- Japan

- /

- Metals and Mining

- /

- TSE:5445

The Market Lifts Tokyo Tekko Co., Ltd. (TSE:5445) Shares 27% But It Can Do More

Tokyo Tekko Co., Ltd. (TSE:5445) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 204% following the latest surge, making investors sit up and take notice.

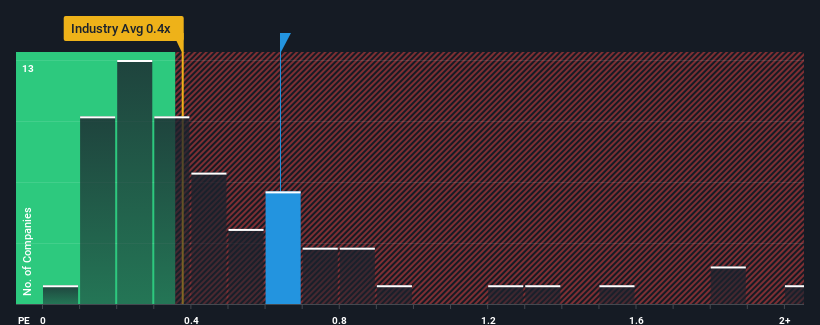

Although its price has surged higher, there still wouldn't be many who think Tokyo Tekko's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Japan's Metals and Mining industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Tokyo Tekko

How Tokyo Tekko Has Been Performing

For example, consider that Tokyo Tekko's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on Tokyo Tekko will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tokyo Tekko's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Tokyo Tekko?

The only time you'd be comfortable seeing a P/S like Tokyo Tekko's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.5% shows it's noticeably more attractive.

In light of this, it's curious that Tokyo Tekko's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Tokyo Tekko's P/S Mean For Investors?

Its shares have lifted substantially and now Tokyo Tekko's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision Tokyo Tekko's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Tokyo Tekko (including 1 which is significant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Tekko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5445

Tokyo Tekko

Engages in the manufacture and sale of steel and reinforcing bars in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives