- China

- /

- Auto Components

- /

- SHSE:603037

Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results and a Federal Reserve rate cut, small-cap stocks have shown significant movement, with the Russell 2000 Index surging over 8% for the week. In this dynamic environment, identifying promising small-cap stocks requires a focus on companies with robust fundamentals and potential for growth amid evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ramco Industries | 3.16% | 9.84% | -14.15% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Shree Pushkar Chemicals & Fertilisers | 22.85% | 17.68% | 3.50% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai CarthaneLtd (SHSE:603037)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Carthane Co., Ltd. operates in the auto parts manufacturing industry in China, with a market cap of CN¥2.75 billion.

Operations: Shanghai Carthane Co., Ltd. generates revenue primarily through its operations in the auto parts manufacturing sector. The company exhibits a net profit margin trend worth noting, which has shown variability over recent periods.

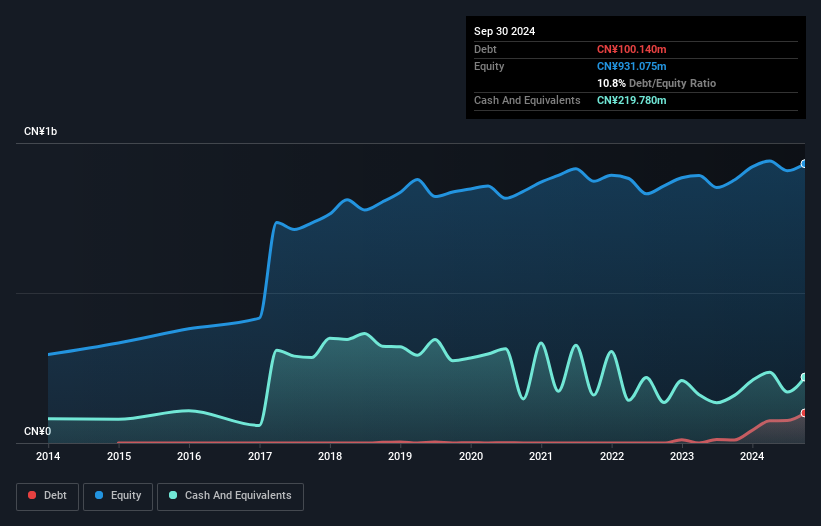

Carthane, a smaller player in the auto components sector, has shown solid performance with a 23.4% earnings growth over the past year, outpacing the industry average of 11%. The company reported CNY 535 million in sales for the first nine months of 2024, an increase from CNY 487 million last year. Net income also rose to CNY 61 million from CNY 54 million. With a price-to-earnings ratio of 28.8x below the CN market's average of 35.8x and high-quality earnings, Carthane seems well-positioned despite its debt-to-equity ratio rising to 10.8% over five years.

- Unlock comprehensive insights into our analysis of Shanghai CarthaneLtd stock in this health report.

Understand Shanghai CarthaneLtd's track record by examining our Past report.

Maeda Kosen (TSE:7821)

Simply Wall St Value Rating: ★★★★★★

Overview: Maeda Kosen Co., Ltd. is engaged in the manufacturing and sale of civil engineering, construction, and agricultural materials, as well as nonwoven fabrics in Japan, with a market cap of ¥115.12 billion.

Operations: The company's revenue primarily comes from its Social Infrastructure Business, contributing ¥31.70 billion, followed by the Industry Infrastructure Business at ¥24.15 billion.

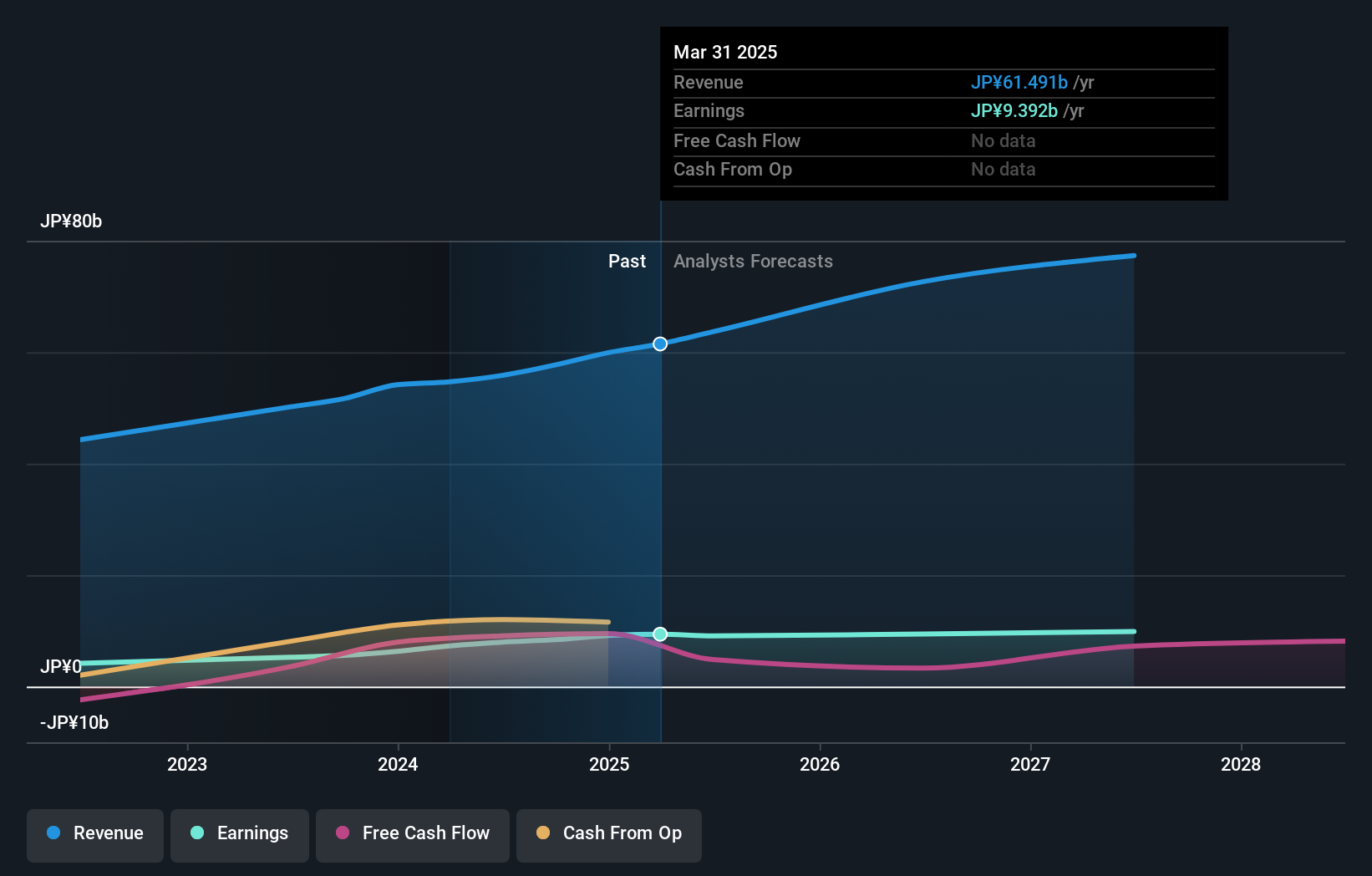

Maeda Kosen, a nimble player in the industry, has demonstrated substantial earnings growth of 51.7% over the past year, outpacing the Basic Materials sector's 9%. Its high-quality earnings and status as free cash flow positive underscore financial health. Despite recent shareholder dilution, Maeda Kosen trades at an attractive 47% below its estimated fair value. The company’s debt management is commendable with a debt-to-equity ratio plummeting from 45.8% to just 1.7% over five years and interest payments are comfortably covered by EBIT at a multiple of 99x. Future growth seems promising with forecasted annual earnings increase of 4.81%.

- Click here to discover the nuances of Maeda Kosen with our detailed analytical health report.

Explore historical data to track Maeda Kosen's performance over time in our Past section.

Central Automotive Products (TSE:8117)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Automotive Products Ltd. is involved in the import, export, and wholesale of automotive parts and accessories with a market capitalization of ¥84.82 billion.

Operations: The company generates revenue primarily through its Automotive Parts and Accessories Sales Business, which accounts for ¥31.47 billion, while the Automobile Disposal Business contributes ¥7.93 billion.

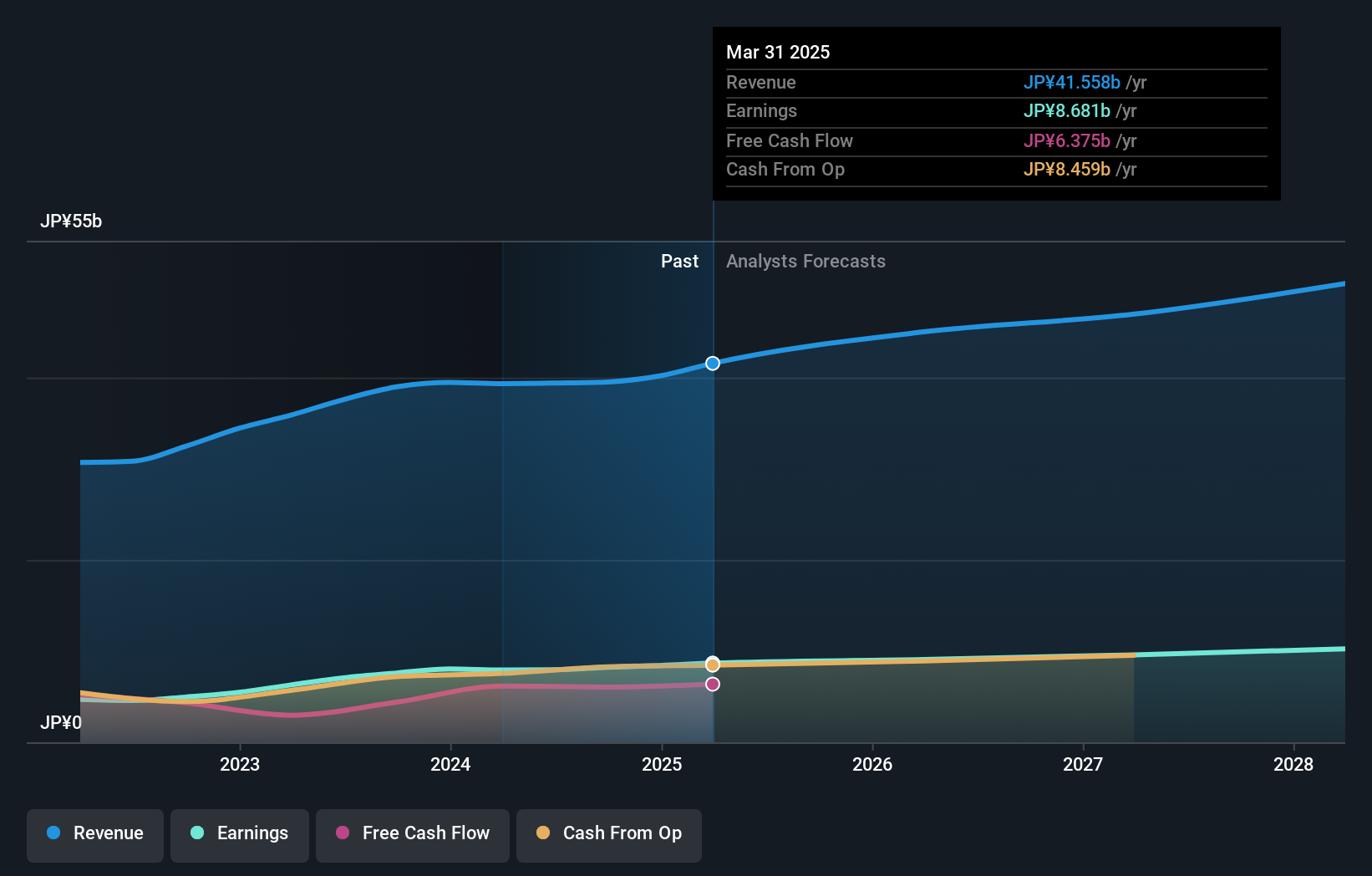

Central Automotive Products, a nimble player in the automotive sector, recently joined the S&P Global BMI Index. This company has demonstrated robust financial health with earnings growth of 12.5% over the past year, outpacing the Retail Distributors industry average of 2.5%. It stands debt-free, which eliminates concerns about interest payments and suggests a solid foundation for future operations. Trading at approximately 42.8% below its estimated fair value indicates potential undervaluation in the market. With high-quality earnings and positive free cash flow, Central Automotive seems poised for continued strength in its niche market segment.

Where To Now?

- Explore the 4659 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603037

Shanghai CarthaneLtd

Operates in the auto parts manufacturing industry in China.

Solid track record with excellent balance sheet.