- Japan

- /

- Metals and Mining

- /

- TSE:5711

Is Mitsubishi Materials (TSE:5711) Overvalued After Its Tungsten Strategy Update?

Reviewed by Simply Wall St

If you own shares in Mitsubishi Materials (TSE:5711) or are considering getting in, you probably noticed the company’s recent investor relations meeting focused on its Tungsten business strategy. While these kinds of updates do not always lead to instant headline-making change, they can hint at shifts on the horizon, especially when a core segment like Tungsten is in the spotlight. Investors tuning in will be looking for clues about potential new initiatives, operational improvements, or changes in how Mitsubishi Materials positions itself in global materials markets.

This meeting comes after a year where Mitsubishi Materials has seen its stock climb 12% and gain momentum over the past three months, with a 16% rise. These numbers suggest that market sentiment has strengthened lately, perhaps in anticipation of upcoming moves or business updates. The company has also reported annual net income growth above 25%, pointing to underlying improvements beyond just share price gains.

After these recent developments and the attention now turning to its Tungsten business, the key question is whether Mitsubishi Materials is undervalued at current levels or if the market is already pricing in all the expected growth ahead.

Price-to-Earnings of 37.5x: Is it justified?

On a price-to-earnings (P/E) basis, Mitsubishi Materials appears overvalued when compared to its peers and the broader Japanese metals and mining industry. Its current P/E ratio stands at 37.5x, which is significantly higher than both the industry average and typical valuations for similar companies.

The P/E ratio measures how much investors are willing to pay for each unit of company earnings. It is a widely used benchmark for relative valuation in the sector and helps investors gauge whether a stock’s price reflects robust profit expectations or if it is stretched relative to its ability to generate earnings.

The high multiple suggests that the market is pricing in substantial future earnings growth or possibly overestimating the company’s prospects compared to the industry norm. This premium could reflect optimism about strategic shifts, but it also increases the risk of disappointment if earnings do not accelerate as expected.

Result: Fair Value of ¥516.54 (OVERVALUED)

See our latest analysis for Mitsubishi Materials.However, continued high valuation may face pressure if earnings growth slows or if analyst targets prove overly optimistic in the coming quarters.

Find out about the key risks to this Mitsubishi Materials narrative.Another View: What Does Our DCF Model Indicate?

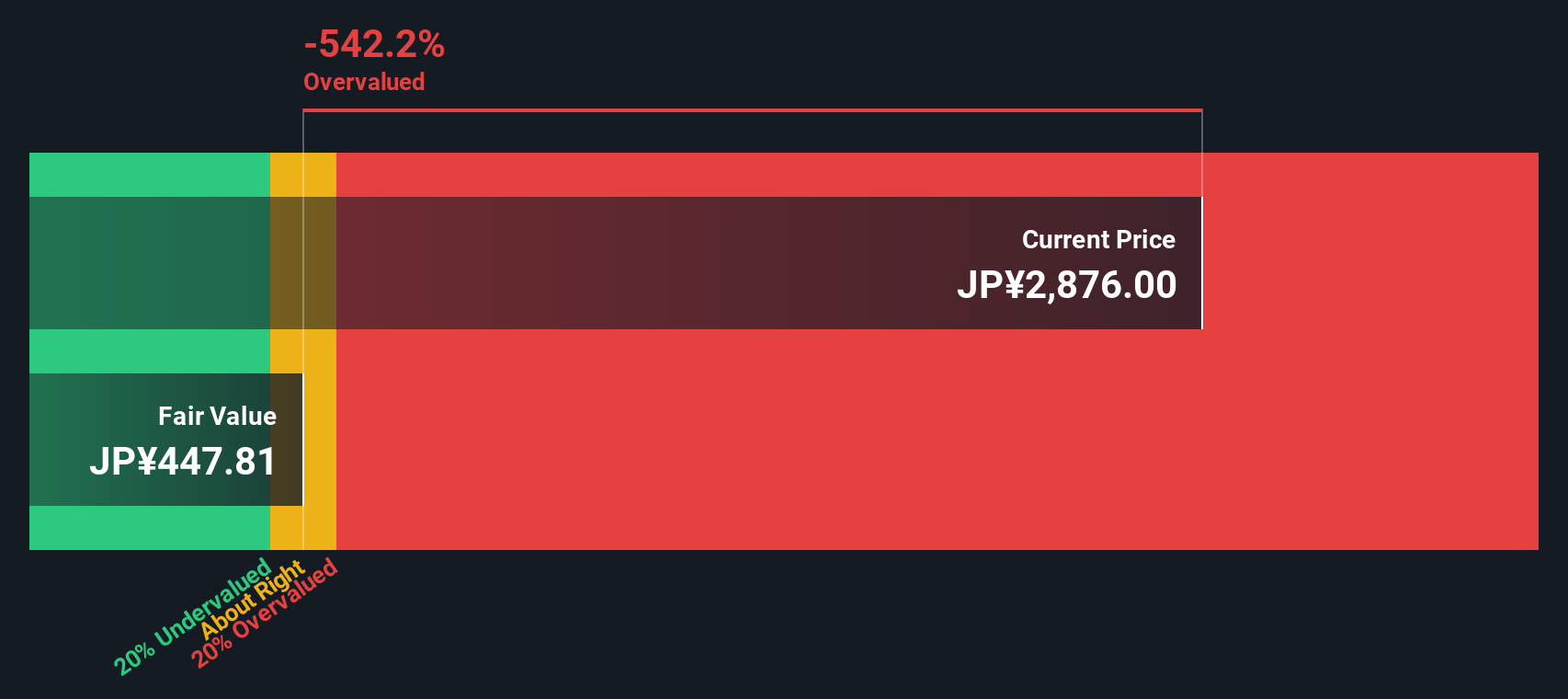

Looking at things from a different angle, our SWS DCF model delivers a strikingly different verdict. It also suggests the shares are overvalued. Does this reinforce or challenge the market's optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mitsubishi Materials Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you have the tools to build your own view in just a few minutes, so why not Do it your way.

A great starting point for your Mitsubishi Materials research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and boost your investment potential by tapping into these hand-picked opportunities. Don’t wait on the sidelines while others take advantage.

- Uncover hidden gems with strong financials that are overlooked by most using penny stocks with strong financials.

- Find tomorrow’s market leaders powered by artificial intelligence by using AI penny stocks.

- Capture value early by targeting companies trading below their cash flow potential through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5711

Mitsubishi Materials

Engages in the manufacture and sale of processed copper products and electronic materials, cemented carbide products, and businesses related to renewable energy in Japan.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives