- Japan

- /

- Metals and Mining

- /

- TSE:7637

Hakudo Co., Ltd. (TSE:7637) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Hakudo Co., Ltd. (TSE:7637) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 8.1% in the last year.

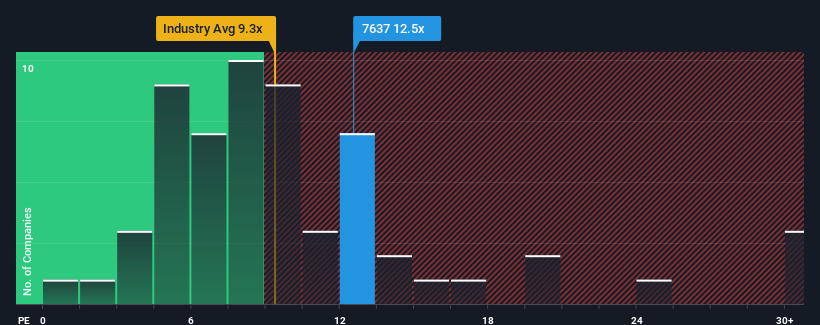

In spite of the heavy fall in price, it's still not a stretch to say that Hakudo's price-to-earnings (or "P/E") ratio of 12.5x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Hakudo over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Hakudo

Is There Some Growth For Hakudo?

In order to justify its P/E ratio, Hakudo would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 30%. Even so, admirably EPS has lifted 50% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Hakudo's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Hakudo's P/E?

Following Hakudo's share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hakudo currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Hakudo, and understanding should be part of your investment process.

If you're unsure about the strength of Hakudo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Hakudo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hakudo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7637

Hakudo

Processes and sells metal and plastic materials in Japan, China, Thailand, and Vietnam.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives