- Japan

- /

- Metals and Mining

- /

- TSE:5461

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this environment, dividend stocks can offer a compelling option for investors seeking steady income and potential growth, especially as they provide regular payouts that can help mitigate market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

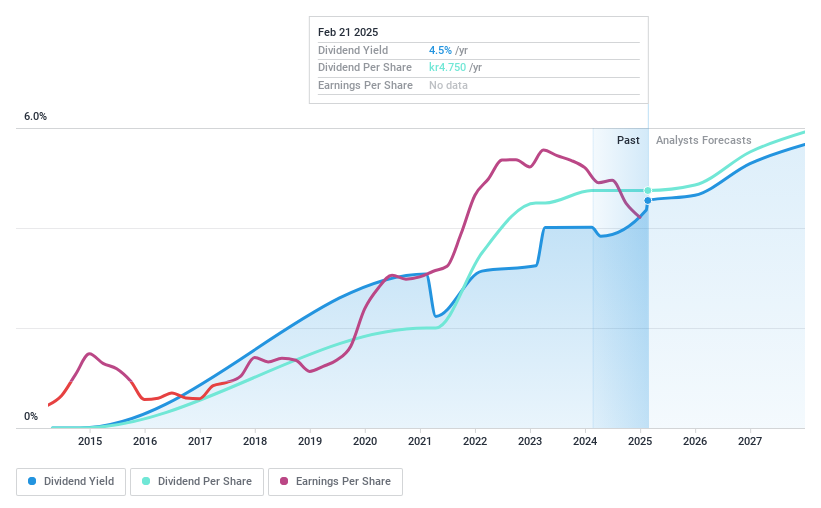

Prevas (OM:PREV B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prevas AB offers technical consultancy services in Sweden and internationally, with a market cap of SEK1.42 billion.

Operations: Prevas AB generates revenue primarily from its operations in Sweden (SEK1.28 billion), followed by Denmark (SEK160.92 million) and Finland (SEK91.54 million).

Dividend Yield: 4.3%

Prevas AB maintains a solid position among Swedish dividend stocks with a proposed dividend of SEK 4.75 per share for 2024, supported by a payout ratio of 66.7%. Despite declining net income, the company's dividends remain well-covered by earnings and cash flows, with a cash payout ratio at 47.8%. Although Prevas has only paid dividends for four years, it offers stability and growth potential in its payments amidst trading below estimated fair value.

- Get an in-depth perspective on Prevas' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Prevas' share price might be too pessimistic.

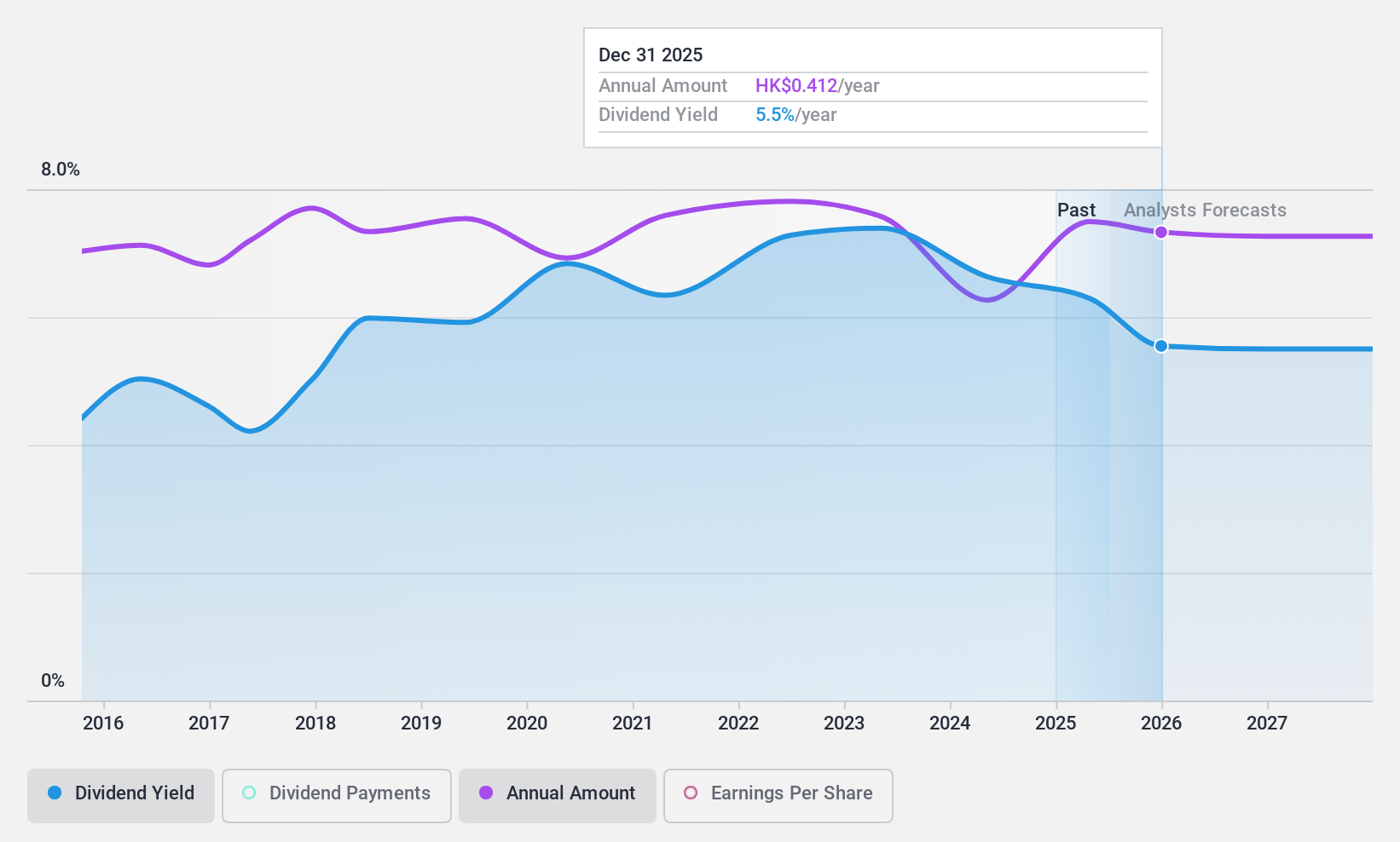

Zhejiang Expressway (SEHK:576)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Expressway Co., Ltd. is an investment holding company that constructs, operates, maintains, and manages roads in the People’s Republic of China with a market cap of HK$33.92 billion.

Operations: Zhejiang Expressway Co., Ltd. generates revenue from constructing, operating, maintaining, and managing roads in the People’s Republic of China.

Dividend Yield: 6%

Zhejiang Expressway's dividend yield of 6.02% is lower than the top quartile in Hong Kong, and while dividends have been stable and growing over a decade, they are not well-covered by cash flows due to a high cash payout ratio of 137.9%. The company trades at a significant discount to its estimated fair value. Recent projects like the digital transformation of expressways may influence future performance but do not currently enhance dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Zhejiang Expressway.

- Our valuation report here indicates Zhejiang Expressway may be undervalued.

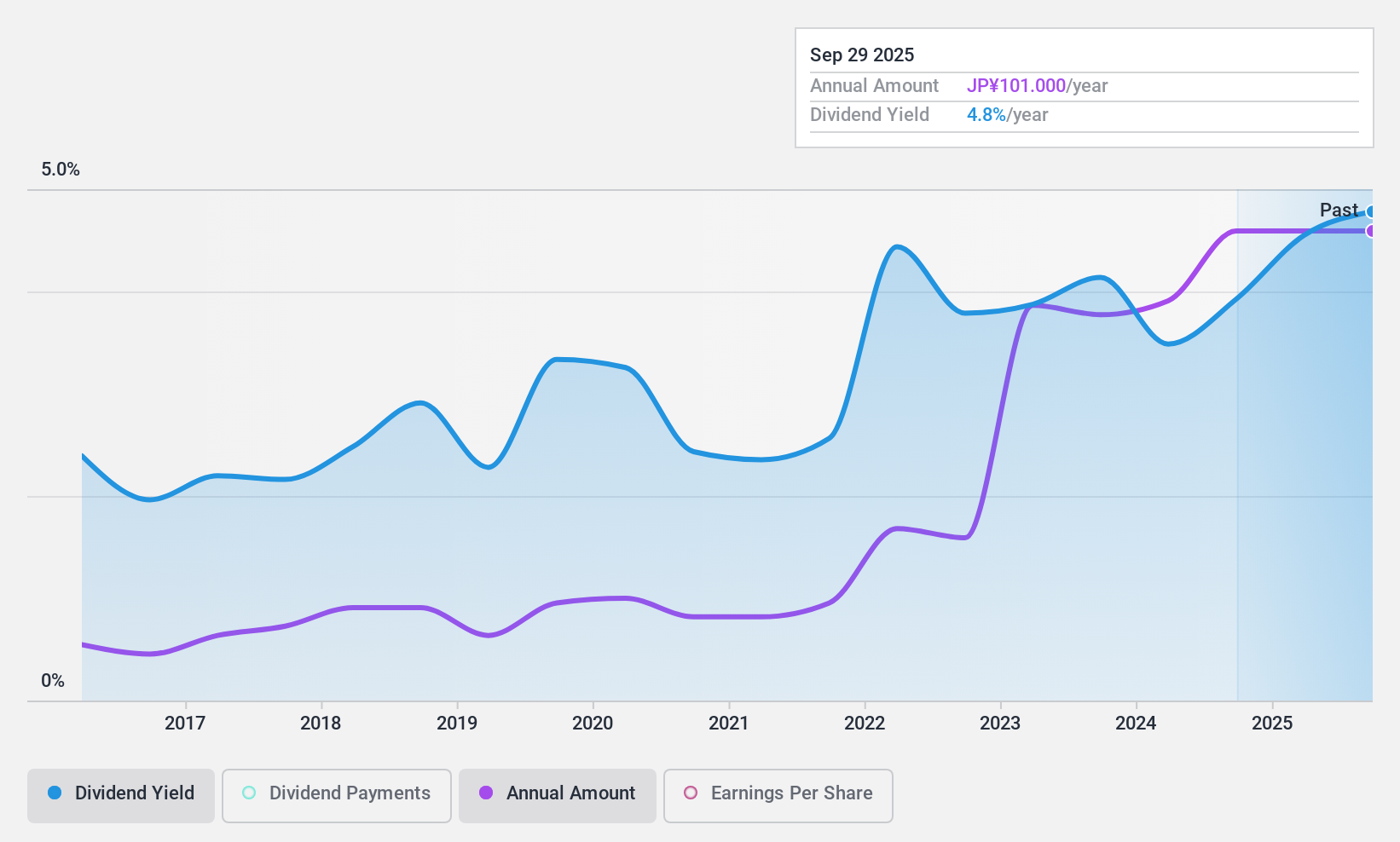

Chubu Steel Plate (TSE:5461)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chubu Steel Plate Co., Ltd. and its subsidiaries are involved in the manufacture and sale of steel plates in Japan, with a market cap of ¥61.23 billion.

Operations: Chubu Steel Plate Co., Ltd.'s revenue primarily comes from its Steel Related Business, which accounts for ¥57.16 billion, with additional contributions from the Engineering segment at ¥2.28 billion, Logistics Business at ¥814 million, and Rental Business at ¥754 million.

Dividend Yield: 4.5%

Chubu Steel Plate's dividend yield of 4.48% ranks in the top quartile of Japanese dividend payers, but its dividends have been volatile over the past decade, with a recent decrease from ¥61 to ¥51 per share. Despite a sustainable payout ratio covered by earnings and cash flows, recent operational disruptions—such as a steam explosion impacting production—have led to lowered financial forecasts and may affect near-term dividend stability.

- Unlock comprehensive insights into our analysis of Chubu Steel Plate stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Chubu Steel Plate shares in the market.

Key Takeaways

- Click this link to deep-dive into the 1968 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5461

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion