As global markets navigate a turbulent start to 2025, with U.S. stocks experiencing volatility due to AI competition fears and mixed corporate earnings, investors are keenly observing the Federal Reserve's steady interest rate policy amid persistent inflation concerns. In this uncertain landscape, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance their portfolios in times of market fluctuation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.81% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

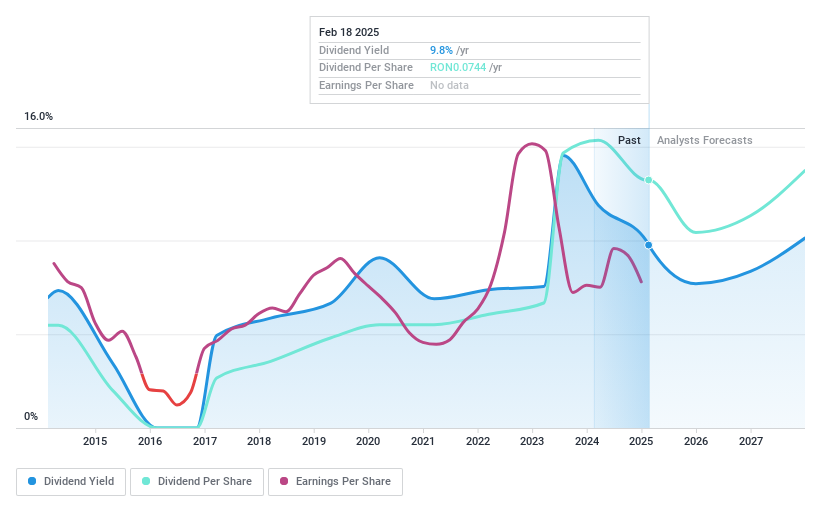

OMV Petrom (BVB:SNP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OMV Petrom S.A. is an energy company involved in the exploration and production of oil and gas in Southeastern Europe, with a market cap of RON46.64 billion.

Operations: OMV Petrom S.A.'s revenue is primarily derived from its Refining and Marketing segment at RON26.76 billion, followed by Exploration and Production at RON10.55 billion, and Gas and Power contributing RON9.26 billion.

Dividend Yield: 9.9%

OMV Petrom's dividend yield of 9.94% ranks in the top 25% among Romanian dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 842.1%. While earnings grew by 4% last year, recent financial results show a decline in quarterly net income from RON 1,482.15 million to RON 263.2 million year-over-year, indicating potential volatility and challenges in maintaining stable dividends despite reasonable earnings coverage with a payout ratio of 66.1%.

- Click here to discover the nuances of OMV Petrom with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, OMV Petrom's share price might be too optimistic.

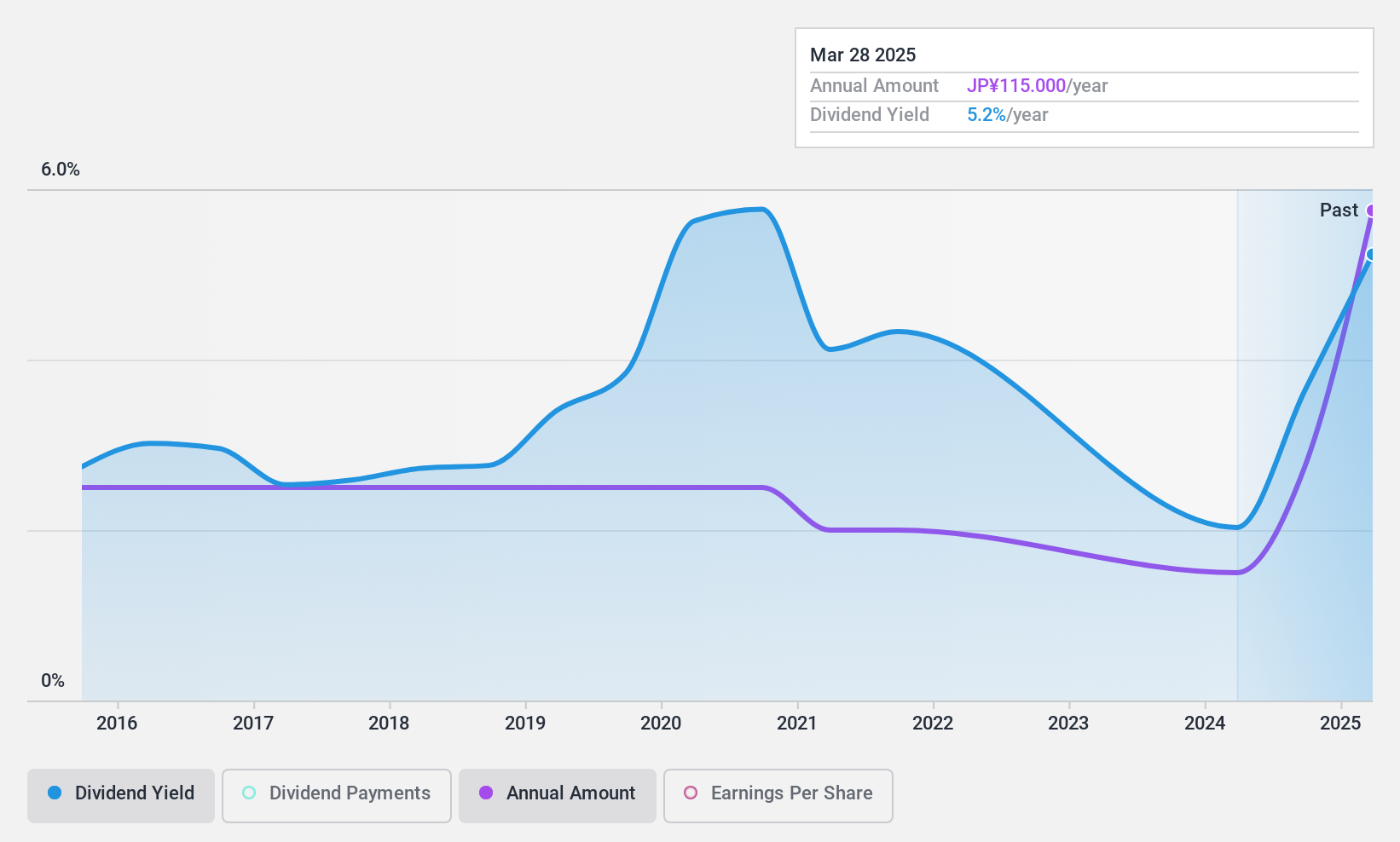

Nihon Yamamura Glass (TSE:5210)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nihon Yamamura Glass Co., Ltd. produces and sells glass bottles and plastic closures both in Japan and internationally, with a market cap of ¥16.10 billion.

Operations: Nihon Yamamura Glass Co., Ltd.'s revenue segments include ¥23.70 billion from the Logistics-Related Business, ¥2.85 billion from the New Glass Related Business, ¥48.02 billion from the Glass Bottle Related Business, and ¥8.49 billion from the Plastic Container Related Business.

Dividend Yield: 3.8%

Nihon Yamamura Glass offers a dividend yield of 3.8%, placing it in the top 25% of Japanese dividend payers. Despite its attractive yield, the company's dividends have been volatile over the past decade and profit margins have decreased from 9.6% to 6.2%. However, dividends are well covered by earnings and cash flows with payout ratios of 17.7% and 47.4%, respectively, suggesting they are currently sustainable despite historical volatility.

- Dive into the specifics of Nihon Yamamura Glass here with our thorough dividend report.

- Upon reviewing our latest valuation report, Nihon Yamamura Glass' share price might be too pessimistic.

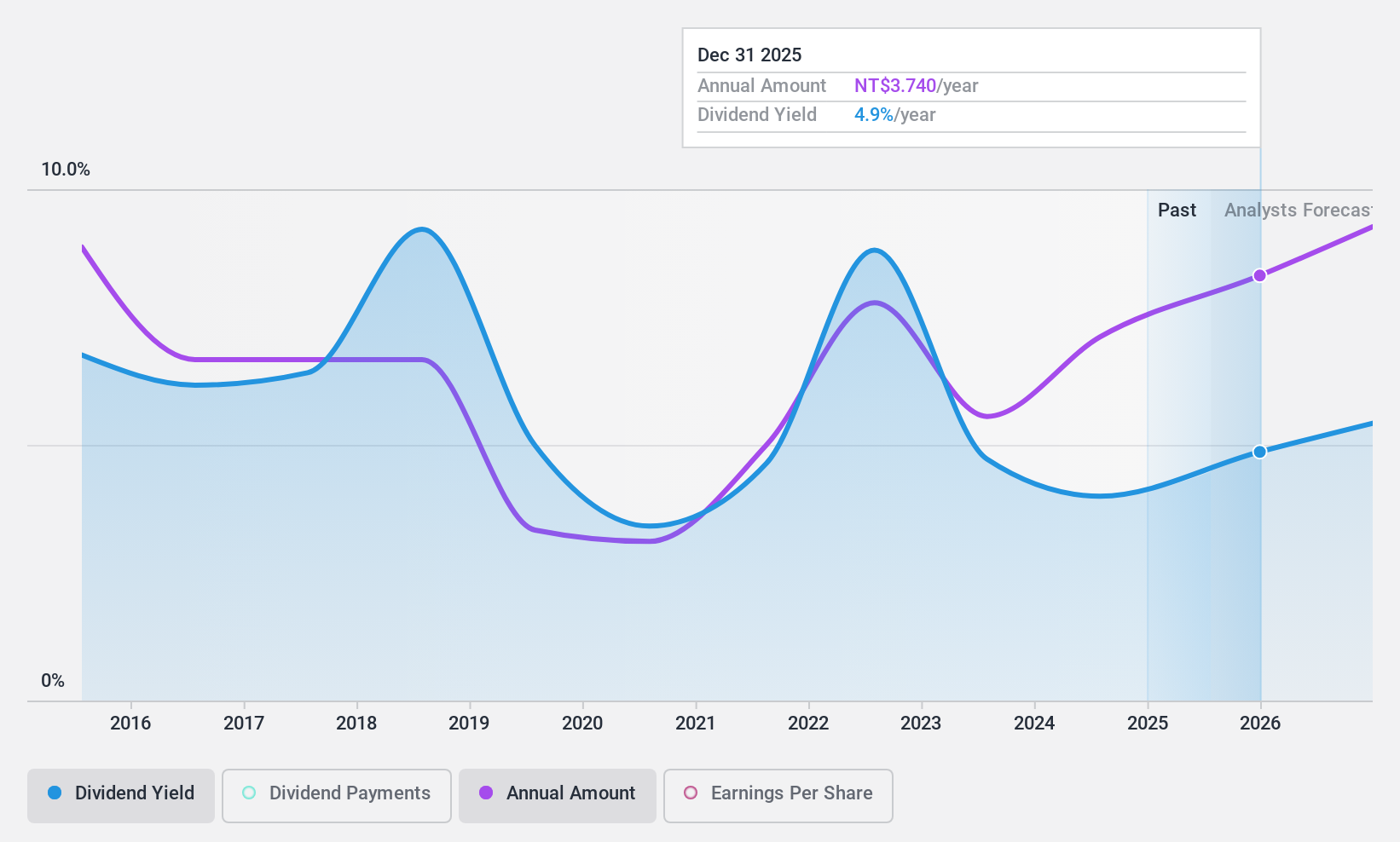

Everlight Electronics (TWSE:2393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Everlight Electronics Co., Ltd. manufactures and sells light-emitting diodes (LEDs) across Taiwan, the rest of Asia, the United States, and internationally, with a market cap of NT$38.18 billion.

Operations: Everlight Electronics Co., Ltd. generates revenue primarily from its LED Sector, which accounts for NT$19.02 billion, followed by its Lighting Segment at NT$787.06 million and the LCD Sector at NT$567.83 million.

Dividend Yield: 3.7%

Everlight Electronics' dividend yield of 3.72% is lower than the top 25% in Taiwan, but dividends are covered by earnings and cash flows with payout ratios of 62.9% and 57.2%, respectively. Despite a volatile dividend history, recent earnings growth—net income rose to TWD 554.73 million in Q3 from TWD 404.89 million a year ago—indicates improved financial performance, potentially supporting future dividend stability if sustained.

- Get an in-depth perspective on Everlight Electronics' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Everlight Electronics shares in the market.

Key Takeaways

- Click here to access our complete index of 1959 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Yamamura Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5210

Nihon Yamamura Glass

Produces and sells glass bottles and plastic closures in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives