- Japan

- /

- Metals and Mining

- /

- TSE:5406

Kobe Steel (TSE:5406): Exploring Valuation After a Period of Steady Share Price Gains

Reviewed by Simply Wall St

Price-to-Earnings of 5.4x: Is it justified?

Valued at a price-to-earnings (P/E) ratio of 5.4x, Kobe Steel appears undervalued compared to both peers and the overall industry average. This figure suggests that the market currently values the company's current earnings at a significant discount.

The P/E ratio compares a company's current share price to its per-share earnings, serving as a barometer of investor expectations for future growth and profitability. In capital-intensive sectors like metals and mining, a lower P/E can mean cautious optimism or skepticism about sustainability of profits.

Given that Kobe Steel's P/E is less than half of the peer group and industry average, investors may be overlooking the company's recent earnings momentum or factoring in anticipated declines. The low multiple could be an opportunity for value seekers if fundamentals hold up and profitability proves resilient in the coming years.

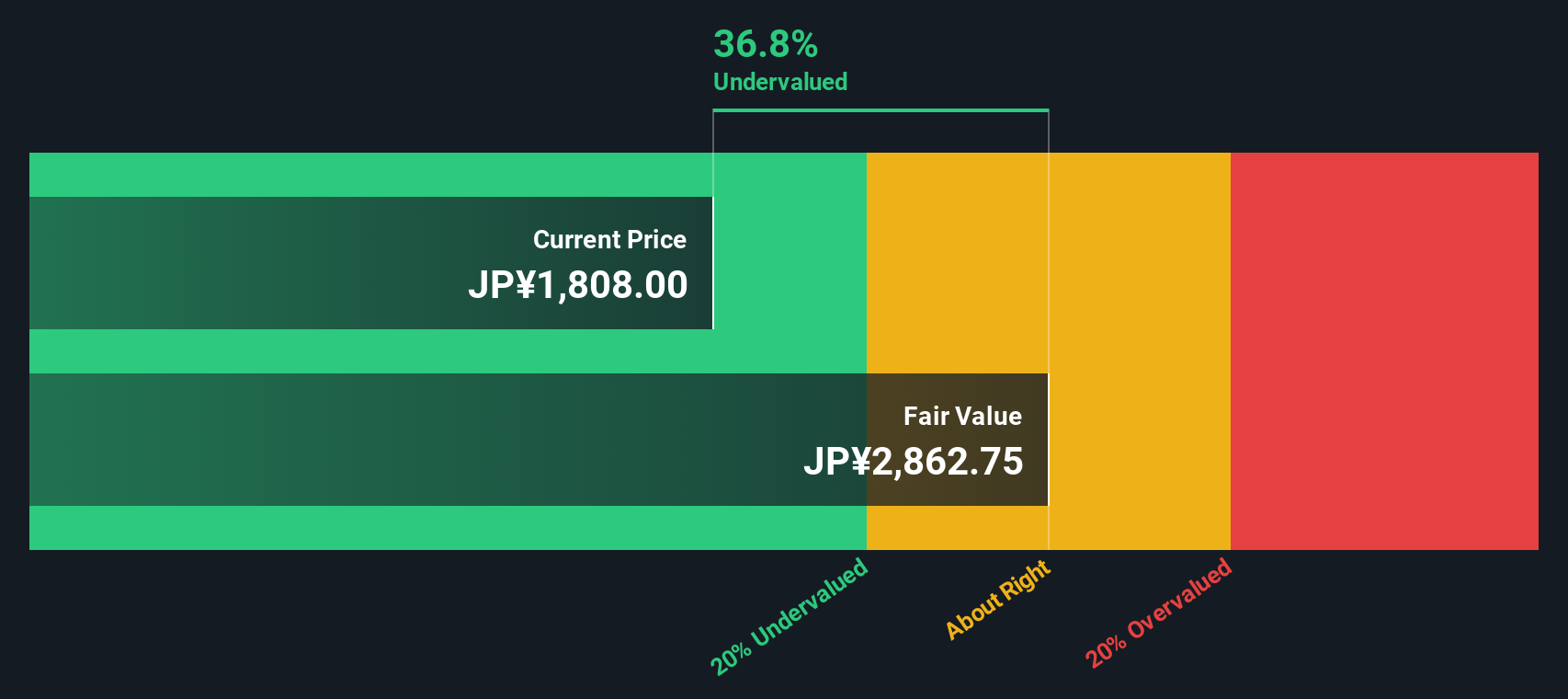

Result: Fair Value of ¥2,950.61 (UNDERVALUED)

See our latest analysis for Kobe Steel.However, slowing net income growth and the recent slide against analyst price targets could challenge the undervaluation thesis if earnings disappoint in the upcoming period.

Find out about the key risks to this Kobe Steel narrative.Another View: What Does the SWS DCF Model Say?

Taking a different approach, our DCF model also finds Kobe Steel to be undervalued. This largely supports the view from the price-to-earnings perspective. However, does this agreement really settle the debate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kobe Steel Narrative

If you have a different perspective or want to investigate the details on your own terms, it's easy to construct your own view in just a few minutes. Do it your way

A great starting point for your Kobe Steel research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop there. Uncover fresh opportunities beyond Kobe Steel and give your portfolio a powerful edge with these standout themes you won't want to miss:

- Boost your returns by targeting hidden gems with strong balance sheets and growth prospects among penny stocks with strong financials.

- Maximize your income potential by focusing on companies consistently rewarding shareholders through dividend stocks with yields > 3%.

- Tap into tomorrow’s breakthroughs by following the innovators leading next-generation computing in quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kobe Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5406

Kobe Steel

Engages in the materials, machinery, and power businesses internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives