The board of Maeda Kosen Co., Ltd. (TSE:7821) has announced that it will pay a dividend on the 30th of September, with investors receiving ¥20.00 per share. Even though the dividend went up, the yield is still quite low at only 1.3%.

Check out our latest analysis for Maeda Kosen

Maeda Kosen's Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Maeda Kosen's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

The next year is set to see EPS grow by 5.5%. If the dividend continues on this path, the payout ratio could be 20% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

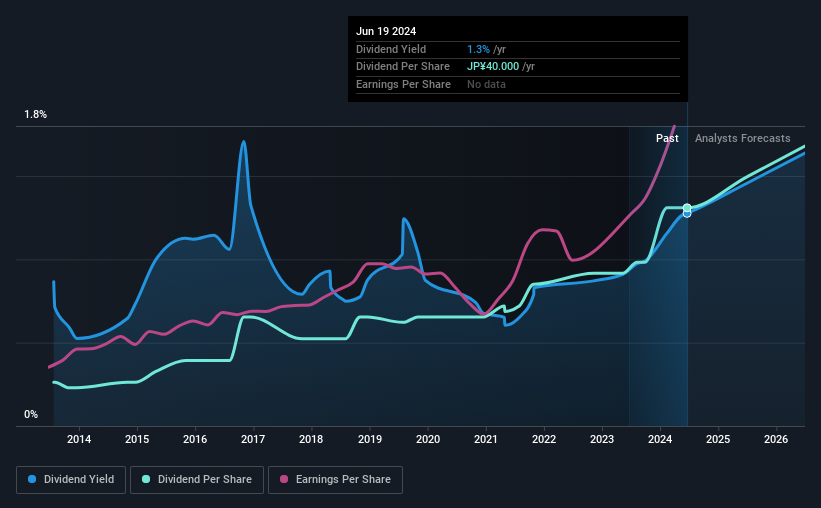

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the annual payment back then was ¥8.00, compared to the most recent full-year payment of ¥40.00. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. Maeda Kosen has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Maeda Kosen has seen EPS rising for the last five years, at 11% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

An additional note is that the company has been raising capital by issuing stock equal to 12% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

We Really Like Maeda Kosen's Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Maeda Kosen that investors should take into consideration. Is Maeda Kosen not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7821

Maeda Kosen

Engages in the manufacture and sale of civil engineering materials, building materials, and non-woven fabrics in Japan.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026