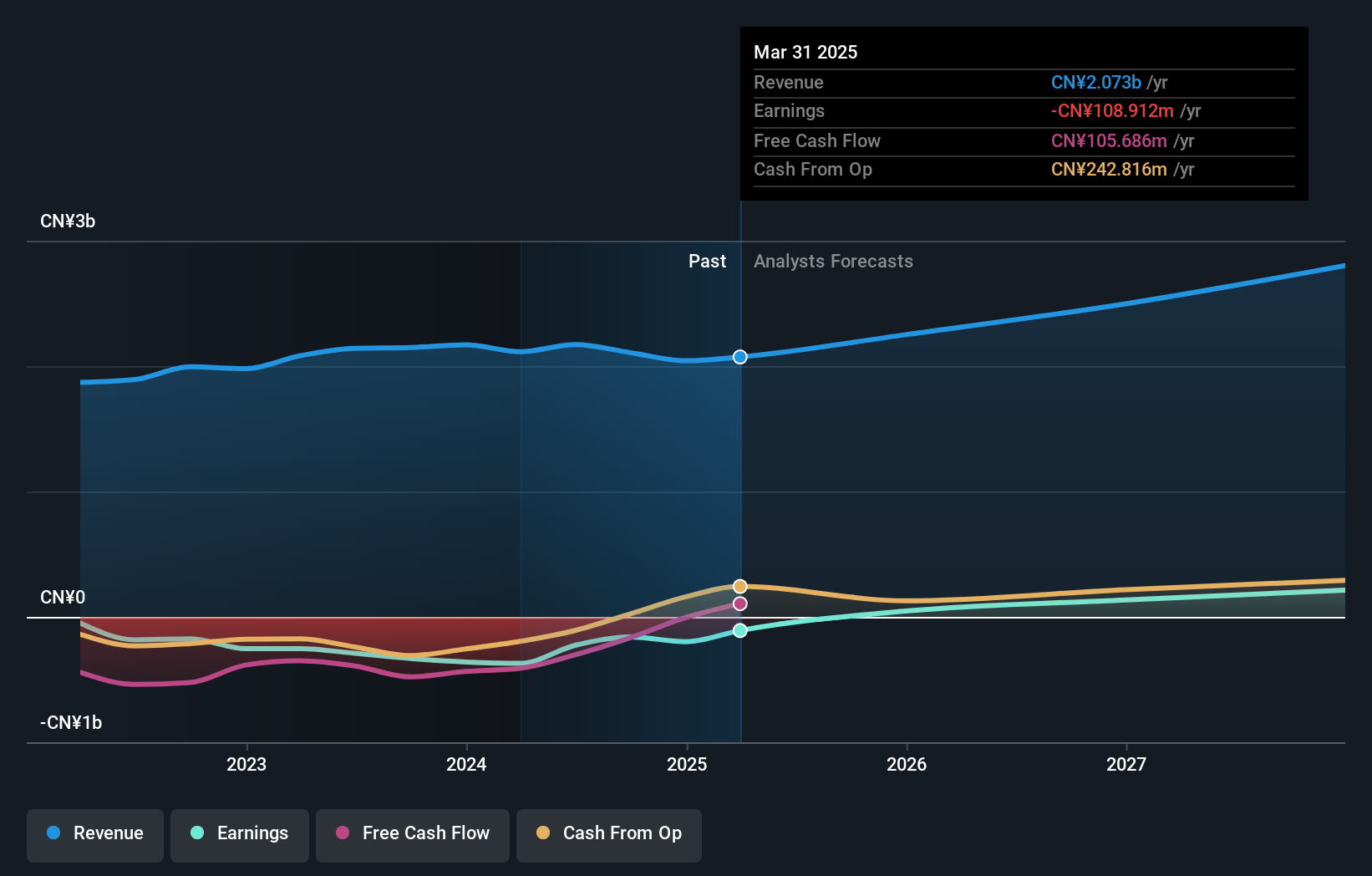

DBAPPSecurity (SHSE:688023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DBAPPSecurity Co., Ltd. focuses on the research, development, manufacture, and sale of cybersecurity products in China with a market capitalization of CN¥5.40 billion.

Operations: DBAPPSecurity Co., Ltd. specializes in cybersecurity solutions, emphasizing research, development, and manufacturing within China. The company's market capitalization stands at approximately CN¥5.40 billion.

DBAPPSecurity, amidst a challenging landscape, shows promising signs with an expected revenue growth of 18.2% annually, outpacing the Chinese market's 13.8%. This growth is supported by substantial R&D investments which are crucial for maintaining technological competitiveness. Despite current unprofitability, forecasts suggest a significant turnaround with earnings potentially growing by 69.7% per year. Recent financials indicate improvement as net losses decreased to CNY 336 million from CNY 535.53 million year-over-year, reflecting effective cost management and operational adjustments. The company’s focus on enhancing its software solutions could position it well for future profitability and market share expansion in the high-stakes tech arena.

- Unlock comprehensive insights into our analysis of DBAPPSecurity stock in this health report.

Gain insights into DBAPPSecurity's historical performance by reviewing our past performance report.

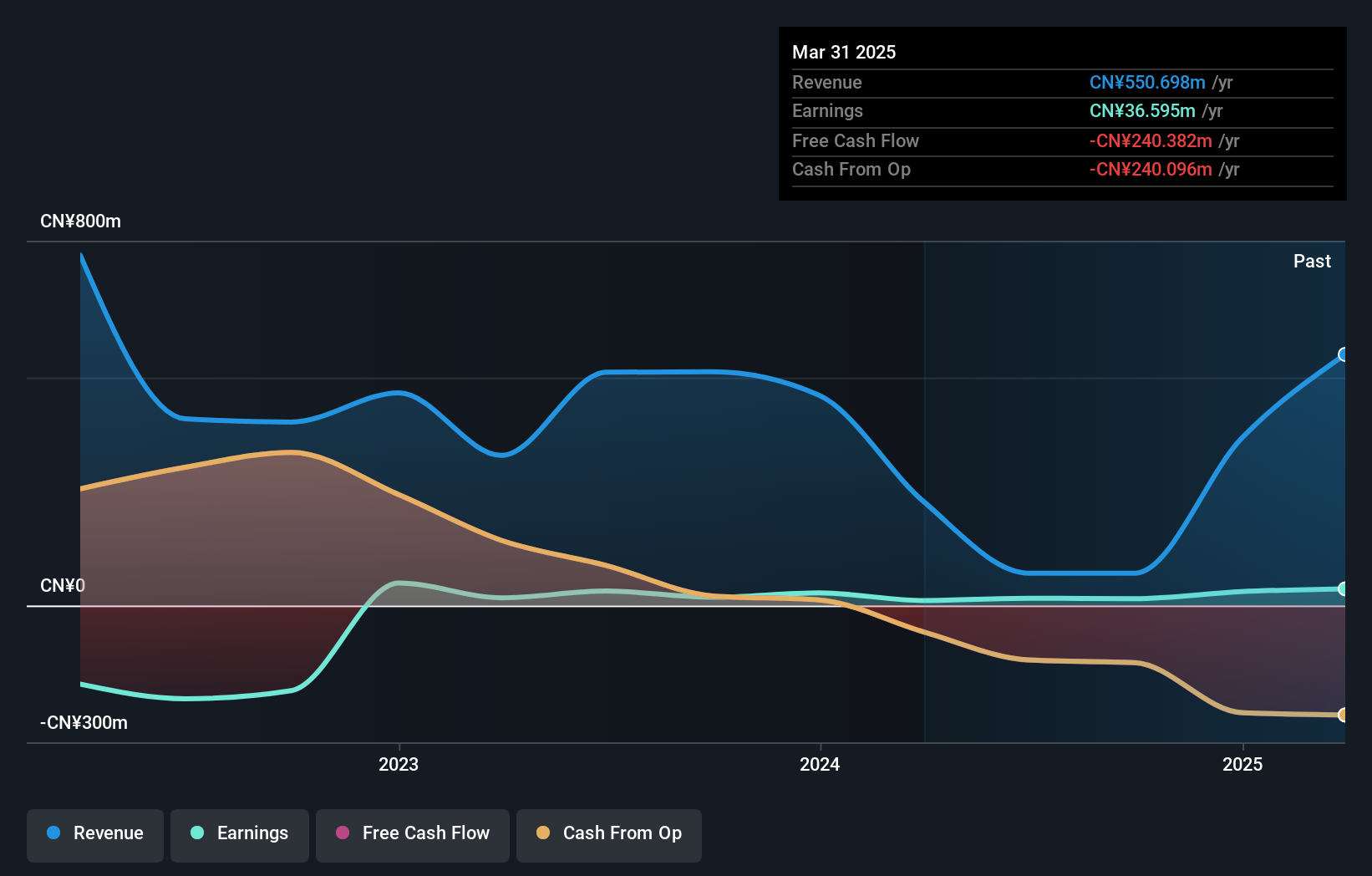

Ciwen MediaLtd (SZSE:002343)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ciwen Media Co., Ltd. operates in the film, television dramas, game products, channel promotions, and artist management sectors both in China and internationally, with a market cap of CN¥4.76 billion.

Operations: The company generates revenue through its diverse operations in film, television dramas, game products, channel promotions, and artist management across China and international markets. Its business model encompasses content creation and distribution alongside talent management.

Ciwen MediaLtd, navigating a transformative phase, is poised for substantial growth with earnings projected to surge by 84.3% annually. This leap is underpinned by an aggressive R&D strategy that not only fuels innovation but also aligns with the broader industry's shift towards digital and streaming platforms. Despite a sharp revenue decline to CNY 52.57 million from CNY 442.81 million year-over-year, the company has managed to maintain profitability with net income reaching CNY 11.41 million. The recent plan for share repurchase reflects confidence in future prospects, potentially stabilizing its financial position and appeasing shareholders concerned about past performance volatility.

- Navigate through the intricacies of Ciwen MediaLtd with our comprehensive health report here.

Gain insights into Ciwen MediaLtd's past trends and performance with our Past report.

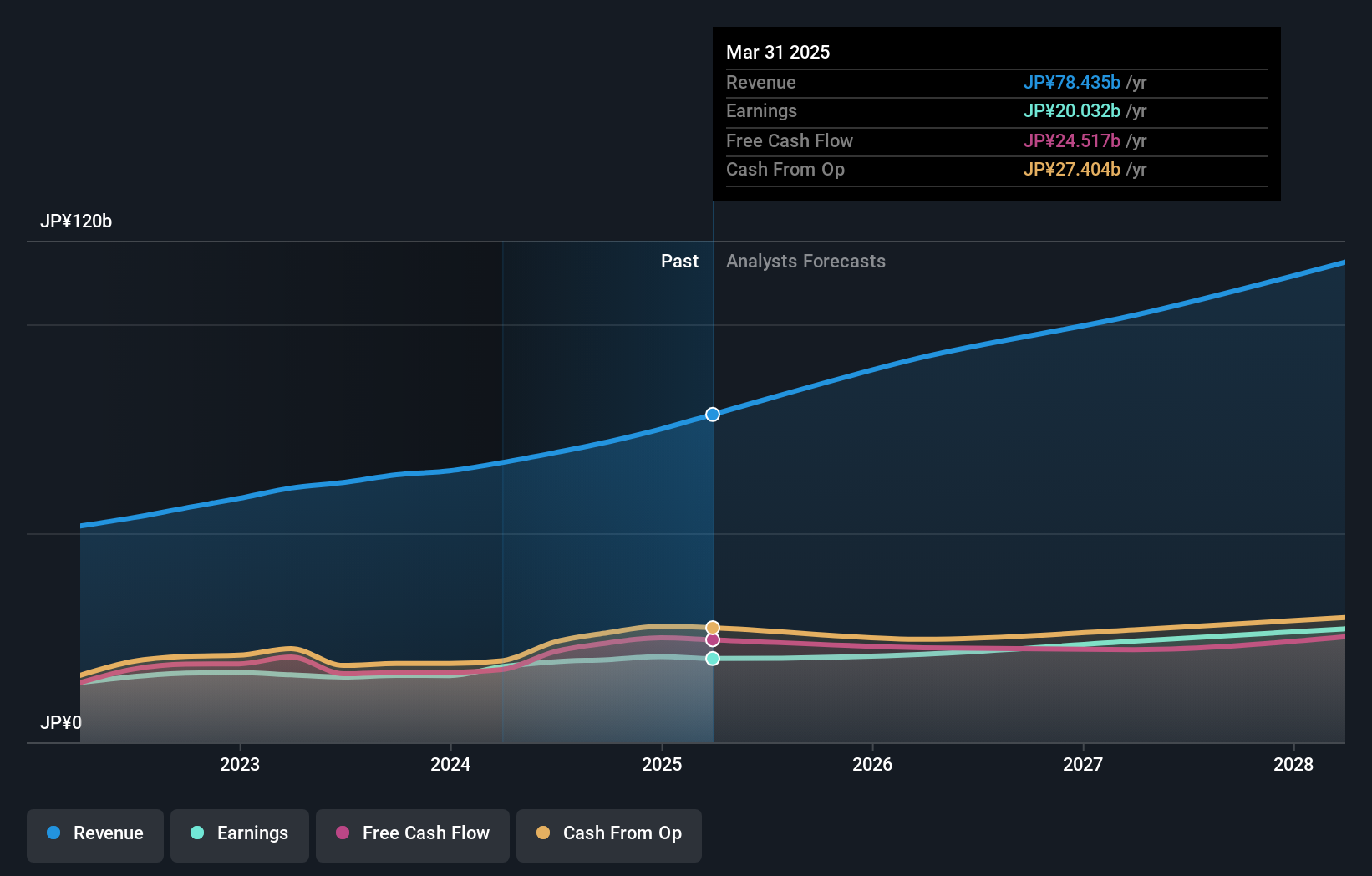

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc. operates in Japan offering purchase support and restaurant review services, with a market cap of ¥499.67 billion.

Operations: Kakaku.com, Inc. focuses on providing purchase support and restaurant review services in Japan. The company generates revenue primarily through its online platforms that facilitate consumer decision-making and dining experiences.

Kakaku.com has demonstrated a robust growth trajectory, with earnings expanding by 23.5% over the past year, outpacing the Interactive Media and Services industry average of 11.1%. This growth is supported by an anticipated annual profit increase of 10.1%, which surpasses the Japanese market forecast of 7.9%. Notably, Kakaku's commitment to innovation is evident in its R&D investments, aligning with revenue projections that expect a yearly increase of 9.2%. The company's strategic focus on research not only fosters product development but also ensures it remains competitive within its sector.

- Click here to discover the nuances of Kakaku.com with our detailed analytical health report.

Assess Kakaku.com's past performance with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 1280 of the High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002343

Ciwen MediaLtd

Engages in the film, television dramas, game products, channel promotions, and artist management businesses in China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives