Nitto Denko (TSE:6988): Assessing Valuation Following Launch of Major Share Buyback Program

Reviewed by Kshitija Bhandaru

Nitto Denko (TSE:6988) has unveiled a new share buyback program that could see up to 4% of its outstanding shares repurchased. This move is likely to catch investors’ attention given its size and timing.

See our latest analysis for Nitto Denko.

This buyback announcement comes as Nitto Denko’s Board approved a plan to cancel a portion of treasury shares, highlighting a series of deliberate moves to support shareholder value. The latest share price is ¥3,650. While recent share price returns have been modest, the company’s 1-year total shareholder return of 0.56% and five-year total shareholder return of 1.87% reflect steady, if unspectacular, long-term gains. With momentum building on the back of fresh capital initiatives, investors will be watching to see if this buyback marks an inflection point for the stock’s broader performance and valuation context.

If you’re scanning the market for new discovery opportunities, now is a great time to broaden your investing horizons and see what you can find with fast growing stocks with high insider ownership

So with Nitto Denko launching a significant buyback, but trading at a modest discount to analyst targets, is this a compelling value play or is the market already factoring in all future growth?

Price-to-Earnings of 18.6x: Is It Justified?

Nitto Denko currently holds a price-to-earnings (P/E) ratio of 18.6x, compared to the latest share price of ¥3,650. This P/E level suggests the stock is priced lower than the estimated fair value ratio and its peers. This may indicate a level of value recognition by the market.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. It is especially pertinent for established manufacturers like Nitto Denko, where steady profit generation and multi-year profitability trends attract long-term investors seeking reliable returns. With a P/E below the estimated fair value, it appears the market may be discounting upcoming growth or pricing in cyclical risks associated with the chemicals sector.

Compared to the industry average P/E of 12.5x, Nitto Denko trades at a premium. This suggests investors see something unique or defensive in the company's earnings power. However, its ratio is still below what regression-based fair multiples suggest the market could move toward. This hints at potential future upside if operational or market confidence improves.

Explore the SWS fair ratio for Nitto Denko

Result: Price-to-Earnings of 18.6x (UNDERVALUED)

However, slower revenue growth or potential profit margin pressures could quickly temper optimism. This underscores the need for caution as broader market dynamics evolve.

Find out about the key risks to this Nitto Denko narrative.

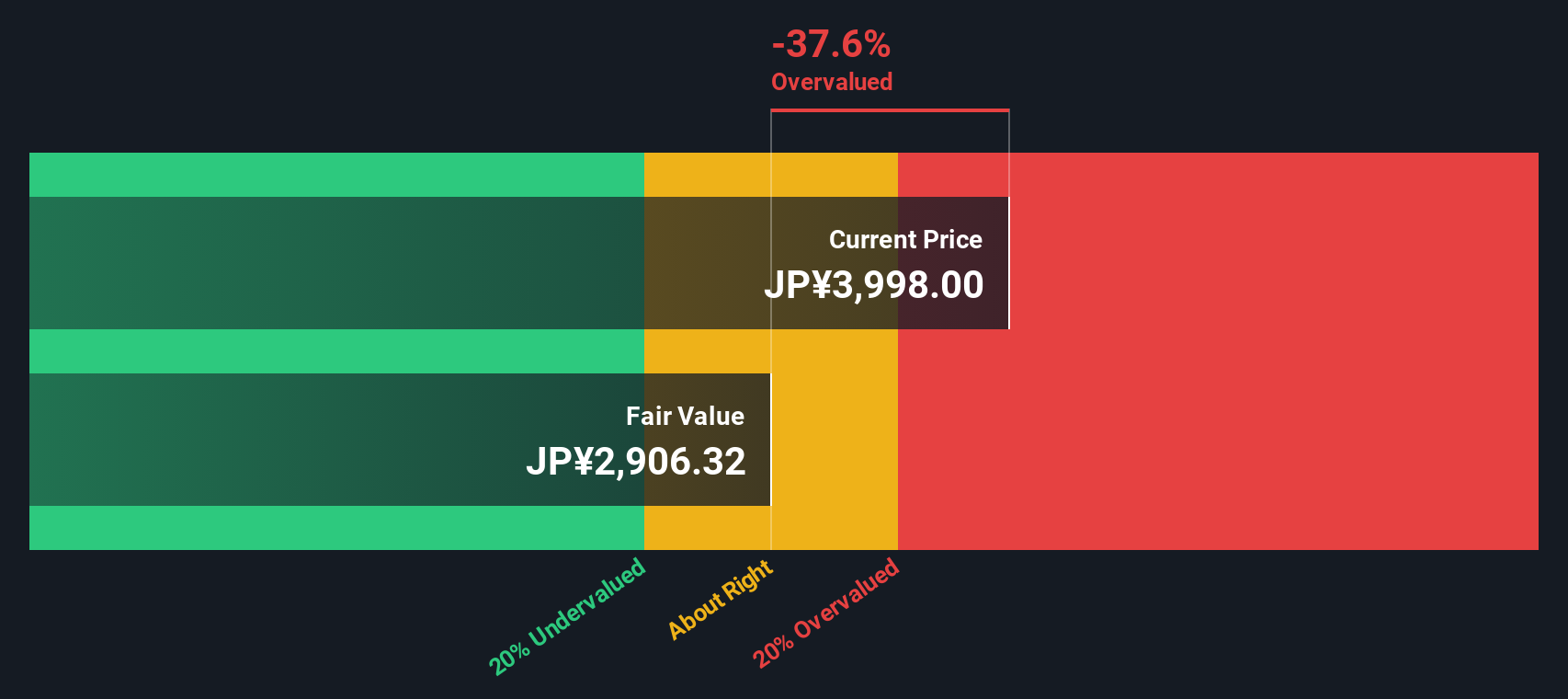

Another View: SWS DCF Model Suggests Overvaluation

While the price-to-earnings approach shows Nitto Denko trading below fair value, our DCF model presents a different perspective. The stock is currently priced above its estimated intrinsic value of ¥2,908, indicating potential overvaluation if cash flow expectations are not met. Can fundamentals catch up, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nitto Denko for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nitto Denko Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own view in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nitto Denko.

Looking for more investment ideas?

Seize the momentum and act now. The right investment could be just a click away. Uncover your next opportunity with these powerful screeners on Simply Wall Street:

- Boost your portfolio’s yield and stability by checking out these 19 dividend stocks with yields > 3% with consistently high payouts above 3%.

- Tap into game-changing innovation as you scan these 26 quantum computing stocks harnessing the potential of quantum computing for tomorrow’s breakthroughs.

- Fuel your strategy with explosive potential by finding these 3563 penny stocks with strong financials showing strong fundamentals in rapidly evolving markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Denko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6988

Nitto Denko

Primarily engages in the adhesive tapes business in Japan, the Americas, Europe, Asia, and Oceania.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives