Assessing Toyo Seikan Group Holdings (TSE:5901) Valuation After Its Health-Focused Investment in TOY MEDICAL

Reviewed by Simply Wall St

Toyo Seikan Group Holdings (TSE:5901) has kicked off a new chapter by investing in TOY MEDICAL, tying its packaging expertise to patented salt offset technology that targets healthier, lower salt diets without sacrificing taste.

See our latest analysis for Toyo Seikan Group Holdings.

The fresh TOY MEDICAL tie up comes as Toyo Seikan’s 1 month share price return of 12.81 percent builds on strong year to date momentum of 60.87 percent, supported by a striking 5 year total shareholder return of 339.17 percent that signals investors are steadily re rating the story.

If this kind of strategic shift has your attention, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

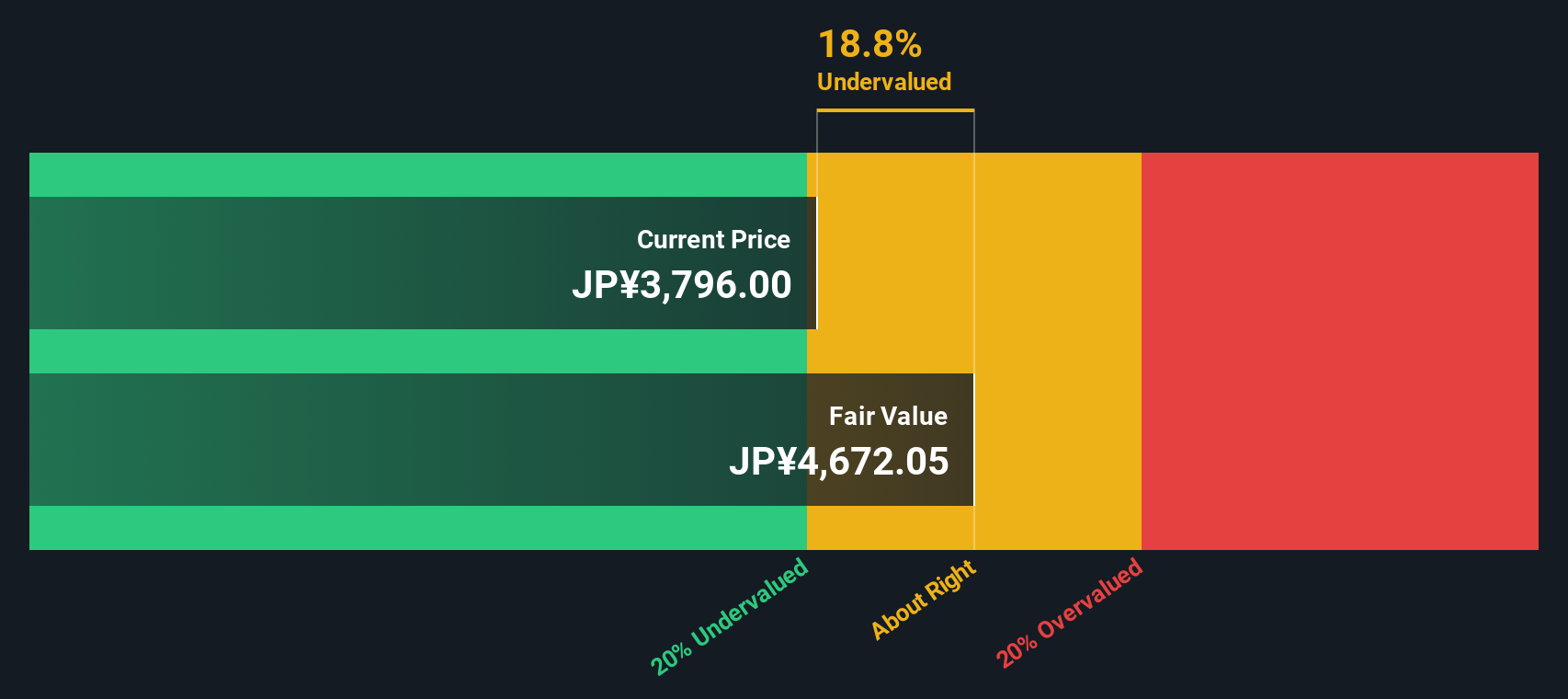

But with Toyo Seikan’s shares already up sharply and our model hinting at roughly an 18 percent intrinsic value discount, is the market still underestimating this health focused pivot, or is future growth already priced in?

Price to earnings of 13.1x, is it justified?

Toyo Seikan Group Holdings last closed at ¥3848, and on a price to earnings ratio of 13.1 times it screens noticeably more expensive than peers.

The price to earnings multiple compares what investors pay today for each unit of current earnings, a useful lens for a mature, cash generative packaging group.

Here, the 13.1 times earnings valuation sits above both direct peers at 10.6 times and the broader Japan packaging industry at 9.2 times. This implies the market is already pricing in stronger profitability or durability of earnings than rivals despite limited forecast data to indicate how far that premium is warranted.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to earnings of 13.1x (OVERVALUED)

However, slowing earnings visibility and any setback in scaling health focused technologies could quickly challenge the premium valuation and recent share price gains.

Find out about the key risks to this Toyo Seikan Group Holdings narrative.

Another View, SWS DCF suggests upside

While the 13.1 times earnings multiple looks rich versus peers, our DCF model paints a different picture and suggests fair value around ¥4676 versus a market price of ¥3848, roughly an 18 percent discount that frames Toyo Seikan as undervalued despite its premium multiple.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyo Seikan Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyo Seikan Group Holdings Narrative

If you see Toyo Seikan differently, or want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Toyo Seikan Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunities by scanning targeted stock ideas that match different strategies, so you are not leaving potential returns on the table.

- Target high potential value plays by reviewing these 908 undervalued stocks based on cash flows, which highlights stocks that currently trade below what their cash flows may justify.

- Level up your growth strategy by focusing on innovative companies at the frontier of automation and machine learning through these 26 AI penny stocks.

- Strengthen your income stream by uncovering reliable payers in these 15 dividend stocks with yields > 3% that offer attractive yields and room for future increases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Seikan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5901

Toyo Seikan Group Holdings

Manufactures and sells packaging containers in Japan, rest of Asia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026