- Japan

- /

- Metals and Mining

- /

- TSE:5451

Dividend Stocks Spotlight Featuring Three Top Picks

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, with U.S. stocks experiencing declines due to tariff uncertainties and mixed economic signals, investors are increasingly seeking stability and income through dividend stocks. In such volatile times, selecting dividend stocks can offer a reliable stream of income and potential for growth, making them an appealing choice for those looking to navigate current market conditions effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Yodogawa Steel Works (TSE:5451)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yodogawa Steel Works, Ltd. manufactures and sells steel products for industrial and consumer applications in Japan, with a market cap of ¥165.33 billion.

Operations: Yodogawa Steel Works, Ltd.'s revenue is derived from its manufacturing and sales of steel products for both industrial and consumer markets within Japan.

Dividend Yield: 5.2%

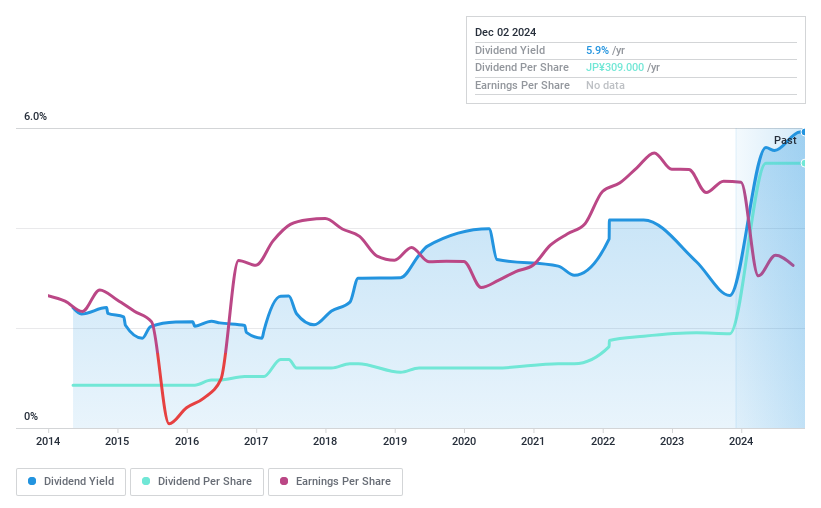

Yodogawa Steel Works offers a dividend yield of 5.19%, placing it in the top 25% of dividend payers in Japan. However, its high cash payout ratio of 93.8% indicates dividends are not well covered by free cash flows, raising concerns about sustainability. Despite a reasonable payout ratio of 52.3%, dividends have been volatile and unreliable over the past decade, with significant annual drops, although they have increased overall during this period.

- Delve into the full analysis dividend report here for a deeper understanding of Yodogawa Steel Works.

- According our valuation report, there's an indication that Yodogawa Steel Works' share price might be on the expensive side.

SIIX (TSE:7613)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SIIX Corporation primarily engages in the sale and distribution of electronic components both in Japan and internationally, with a market cap of ¥54.25 billion.

Operations: SIIX Corporation generates revenue from various regions, with ¥103.89 billion from Japan, ¥27.16 billion from Europe, ¥76.21 billion from the Americas, ¥85.60 billion from Greater China, and ¥115.45 billion from Southeast Asia.

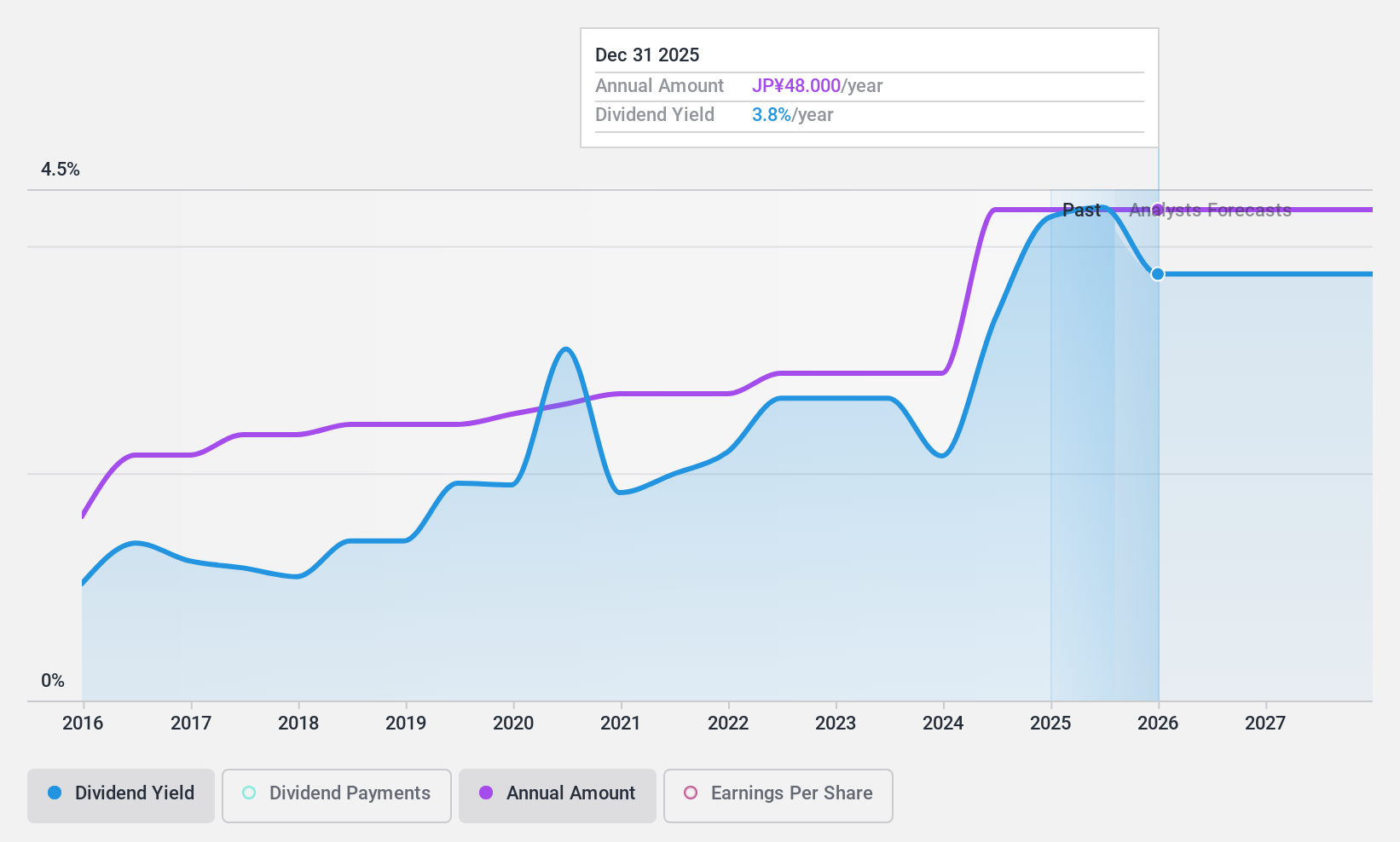

Dividend Yield: 4.1%

SIIX offers a dividend yield of 4.12%, ranking in the top 25% of Japanese dividend payers. Its dividends have been stable and growing over the past decade, supported by a low cash payout ratio of 18.4% and a reasonable payout ratio of 44.6%, ensuring coverage by both earnings and cash flows. Trading at 35.6% below estimated fair value, SIIX presents an attractive option for investors seeking reliable income with growth potential in earnings forecasted at 22.59% annually.

- Take a closer look at SIIX's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that SIIX is trading behind its estimated value.

Shibusawa Logistics (TSE:9304)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shibusawa Logistics Corporation offers logistics and warehousing services both in Japan and internationally, with a market cap of ¥45.73 billion.

Operations: Shibusawa Logistics Corporation generates revenue from its Logistics Business, which accounts for ¥69.99 billion, and its Real Estate Business, contributing ¥6.25 billion.

Dividend Yield: 3.7%

Shibusawa Logistics maintains a stable dividend history with consistent growth over the past decade. However, its high cash payout ratio of 374.8% indicates dividends are not well covered by cash flows, despite a low earnings payout ratio of 37.1%. With a dividend yield of 3.72%, slightly below the top tier in Japan, and trading at a price-to-earnings ratio of 10.1x, it offers moderate value but raises sustainability concerns due to cash flow coverage issues.

- Click here and access our complete dividend analysis report to understand the dynamics of Shibusawa Logistics.

- Insights from our recent valuation report point to the potential overvaluation of Shibusawa Logistics shares in the market.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1960 more companies for you to explore.Click here to unveil our expertly curated list of 1963 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5451

Yodogawa Steel Works

Manufactures and sells steel products for industrial and consumer products in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives