- Israel

- /

- Capital Markets

- /

- TASE:MRIN

Discovering Y.D. More Investments And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

In the final weeks of 2024, global markets experienced moderate gains despite a dip in U.S. consumer confidence and mixed economic indicators. While large-cap growth stocks initially led the charge, small-cap indices like the Russell 2000 showed more modest improvements, reflecting broader market sentiment and potential opportunities for investors seeking value in overlooked sectors. In this environment, identifying promising small-cap stocks requires a focus on companies with solid fundamentals and resilience amidst fluctuating economic conditions. As we explore Y.D. More Investments and two other hidden gems, these criteria become essential in uncovering their potential within a dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Y.D. More Investments (TASE:MRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Y.D. More Investments Ltd is a publicly owned investment manager operating in Israel, with a market capitalization of ₪1.06 billion.

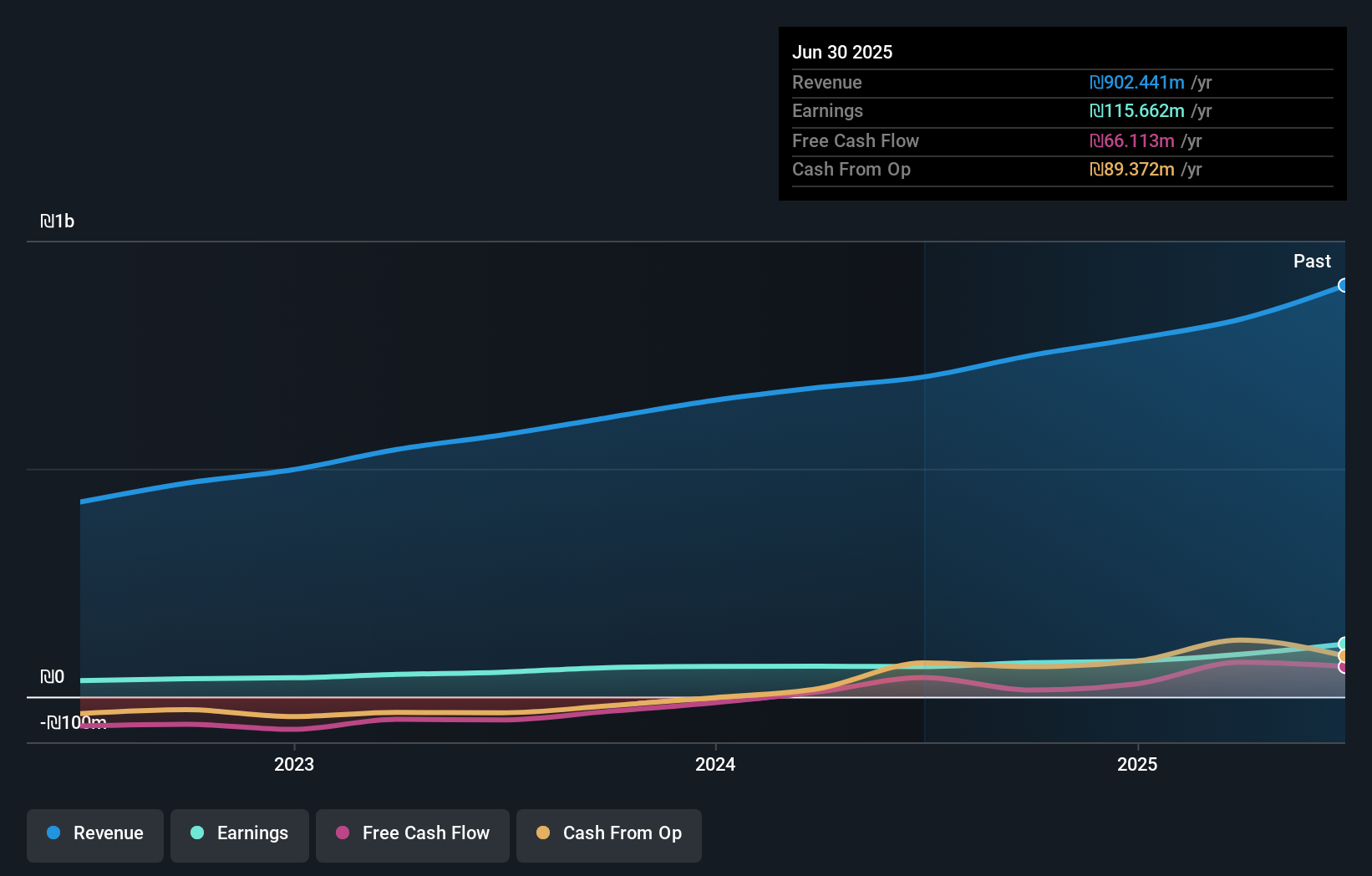

Operations: Y.D. More Investments generates revenue primarily from the management of provident and pension funds, contributing ₪500.22 million, and mutual fund management, adding ₪198.82 million. Investment portfolio management further supplements its income with ₪30.99 million.

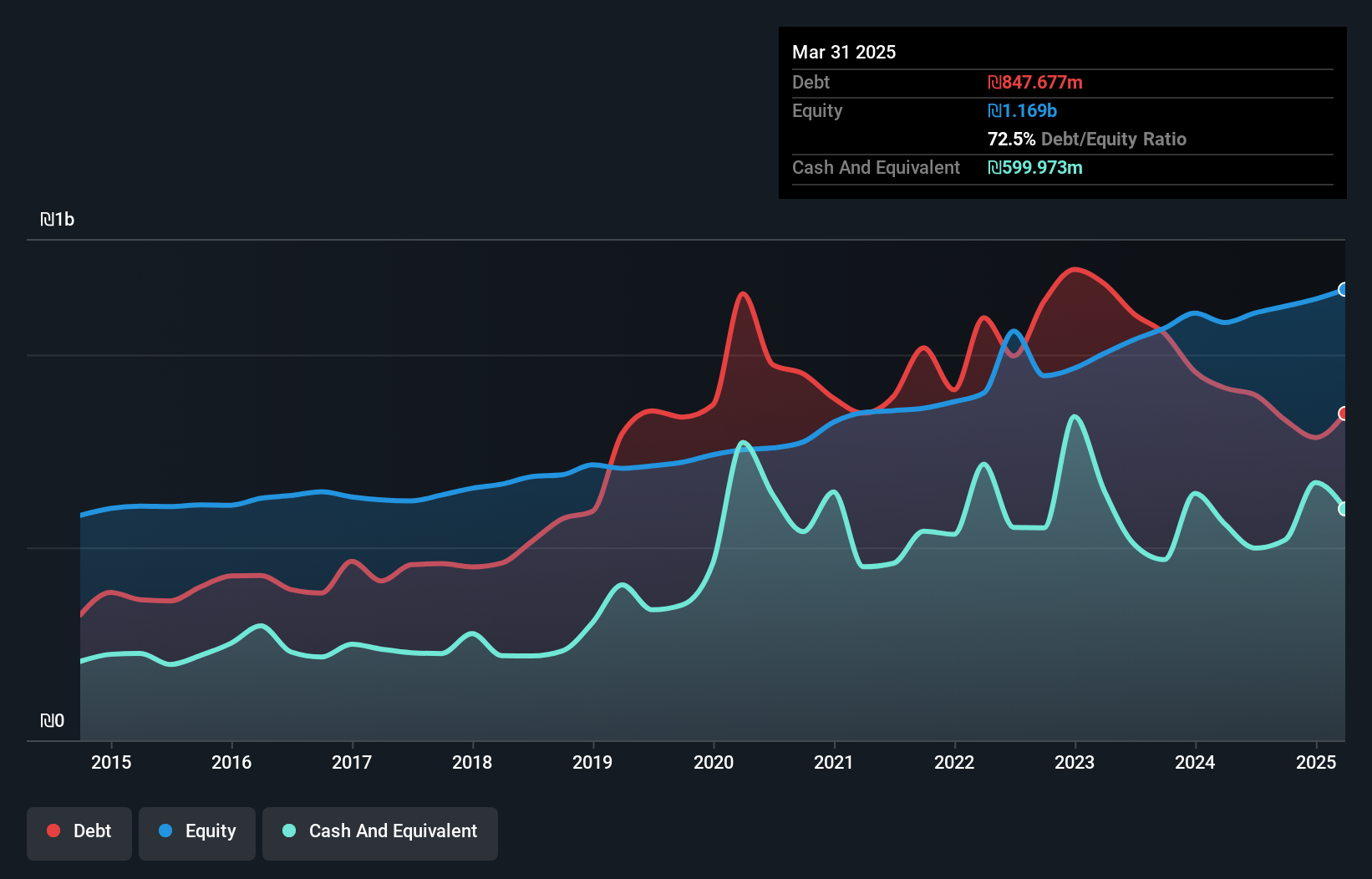

Y.D. More Investments, a small player in the financial sector, has shown impressive growth with earnings increasing by 16.7% over the past year, surpassing the industry's 12.8%. The company's debt to equity ratio has climbed significantly from 2.2% to 69.3% over five years, indicating increased leverage but with interest payments well covered by EBIT at a robust 46.9x coverage. Recent financials reveal third-quarter revenue at ILS 212 million and net income of ILS 28 million, up from ILS 165 million and ILS 19 million respectively last year, reflecting strong operational performance despite share price volatility in recent months.

- Click here to discover the nuances of Y.D. More Investments with our detailed analytical health report.

Evaluate Y.D. More Investments' historical performance by accessing our past performance report.

Matrix IT (TASE:MTRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Matrix IT Ltd., along with its subsidiaries, offers information technology solutions and services across Israel, the United States, Europe, and other international markets with a market capitalization of ₪5.43 billion.

Operations: Matrix IT generates revenue primarily from Information Technology Solutions and Services in Israel (₪3.14 billion) and Cloud and Computing Infrastructure (₪1.53 billion).

Matrix IT, a notable player in the tech sector, has shown robust financial health with its debt to equity ratio improving from 116.2% to 73.8% over five years, and interest payments comfortably covered by EBIT at 11.1 times. Despite earnings growth of 17.3% not outpacing the industry average of 17.9%, it remains a solid performer with high-quality earnings and consistent profitability, boasting an annual earnings increase of 11.3%. Recent quarterly results reveal sales climbing to ILS 1,418 million from ILS 1,334 million year-on-year and net income rising to ILS 64 million from ILS 51 million previously.

- Get an in-depth perspective on Matrix IT's performance by reading our health report here.

Examine Matrix IT's past performance report to understand how it has performed in the past.

JCU (TSE:4975)

Simply Wall St Value Rating: ★★★★★★

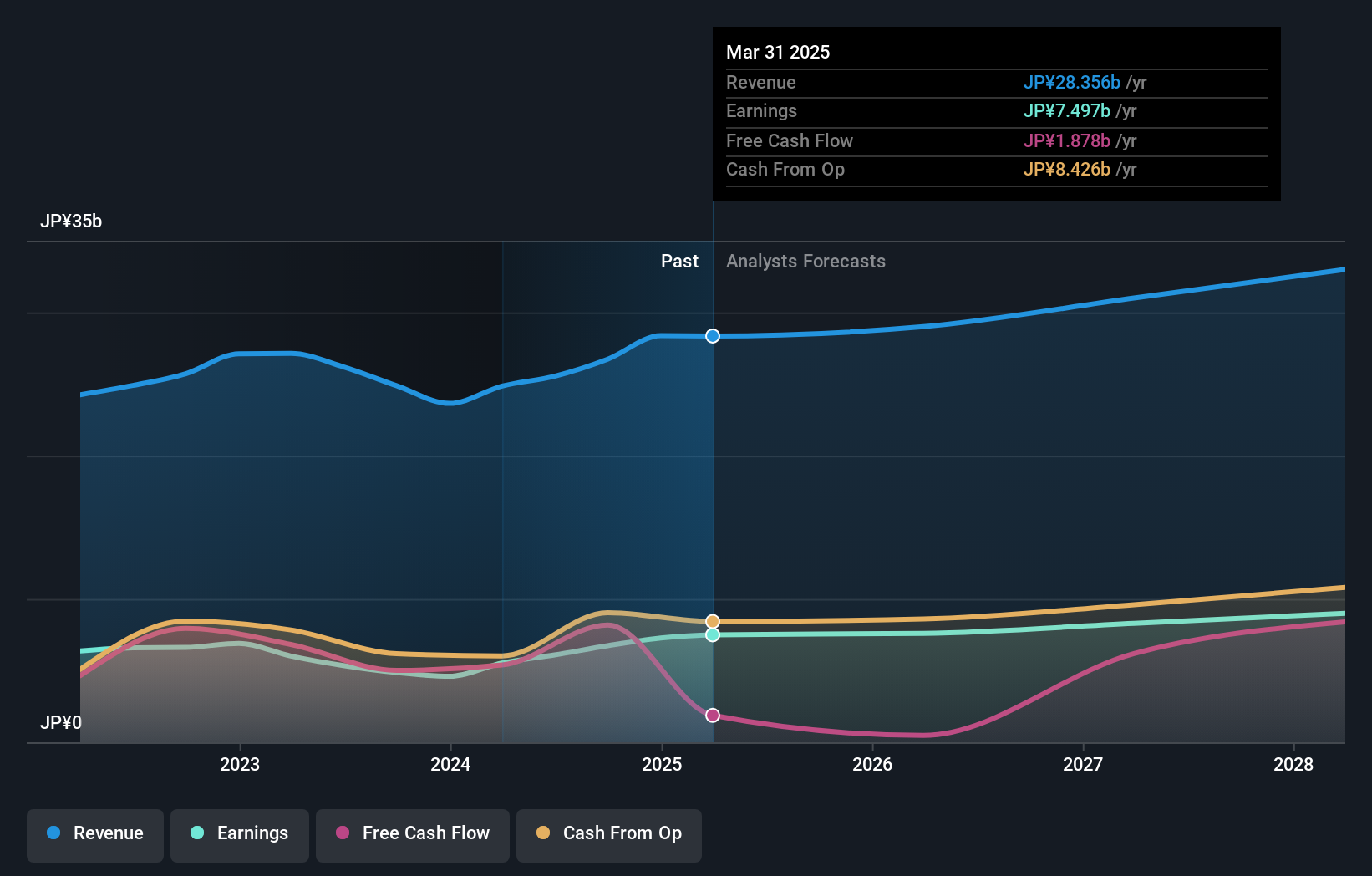

Overview: JCU Corporation operates in Japan, producing and selling chemicals, machines, and auxiliary equipment for surface treatment with a market capitalization of ¥97.01 billion.

Operations: JCU Corporation's revenue primarily comes from its Pharmaceutical Business, generating ¥23.26 billion, with the Equipment Business contributing ¥3.47 billion.

JCU, a promising player in its sector, has shown robust financial health with earnings growing by 39% last year, outpacing the chemicals industry average of 14%. The company is trading at a significant discount to its estimated fair value by about 53%, suggesting potential undervaluation. Over the past five years, JCU's debt-to-equity ratio has impressively decreased from 6.4% to just 1%, indicating prudent financial management. Recently, JCU repurchased approximately 0.44% of its shares for ¥381 million between August and September, reflecting confidence in its own valuation and future prospects.

Key Takeaways

- Unlock our comprehensive list of 4637 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MRIN

Y.D. More Investments

A publicly owned investment manager engages in the investment management business in Israel.

Excellent balance sheet with proven track record.