- Japan

- /

- Metals and Mining

- /

- TSE:5401

Nippon Steel (TSE:5401): Assessing Whether Recent Gains Reflect Its True Valuation

Reviewed by Simply Wall St

Nippon Steel (TSE:5401) has caught attention after a recent move in its stock price. Investors are curious how the latest market activity lines up with Japanese industrial stocks and sector performance.

See our latest analysis for Nippon Steel.

Nippon Steel’s share price has steadily gained ground lately, reflecting a shift in market sentiment following recent industrial sector momentum and business updates. While the past week’s 1.5% climb is a small step, the main focus is on its long-term growth, with a five-year total shareholder return of over 280% suggesting sustained strength rather than short-term hype.

If you’re interested in broader opportunities beyond the big names, this could be the ideal moment to discover fast growing stocks with high insider ownership.

With Nippon Steel trading at a notable discount to many analyst estimates, but also boasting strong long-term gains, the question remains: is there more upside left for investors, or is the future growth already priced in?

Price-to-Sales of 0.4x: Is it justified?

At a price-to-sales ratio of 0.4x, Nippon Steel trades well below peer averages. This signals that the market currently prices its sales more conservatively than its competitors. The latest close stands at ¥636.4 per share, while comparable companies are valued at an average of 1.2x sales.

The price-to-sales ratio shows what investors are willing to pay for each unit of revenue. For an industrial heavyweight such as Nippon Steel, this metric helps assess whether market expectations for future sales growth or profitability may be understated or overly optimistic, especially in a sector driven by large revenues but cyclical margins.

This low multiple implies investors are hesitant to assign a higher valuation until signs of sustainable profitability emerge, even with top-line growth. Compared to its own estimated fair price-to-sales ratio of 0.9x, Nippon Steel's current valuation suggests the market could eventually move closer to this fair level if growth and margins improve.

Explore the SWS fair ratio for Nippon Steel

Result: Price-to-Sales of 0.4x (UNDERVALUED)

However, Nippon Steel’s negative net income and cyclical industry pressures still pose risks that could challenge the bullish outlook as the company moves forward.

Find out about the key risks to this Nippon Steel narrative.

Another View: SWS DCF Model Shows Bigger Discount

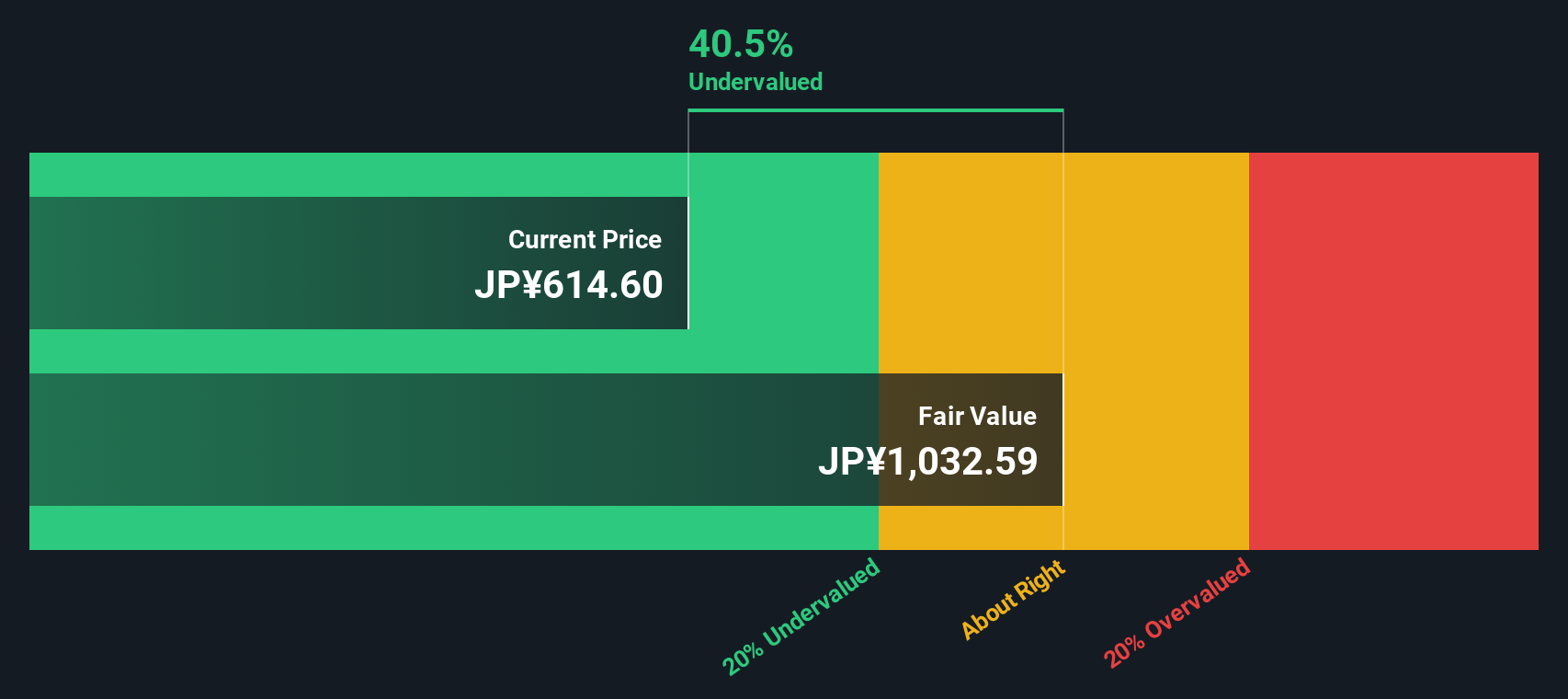

While Nippon Steel looks undervalued by its price-to-sales ratio, our DCF model takes a deeper dive and suggests an even larger discount. The shares are trading about 39% below the estimate of fair value from this cash flow-based method. But does this gap reflect a real opportunity, or do ongoing risks explain the low price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Steel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Steel Narrative

If you see the numbers differently, or want to run your own assessment, building your own perspective takes less than three minutes. Why not Do it your way?

A great starting point for your Nippon Steel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Don’t let great investments pass you by while others take charge. With Simply Wall Street’s unique screeners, you’ll spot exciting ideas before the crowd.

- Boost your portfolio potential by targeting high-yield payers with these 21 dividend stocks with yields > 3%. This approach offers reliable income even in uncertain markets.

- Uncover tomorrow’s innovators by searching for disruptive companies with strong growth in these 26 AI penny stocks. This positions you at the forefront of artificial intelligence.

- Accelerate your returns by tracking undervalued gems using these 856 undervalued stocks based on cash flows. Attractive stocks based on cash flows could mean more upside for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives