- Japan

- /

- Metals and Mining

- /

- TSE:5401

What Nippon Steel (TSE:5401)'s Partnership with Mazda Means for Shareholders

Reviewed by Sasha Jovanovic

- Mazda Motor recently announced a partnership with Nippon Steel to improve the body design, production, and procurement process for the latest Mazda CX-5, resulting in a 10% lighter vehicle body.

- The alliance leverages local steel manufacturing to streamline procurement, cut transportation costs and emissions, and address supply chain risks in alignment with Mazda's long-term strategies.

- We'll explore how the increased supply chain efficiency from this collaboration shapes Nippon Steel's broader investment narrative.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Nippon Steel's Investment Narrative?

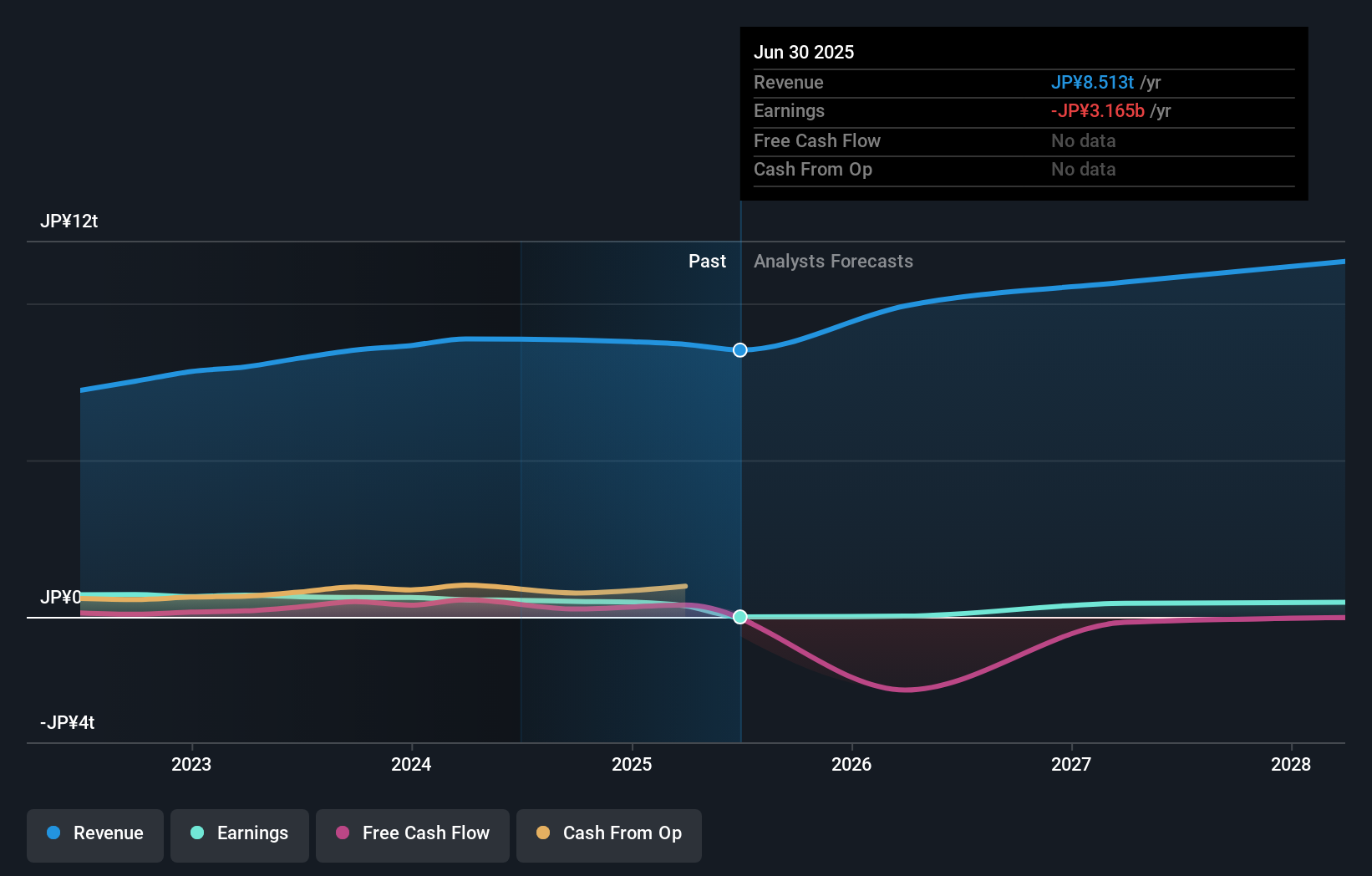

For anyone considering Nippon Steel, the core belief centers on the company’s ability to turn its scale, strategic partnerships, and shift to greener production into competitive advantages in a global steel industry facing rapid change. The fresh tie-up with Mazda around the CX-5 exemplifies these themes: focusing on resilient, localized supply chains and lightweight, low-emission products. While this collaboration showcases Nippon Steel’s relevance in auto steel innovation and may reinforce revenue stability, it’s unlikely to be a near-term gamechanger for the company’s challenged earnings and reduced dividends, at least if recent price movements are any guide. However, it does help ease concerns about supply chain risk and environmental compliance, two key themes in recent company strategies. That could subtly lower risk and provide some support against sector volatility, though the bigger catalysts and risks for investors remain unchanged: improving profitability, execution of international projects, and progress on major acquisitions.

On the flip side, the biggest question remains the company’s path back to sustained profitability after recent losses.

Exploring Other Perspectives

Explore 3 other fair value estimates on Nippon Steel - why the stock might be worth just ¥707!

Build Your Own Nippon Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Steel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Steel's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives