- Japan

- /

- Trade Distributors

- /

- TSE:9845

3 Global Dividend Stocks Yielding Up To 8.3%

Reviewed by Simply Wall St

Amidst the backdrop of global markets reaching new highs, driven by easing geopolitical tensions and positive trade developments, investors are increasingly seeking stable income opportunities as inflationary pressures persist. In this environment, dividend stocks stand out for their potential to provide consistent returns through regular payouts, making them an attractive option for those looking to balance growth with income stability.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.33% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.00% | ★★★★★★ |

| NCD (TSE:4783) | 4.24% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.53% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.44% | ★★★★★★ |

| ENEOS Holdings (TSE:5020) | 4.20% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.37% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.04% | ★★★★★★ |

Click here to see the full list of 1546 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

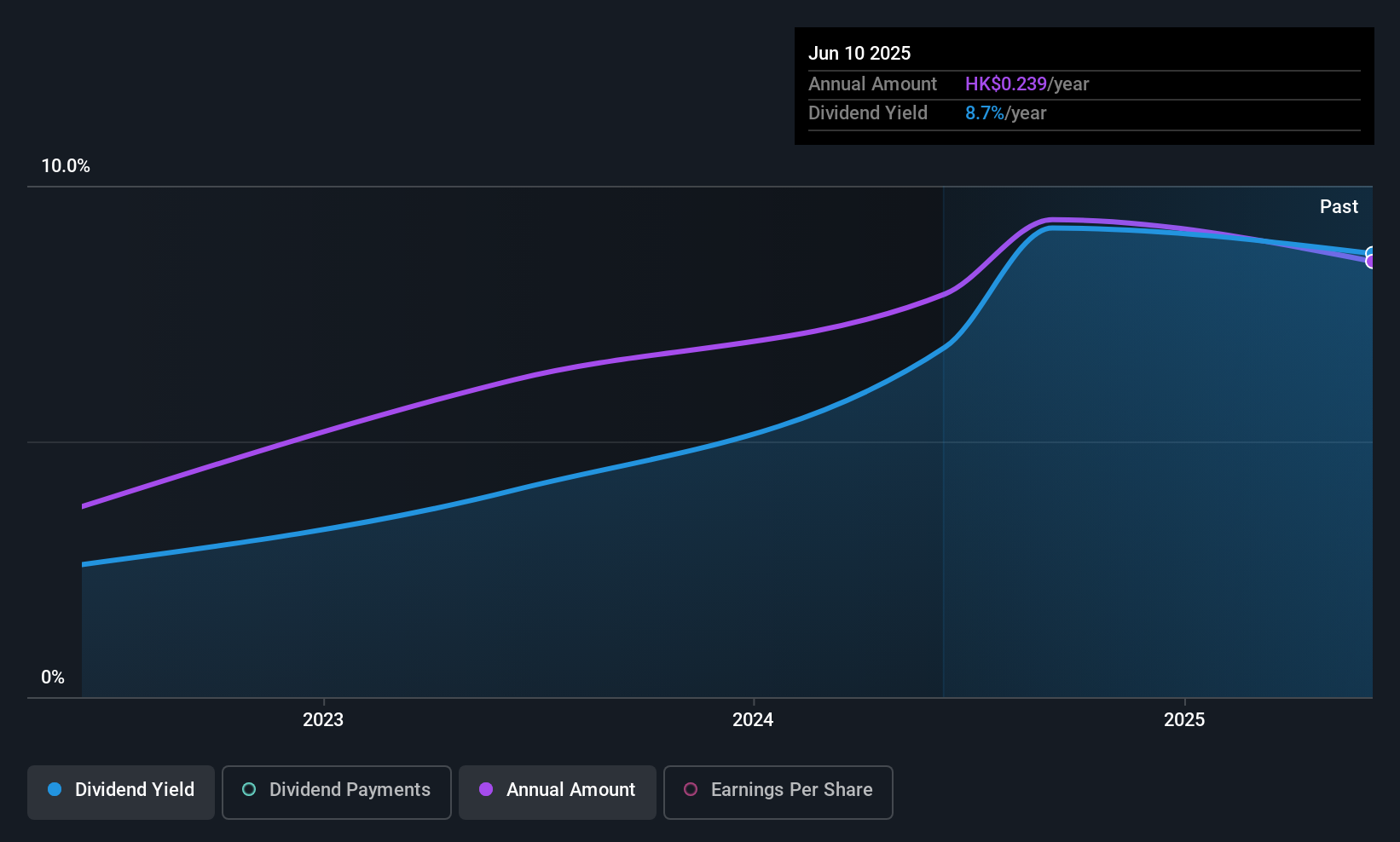

Chaoju Eye Care Holdings (SEHK:2219)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chaoju Eye Care Holdings Limited operates a network of ophthalmic hospitals and optical centers in China, with a market cap of HK$1.97 billion.

Operations: Chaoju Eye Care Holdings Limited generates revenue from three main segments: Basic Ophthalmic Services (CN¥697.84 million), Consumer Ophthalmic Services (CN¥706.45 million), and Sales of Equipment and Medical Consumables (CN¥1.17 million).

Dividend Yield: 8.4%

Chaoju Eye Care Holdings' dividend payments are supported by both earnings and cash flows, with a payout ratio of 83% and a cash payout ratio of 54.2%. Although the company has only been paying dividends for three years, these payments have grown steadily without volatility. The dividend yield is in the top 25% within Hong Kong's market. Recently, Chaoju declared a final dividend of HK$0.12 per share for 2024, affirming its commitment to shareholders.

- Click to explore a detailed breakdown of our findings in Chaoju Eye Care Holdings' dividend report.

- The valuation report we've compiled suggests that Chaoju Eye Care Holdings' current price could be quite moderate.

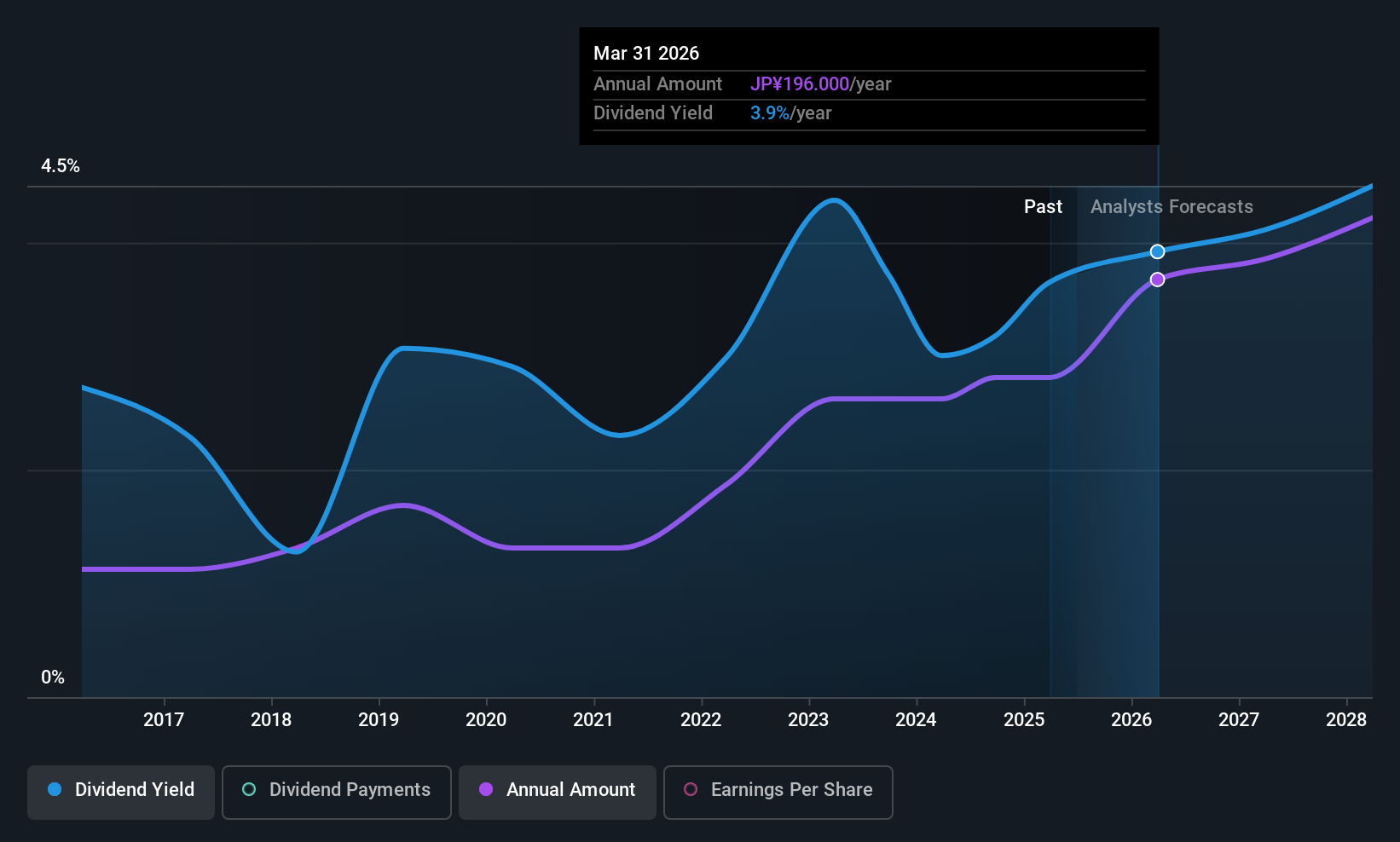

Mitsui Mining & Smelting (TSE:5706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui Mining & Smelting Co., Ltd. is involved in the manufacture and sale of nonferrous metal products both in Japan and internationally, with a market capitalization of ¥288.14 billion.

Operations: Mitsui Mining & Smelting Co., Ltd.'s revenue segments include Metals at ¥294.82 billion, Mobility at ¥204.91 billion, and Engineering at ¥153.45 billion.

Dividend Yield: 3.9%

Mitsui Mining & Smelting's dividend policy has shifted to a progressive approach, with recent increases reflecting this change. The company announced a year-end dividend of JPY 90 per share for fiscal 2025, up from JPY 70 the previous year. For fiscal 2026, guidance suggests further growth with dividends of JPY 100 and JPY 95 per share at different intervals. Despite past volatility in payouts, current dividends are well-covered by earnings and cash flows due to low payout ratios.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitsui Mining & Smelting.

- In light of our recent valuation report, it seems possible that Mitsui Mining & Smelting is trading behind its estimated value.

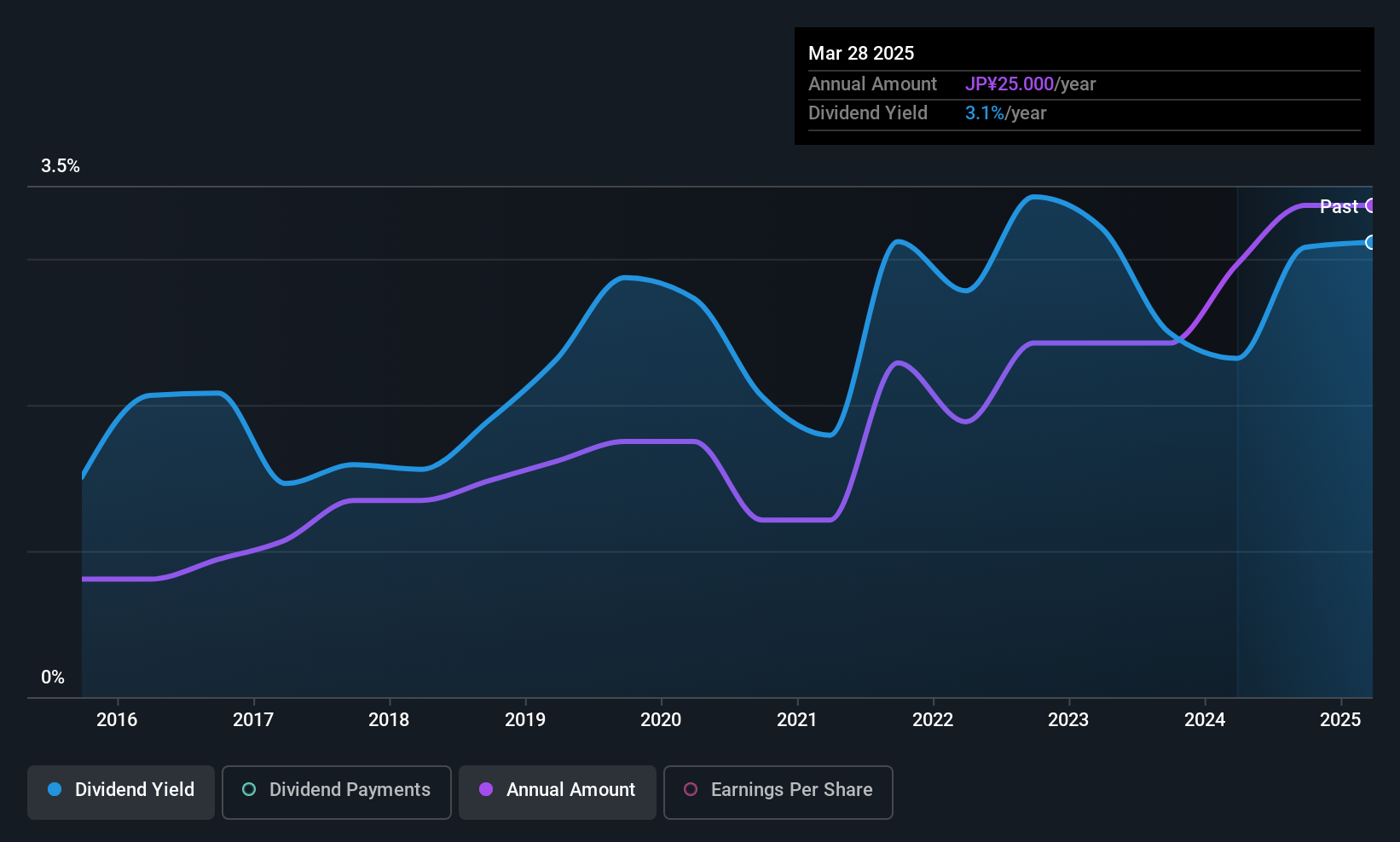

Parker (TSE:9845)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parker Corporation engages in product development, manufacturing, sales, and technical services across various sectors including automobiles, electrical machinery, chemicals, steel, electronics, and food with a market cap of ¥22.32 billion.

Operations: Parker Corporation's revenue is derived from its activities in automobiles, electrical machinery, chemicals, steel, electronics, and food sectors.

Dividend Yield: 3.1%

Parker Corporation's dividend payments are well-supported by both earnings and cash flows, with low payout ratios of 18.2% and 18.1%, respectively. However, the dividends have been volatile over the past decade, with significant annual drops exceeding 20%. Although trading at a substantial discount to its estimated fair value, Parker's dividend yield of 3.14% is below the top quartile in Japan's market. Upcoming insights may arise from its Annual General Meeting on June 25, 2025.

- Take a closer look at Parker's potential here in our dividend report.

- Upon reviewing our latest valuation report, Parker's share price might be too pessimistic.

Seize The Opportunity

- Unlock our comprehensive list of 1546 Top Global Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9845

Parker

Provides product development, manufacturing, sales, and technical services for industrial fine chemicals, sealing materials and adhesives, soundproofing materials, machinery and equipment in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives