- Taiwan

- /

- Construction

- /

- TPEX:2072

Global Undiscovered Gems Three Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

As global markets experience a mix of easing trade tensions and economic uncertainties, small-cap equities have shown resilience with gains for the third consecutive week. In this environment, identifying stocks with robust fundamentals becomes crucial, as they can offer potential opportunities amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 2.62% | 7.38% | ★★★★★★ |

| Tianjin Port Holdings | 17.03% | -3.88% | 9.77% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Shanghai Chlor-Alkali Chemical | 9.56% | 7.12% | 1.55% | ★★★★★☆ |

| Lungteh Shipbuilding | 55.17% | 28.09% | 42.33% | ★★★★★☆ |

| Sinomag Technology | 68.98% | 16.59% | 3.83% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Yukiguni Factory | 126.48% | -5.17% | -33.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Century Wind Power (TPEX:2072)

Simply Wall St Value Rating: ★★★★★☆

Overview: Century Wind Power Co., Ltd. focuses on construction activities and has a market capitalization of NT$43.95 billion.

Operations: The primary revenue stream for Century Wind Power Co., Ltd. is from its Electric Equipment segment, which generated NT$9.66 billion. The company has a significant market capitalization of NT$43.95 billion, indicating its substantial presence in the industry.

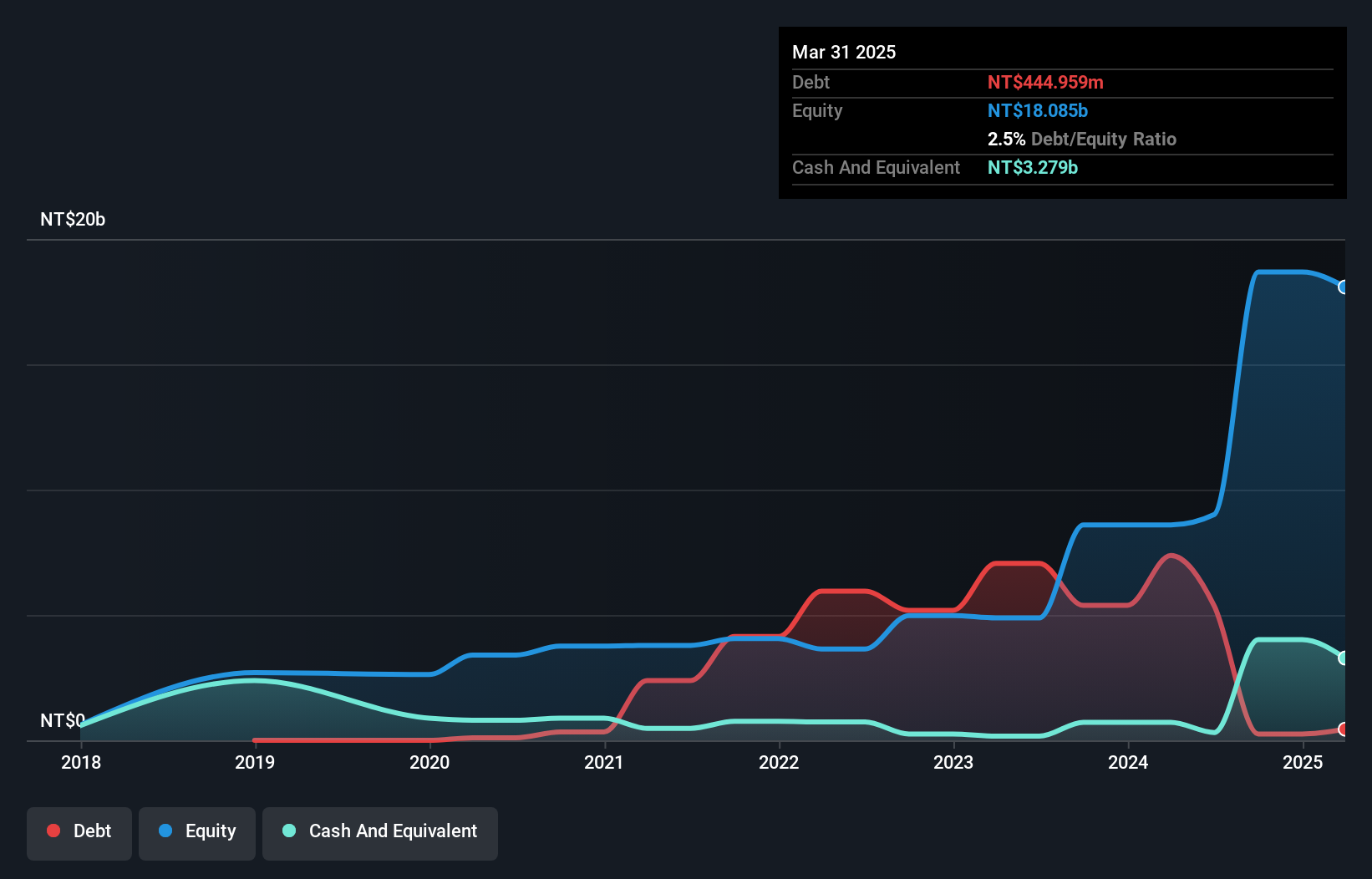

Century Wind Power, a rising player in the renewable energy sector, has demonstrated impressive financial growth. With sales reaching TWD 9.66 billion and net income climbing to TWD 1.50 billion for the year ending December 31, 2024, it reflects a robust performance compared to the previous year’s figures of TWD 8.21 billion and TWD 822 million respectively. Earnings per share also improved significantly from TWD 6.67 to TWD 10.62 over the same period. Although recent months have seen share price volatility, its earnings growth of 83% outpaces industry averages, indicating strong operational momentum despite some dilution concerns.

- Delve into the full analysis health report here for a deeper understanding of Century Wind Power.

Explore historical data to track Century Wind Power's performance over time in our Past section.

Aichi Steel (TSE:5482)

Simply Wall St Value Rating: ★★★★★★

Overview: Aichi Steel Corporation manufactures and sells steel, forged products, and electro-magnetic products in Japan, with a market cap of ¥145.93 billion.

Operations: Aichi Steel generates revenue primarily from the sale of steel, forged products, and electro-magnetic products. The company's financial performance is influenced by its cost structure and market demand for these products.

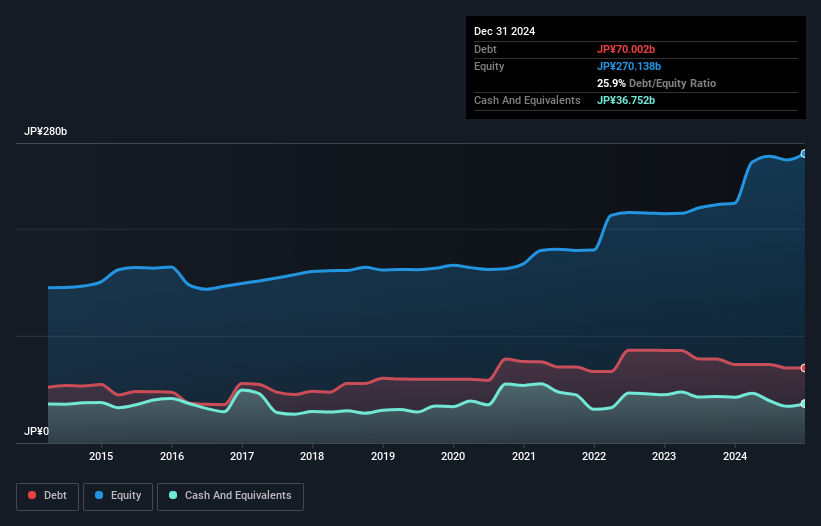

Aichi Steel, a nimble player in the industry, has shown notable financial health with its debt to equity ratio improving from 36.3% to 26.5% over five years. The company's interest obligations are comfortably managed with EBIT covering them 109 times, highlighting robust earnings quality. Recent initiatives include a buyback program repurchasing 650,000 shares for ¥4.39 billion, signaling a focus on shareholder value and capital efficiency. Earnings have surged by 18.6%, outpacing the broader Metals and Mining sector's -8.8%. With dividends increasing from ¥60 to ¥90 per share this year, Aichi Steel seems poised for continued investor interest.

- Dive into the specifics of Aichi Steel here with our thorough health report.

Assess Aichi Steel's past performance with our detailed historical performance reports.

MITSUI E&S (TSE:7003)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MITSUI E&S Co., Ltd. is a company that, along with its subsidiaries, specializes in providing marine propulsion systems globally and has a market capitalization of ¥167.27 billion.

Operations: MITSUI E&S generates significant revenue from Marine Propulsion Systems, contributing ¥133.82 billion, followed by Peripheral Businesses at ¥85.66 billion and New Business Development at ¥39.75 billion. The company focuses on diverse revenue streams across different sectors, with Logistics Systems also playing a notable role by generating ¥58.79 billion in revenue.

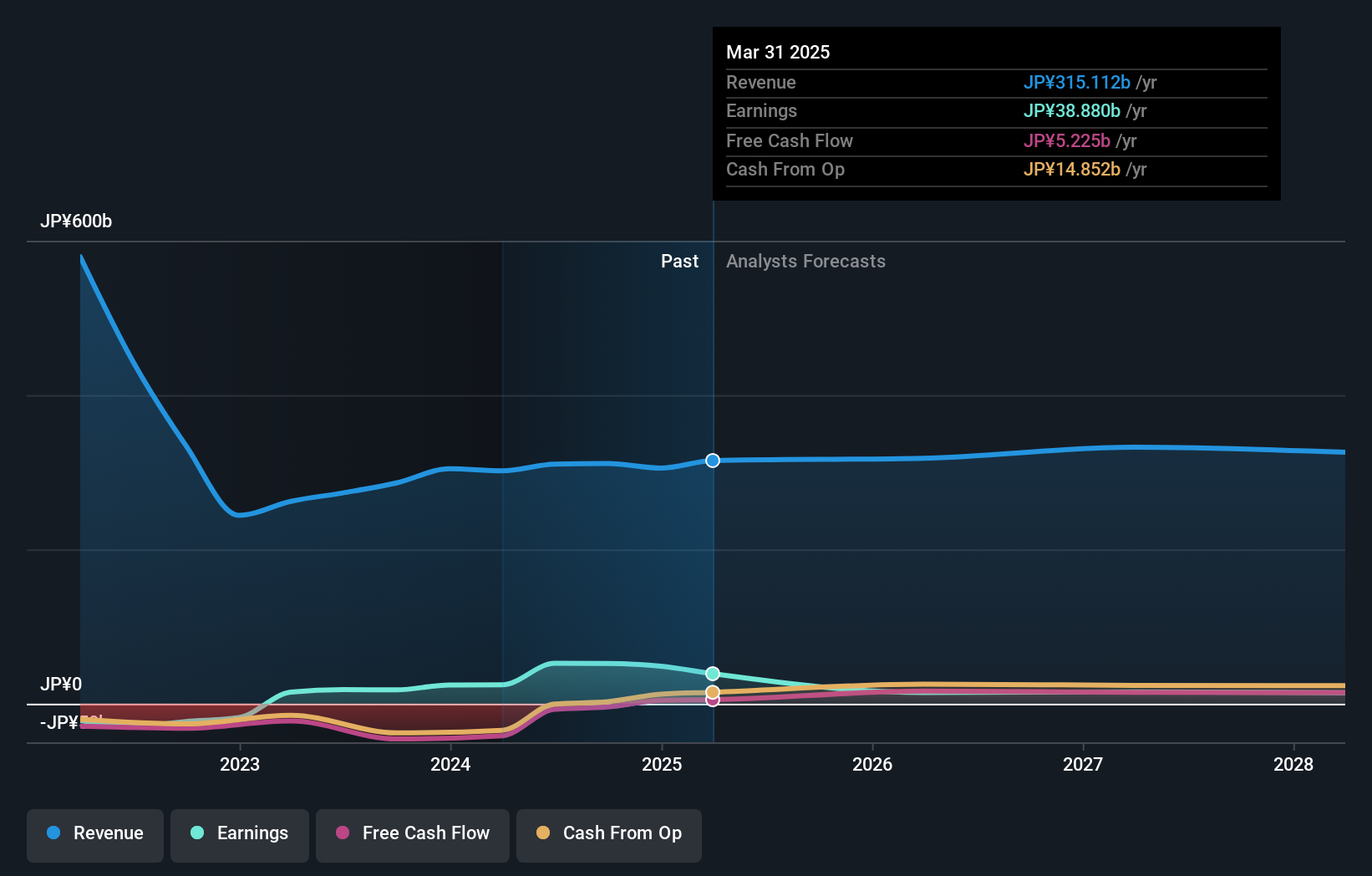

Mitsui E&S, a smaller player in the machinery sector, has shown impressive earnings growth of 99.6% over the past year, outpacing the industry's 5%. Despite a high net debt to equity ratio at 41%, its interest payments are well covered by EBIT at 8.1 times. A significant one-off gain of ¥19.5 billion influenced recent financial results, and the company's debt to equity ratio improved from 127.4% to 64.8% over five years. Recent updates include an increased dividend forecast and revised earnings guidance for fiscal year-end March 2025, reflecting upward profit expectations with projected profits of ¥38 billion or ¥374 per share.

- Click here and access our complete health analysis report to understand the dynamics of MITSUI E&S.

Review our historical performance report to gain insights into MITSUI E&S''s past performance.

Summing It All Up

- Explore the 3269 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:2072

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion