- Japan

- /

- Metals and Mining

- /

- TSE:5706

Mitsui Mining & Smelting (TSE:5706) Valuation Deep Dive After Launching Advanced Semiconductor Materials Production

Reviewed by Kshitija Bhandaru

Mitsui Kinzoku Company (TSE:5706) has kicked off mass production of advanced negative thermal expansion materials for use in high-end semiconductors, including GPUs made by NVIDIA. This development quickly lifted the stock to its year-to-date high.

See our latest analysis for Mitsui Kinzoku Company.

The strategic leap into cutting-edge semiconductor materials has clearly excited investors. After months of building momentum, Mitsui Kinzoku’s share price return has soared nearly 197% so far this year. Total shareholder returns have risen above 500% over five years, which signals that growth potential and optimism are on the rise.

If this surge has you watching for the next big move, consider broadening your search and discover fast growing stocks with high insider ownership

This dramatic rally raises a key question: is Mitsui Kinzoku still undervalued with more room to run, or has the market already priced in all of the upside from its latest breakthrough?

Price-to-Earnings of 21.4x: Is it justified?

Mitsui Kinzoku currently trades on a price-to-earnings (PE) ratio of 21.4x, which positions it at a premium compared to industry peers and internal estimates. With its last close at ¥13,675, investors are paying more for each unit of earnings than the average Japanese metals and mining stock.

The price-to-earnings ratio is a widely used metric that reflects how much shareholders are willing to pay per yen of current earnings. In Mitsui Kinzoku's case, the higher PE could indicate the market expects further progress from its advanced materials division, or that optimism from recent share price momentum has pushed valuation ahead of fundamentals.

Yet, when compared to the Japanese metals and mining sector average of just 13.5x, the company's shares look especially expensive. Notably, its PE also exceeds the estimated fair price-to-earnings ratio of 20.6x, hinting that shares may already trade above their internal value benchmark. This could indicate the market has possibly gotten ahead of itself.

Explore the SWS fair ratio for Mitsui Kinzoku Company

Result: Price-to-Earnings of 21.4x (OVERVALUED)

However, recent revenue contraction and a premium valuation could signal challenges ahead, particularly if further growth from new materials does not occur quickly.

Find out about the key risks to this Mitsui Kinzoku Company narrative.

Another View: Our DCF Model Tells a Different Story

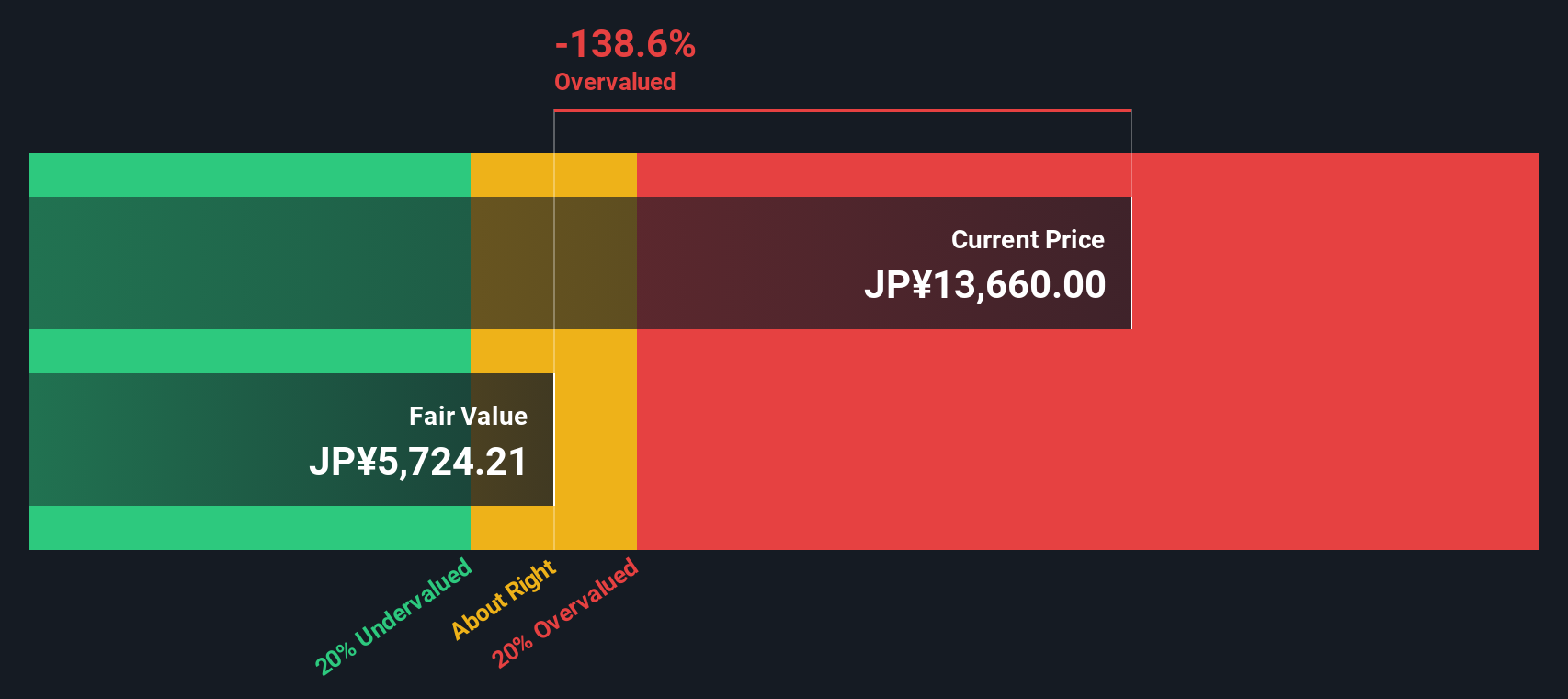

Switching to the SWS DCF model provides a fundamentally different perspective. According to our DCF analysis, Mitsui Kinzoku's shares are currently trading far above their estimated fair value of ¥5,758. This suggests the stock is overvalued on this metric. However, does this discounted cash flow approach overlook the potential of Mitsui Kinzoku’s innovation-driven growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui Kinzoku Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui Kinzoku Company Narrative

Feeling inspired to dig deeper and form your own perspective? You can easily build your own analysis in under three minutes and share your view using Do it your way.

A great starting point for your Mitsui Kinzoku Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors act quickly to capture the next big opportunity. Supercharge your watchlist by seeing which stocks meet the criteria that matter most to you today.

- Tap into tomorrow’s growth by evaluating these 24 AI penny stocks identified for their high potential in artificial intelligence and breakthrough automation.

- Maximize your yield and strengthen your portfolio with these 18 dividend stocks with yields > 3%, which offers robust returns above 3%.

- Embrace the blockchain future and uncover market leaders among these 79 cryptocurrency and blockchain stocks focused on digital assets and decentralized technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5706

Mitsui Kinzoku Company

Engages in the manufacture and sale of metal products in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives