- Japan

- /

- Trade Distributors

- /

- TSE:9906

Global Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by dovish Federal Reserve signals and fluctuating consumer confidence, investors are increasingly looking to dividend stocks as a steadying force in their portfolios. In times of economic uncertainty, stocks that offer reliable dividends can provide not only potential income but also a measure of stability, making them an attractive option for those seeking to enhance their investment strategy.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.44% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.39% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.89% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★★ |

| NCD (TSE:4783) | 4.58% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.69% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.15% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.56% | ★★★★★★ |

Click here to see the full list of 1335 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

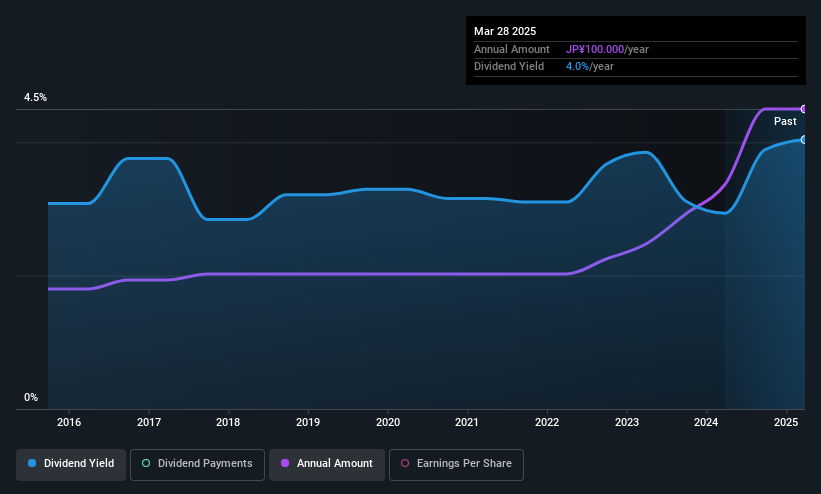

Yushiro (TSE:5013)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yushiro Inc. and its subsidiaries manufacture and sell metalworking oils, fluids, and building maintenance products across Japan, the Americas, the United States, China, Southeast Asia, and India with a market cap of ¥30.84 billion.

Operations: Yushiro Inc.'s revenue is primarily derived from its manufacturing and sales of metalworking oils, fluids, and building maintenance products across various international markets including Japan, the Americas, China, Southeast Asia, and India.

Dividend Yield: 3.8%

Yushiro's dividend yield of 3.82% ranks in the top 25% of JP market payers, and its dividends are well-covered by earnings with a payout ratio of 27.7%. However, the dividend track record is unstable with past volatility. Recent share buybacks worth ¥519.07 million aim to enhance shareholder returns and capital efficiency, aligning with their medium-term management plan. Despite stable recent dividends, the company maintains a cautious outlook on future payments due to historical unreliability.

- Click to explore a detailed breakdown of our findings in Yushiro's dividend report.

- According our valuation report, there's an indication that Yushiro's share price might be on the cheaper side.

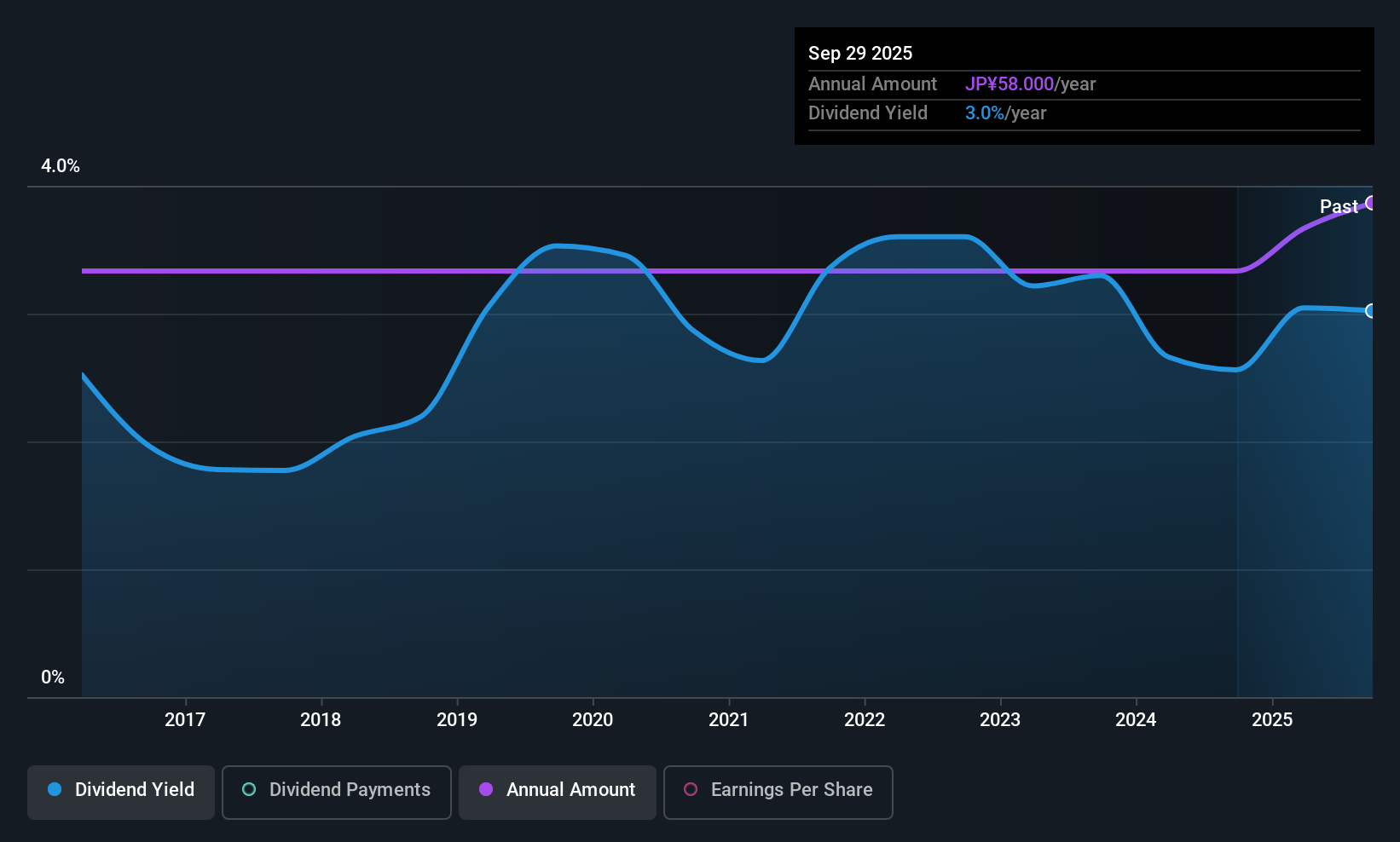

Fukui Bank (TSE:8362)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Fukui Bank, Ltd., along with its subsidiaries, offers a range of banking products and services in Japan and has a market cap of ¥56.87 billion.

Operations: Fukui Bank generates revenue through its diverse banking products and services offered in Japan.

Dividend Yield: 3.1%

Fukui Bank's recent dividend increase to JPY 29.00 per share for Q2 and a projected annual dividend of JPY 75 reflects its commitment to shareholder returns, supported by a low payout ratio of 19.1%. The bank's dividends have been stable and growing over the past decade, though its yield of 3.1% is below the top quartile in Japan. Earnings guidance revisions indicate strong financial performance, driven by improved loan yields and strategic portfolio restructuring.

- Unlock comprehensive insights into our analysis of Fukui Bank stock in this dividend report.

- Our valuation report unveils the possibility Fukui Bank's shares may be trading at a premium.

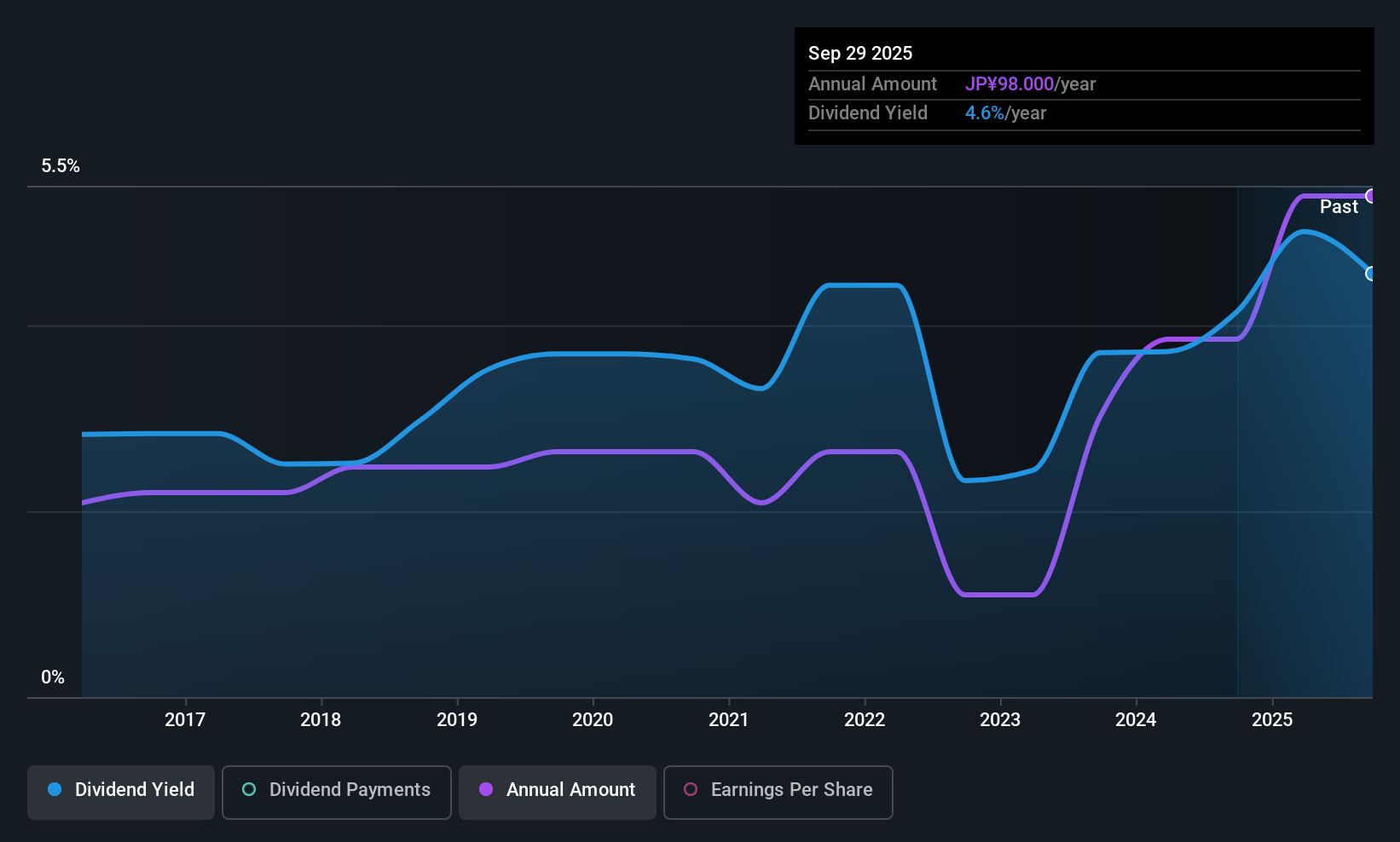

Fujii Sangyo (TSE:9906)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fujii Sangyo Corporation operates in Japan, selling electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery with a market cap of ¥33.45 billion.

Operations: Fujii Sangyo Corporation generates revenue through the sale of electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery in Japan.

Dividend Yield: 3.2%

Fujii Sangyo's dividend payments have been stable and growing over the past decade, but the current yield of 3.17% is below Japan's top quartile. Despite a low payout ratio of 18.1%, dividends are not well covered by free cash flows due to a high cash payout ratio of 221.6%. While earnings grew by 35.3% last year, reliance on non-cash earnings raises concerns about dividend sustainability despite an attractive price-to-earnings ratio of 7.1x compared to the market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Fujii Sangyo.

- Our expertly prepared valuation report Fujii Sangyo implies its share price may be too high.

Make It Happen

- Reveal the 1335 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9906

Fujii Sangyo

Engages in the sale of electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery in Japan.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026