- Japan

- /

- Interactive Media and Services

- /

- TSE:2371

High Growth Tech Stocks In Japan To Watch This September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%. Amid these fluctuations, expectations of additional rate hikes from the Bank of Japan and a stronger yen have created a challenging environment for exporters. When considering high-growth tech stocks in this context, it's crucial to focus on companies with strong fundamentals and innovative potential that can navigate these economic headwinds effectively.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GNI Group Ltd. engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally with a market cap of ¥124.90 billion.

Operations: GNI Group Ltd. generates revenue primarily from its pharmaceutical segment, which accounts for ¥19.35 billion, and its medical device segment, contributing ¥4.30 billion.

GNI Group's recent approval for Avatrombopag Maleate Tablets, targeting thrombocytopenia in chronic liver disease, marks a significant milestone. This addition to their lineup, alongside ETUARY and Nintedanib, underscores their commitment to rare diseases. With earnings growth of 393.9% over the past year and projected revenue growth of 24.6% annually, GNI is outpacing the broader JP market's 4.3%. Their R&D investments remain robust, ensuring continued innovation in both new and generic drugs.

- Click here and access our complete health analysis report to understand the dynamics of GNI Group.

Gain insights into GNI Group's past trends and performance with our Past report.

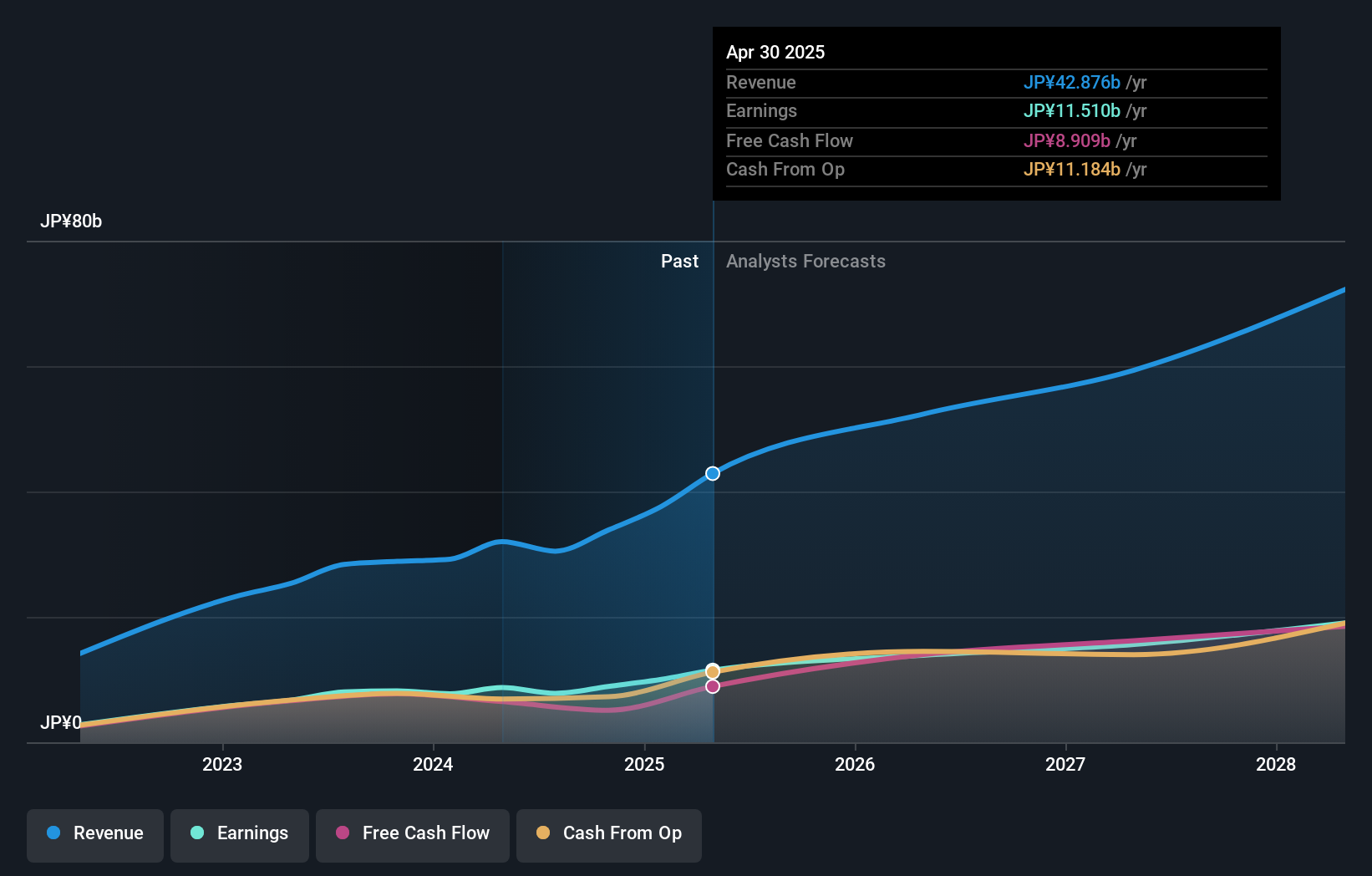

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc., along with its subsidiaries, provides purchase support and restaurant review services in Japan, with a market cap of ¥505.48 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through its purchase support and restaurant review services in Japan. The company leverages its online platforms to attract users seeking product comparisons and dining recommendations, driving advertising and affiliate marketing income.

Kakaku.com, a prominent player in Japan's tech sector, has shown impressive earnings growth of 23.4% over the past year. Their forecasted annual profit growth of 9.9% outpaces the broader JP market's 8.6%, while their revenue is expected to grow at 9.4% annually, surpassing the market average of 4.3%. Notably, their R&D expenses have been substantial, contributing to ongoing innovation and competitive positioning within the interactive media and services industry.

- Click to explore a detailed breakdown of our findings in Kakaku.com's health report.

Gain insights into Kakaku.com's historical performance by reviewing our past performance report.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and has a market cap of ¥153.52 billion.

Operations: ANYCOLOR Inc. generates revenue primarily through its entertainment operations both in Japan and internationally. The company focuses on various segments within the entertainment industry to drive its income streams.

ANYCOLOR, a Japanese tech firm, is set to grow its earnings by 14.5% annually, outpacing the broader JP market's 8.6%. Their revenue is forecasted to increase at 13.9% per year, significantly higher than the market average of 4.3%. Notably, ANYCOLOR has invested heavily in R&D to drive innovation and maintain competitive positioning within the entertainment industry. Recently, they repurchased 2.71 million shares for ¥7.50 billion ($50 million), reflecting strong confidence in their growth prospects.

- Get an in-depth perspective on ANYCOLOR's performance by reading our health report here.

Examine ANYCOLOR's past performance report to understand how it has performed in the past.

Where To Now?

- Take a closer look at our Japanese High Growth Tech and AI Stocks list of 125 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakaku.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2371

Kakaku.com

Engages in the provision of purchase support, restaurant review, and other services in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives