As global markets navigate a landscape marked by rate cuts from the ECB and SNB, alongside anticipation of further adjustments from the Federal Reserve, investors are keenly observing how these shifts impact various sectors. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams even as major indexes like the Nasdaq reach new highs. In such an environment, selecting reliable dividend stocks involves focusing on companies with strong fundamentals and a history of consistent payouts, which can offer stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.31% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

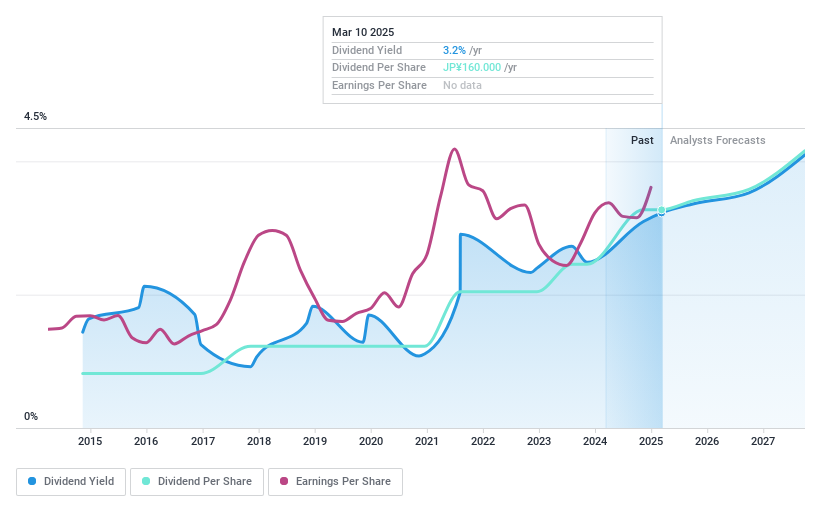

Nissei ASB Machine (TSE:6284)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissei ASB Machine Co., Ltd. is involved in the planning, development, manufacturing, and sale of machines for producing PET and other plastic bottles globally, with a market cap of ¥76.45 billion.

Operations: Nissei ASB Machine Co., Ltd.'s revenue is comprised of ¥7.56 billion from Europe, ¥12.36 billion from the Americas, ¥24.55 billion from East Asia, and ¥22.78 billion from South/West Asia.

Dividend Yield: 3.1%

Nissei ASB Machine offers a stable dividend profile, with payments consistently growing over the past decade. Its dividends are well covered by both earnings and cash flows, boasting a payout ratio of 30.9% and a cash payout ratio of 27.2%. Despite trading at a significant discount to its estimated fair value, its dividend yield of 3.14% is below the top quartile in Japan's market but remains reliable with minimal volatility historically.

- Dive into the specifics of Nissei ASB Machine here with our thorough dividend report.

- The valuation report we've compiled suggests that Nissei ASB Machine's current price could be quite moderate.

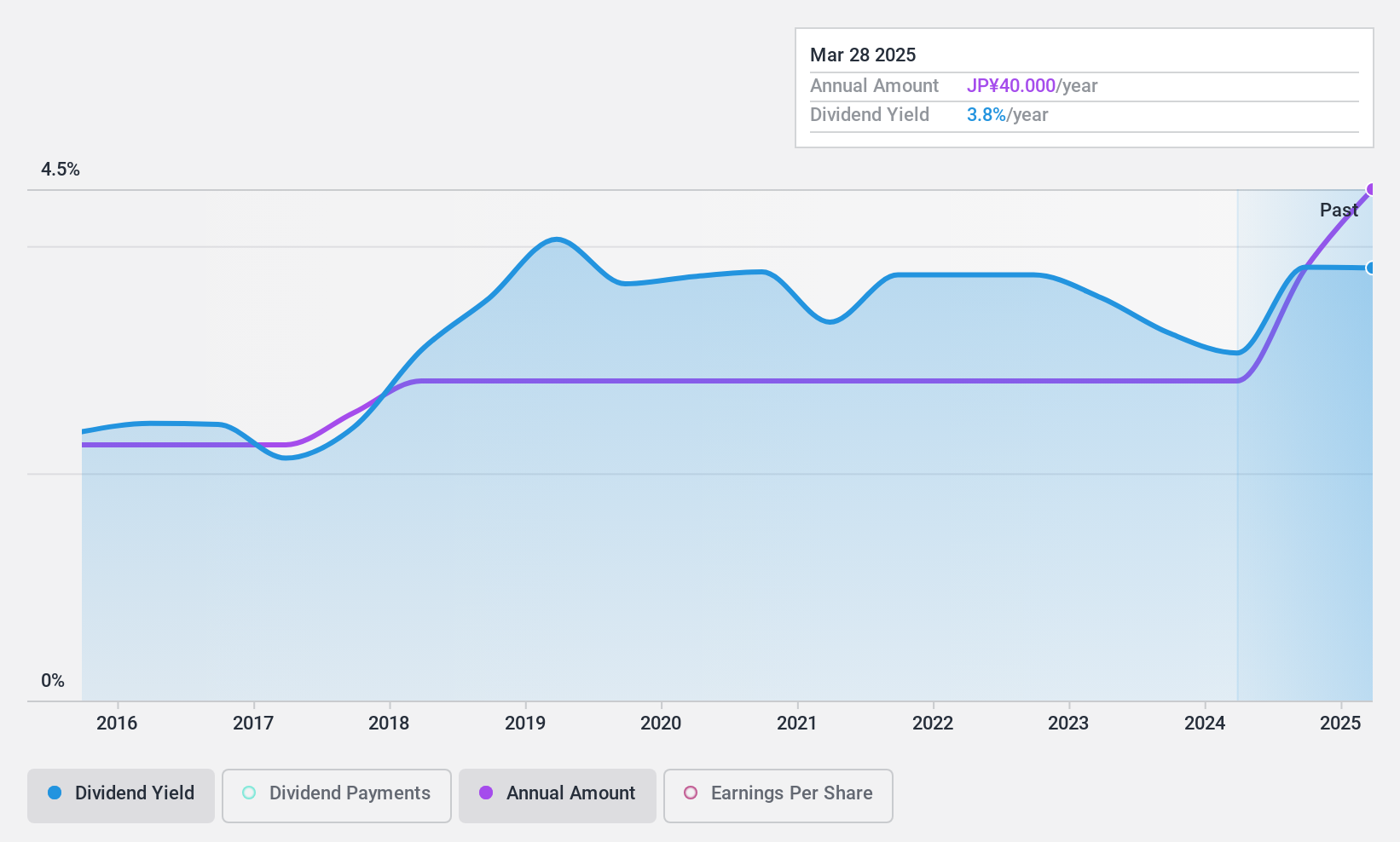

Kyodo Printing (TSE:7914)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kyodo Printing Co., Ltd., along with its subsidiaries, operates in the printing industry in Japan and has a market capitalization of ¥29.71 billion.

Operations: Kyodo Printing Co., Ltd. generates revenue through its Information Security Division (¥31.07 billion), Information Communication Department (¥35.76 billion), and Life and Industrial Materials Division (¥32.56 billion).

Dividend Yield: 3.9%

Kyodo Printing maintains a strong dividend profile with a yield of 3.93%, placing it in the top 25% of JP market payers. Dividends are well-supported by earnings and cash flows, with payout ratios at 38% and 43.4%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and growing without volatility. The recent share buyback program aims to enhance shareholder value further, reflecting a robust capital strategy amidst consistent financial performance forecasts for FY2025.

- Click here to discover the nuances of Kyodo Printing with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Kyodo Printing's current price could be inflated.

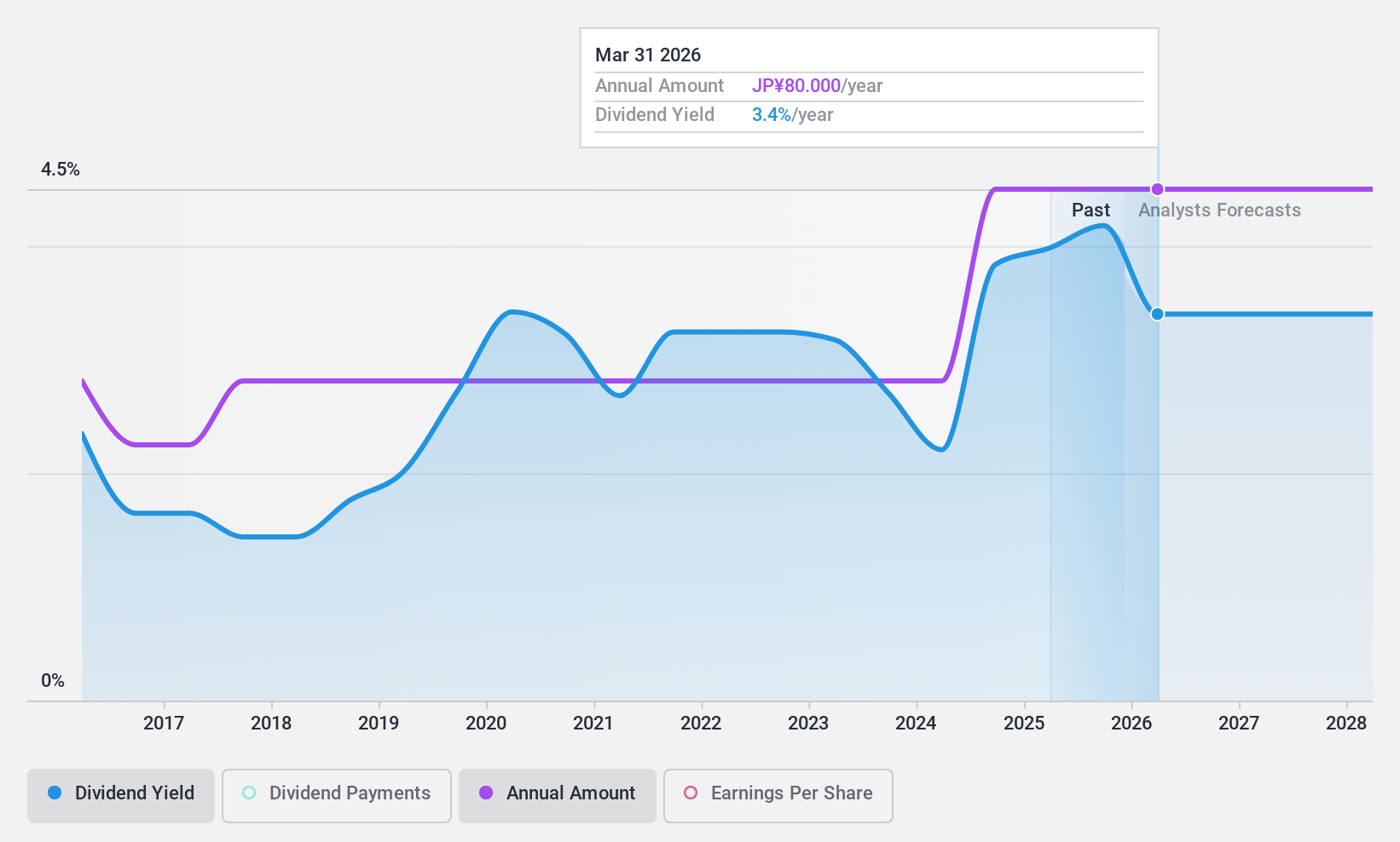

JSP (TSE:7942)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JSP Corporation is a global manufacturer and seller of expanded polymers with a market capitalization of ¥55.95 billion.

Operations: JSP Corporation's revenue is primarily derived from its Bead Business, which accounts for ¥92.84 billion, and its Extrusion Business, contributing ¥45.55 billion.

Dividend Yield: 3.7%

JSP's dividend payments have been volatile and unreliable over the past decade, despite an overall increase. The dividend yield of 3.75% is slightly below the top 25% of JP market payers. However, dividends are well-covered by earnings and cash flows, with payout ratios at 35% and 35.7%, respectively, suggesting sustainability in current conditions. Trading significantly below estimated fair value indicates potential for capital appreciation alongside its dividend profile.

- Click here and access our complete dividend analysis report to understand the dynamics of JSP.

- Our valuation report here indicates JSP may be undervalued.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1938 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7942

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives