- Japan

- /

- Metals and Mining

- /

- TSE:5922

Even With A 28% Surge, Cautious Investors Are Not Rewarding Nasu Denki-Tekko Co., Ltd.'s (TSE:5922) Performance Completely

The Nasu Denki-Tekko Co., Ltd. (TSE:5922) share price has done very well over the last month, posting an excellent gain of 28%. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

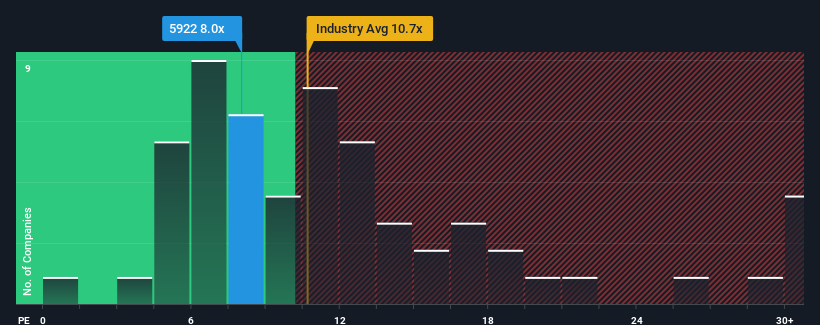

Even after such a large jump in price, Nasu Denki-Tekko may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Nasu Denki-Tekko's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Nasu Denki-Tekko

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Nasu Denki-Tekko's is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 73% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 9.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Nasu Denki-Tekko's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Nasu Denki-Tekko's P/E

The latest share price surge wasn't enough to lift Nasu Denki-Tekko's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nasu Denki-Tekko currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Nasu Denki-Tekko (1 is a bit unpleasant) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Nasu Denki-Tekko, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nasu Denki-Tekko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5922

Nasu Denki-Tekko

Manufactures and sells steel towers, steel structures, transportation system materials, overhead wire hardware products, and underground wire materials in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives