- Japan

- /

- Metals and Mining

- /

- TSE:5471

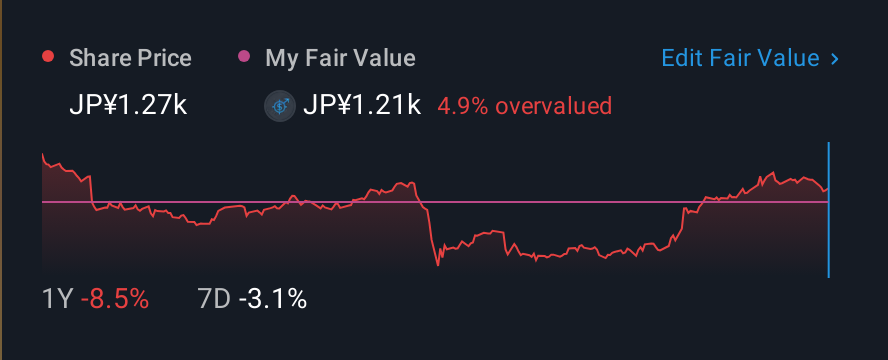

Daido Steel Co., Ltd. (TSE:5471) Held Back By Insufficient Growth Even After Shares Climb 25%

Daido Steel Co., Ltd. (TSE:5471) shareholders have had their patience rewarded with a 25% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

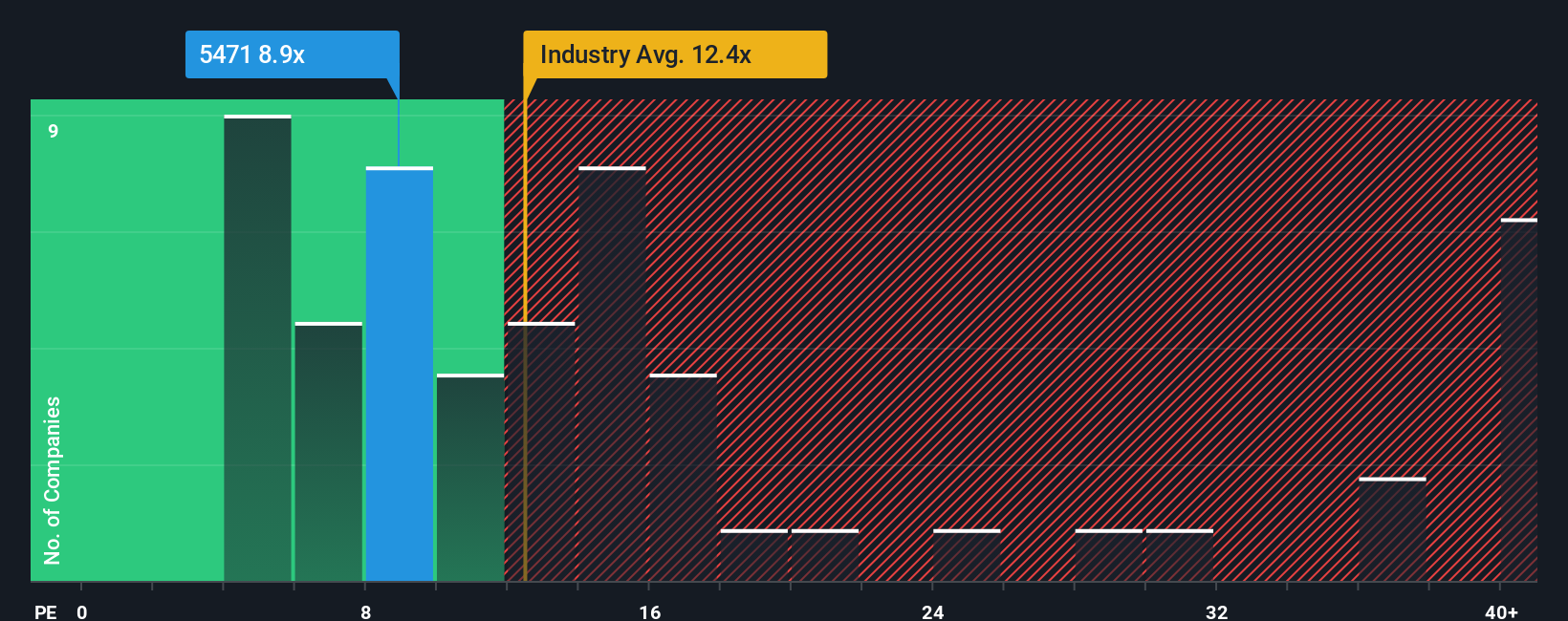

Although its price has surged higher, Daido Steel's price-to-earnings (or "P/E") ratio of 8.9x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 23x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Daido Steel hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Daido Steel

How Is Daido Steel's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Daido Steel's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.9%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 2.1% per annum over the next three years. With the market predicted to deliver 9.5% growth per year, the company is positioned for a weaker earnings result.

With this information, we can see why Daido Steel is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Daido Steel's P/E?

The latest share price surge wasn't enough to lift Daido Steel's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Daido Steel's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Daido Steel that you should be aware of.

If you're unsure about the strength of Daido Steel's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5471

Daido Steel

Manufactures and sells steel products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives