3 Reliable Dividend Stocks To Consider With Up To 6.7% Yield

Reviewed by Simply Wall St

As global markets react to cooling inflation and strong earnings reports, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares amid rising oil prices and robust financial sector gains. In this environment of cautious optimism, investors may find dividend stocks appealing due to their potential for providing steady income streams; these attributes can be especially attractive when market volatility is a concern.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

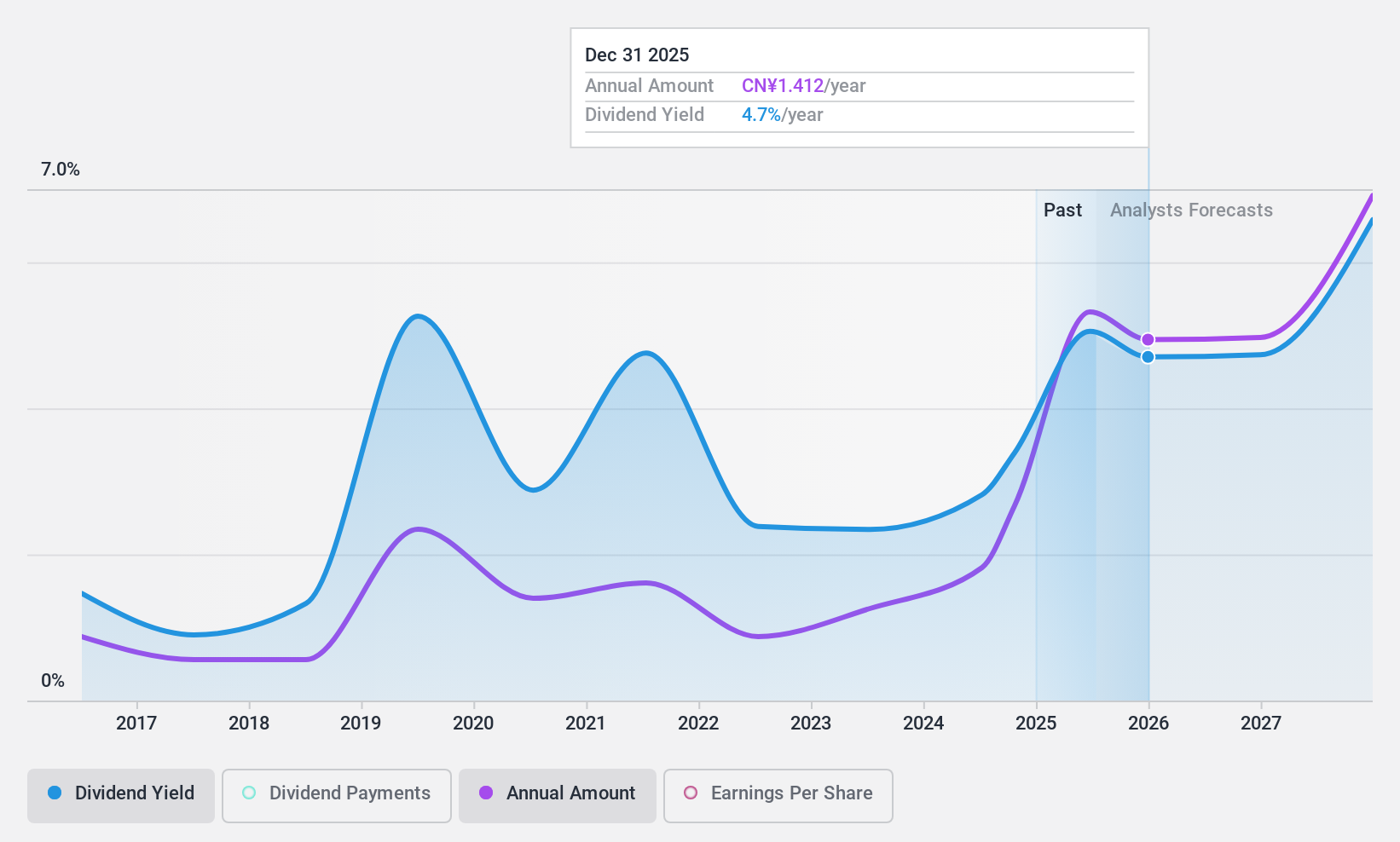

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. is engaged in the research, development, production, and sale of industrial valves both within China and internationally, with a market cap of approximately CN¥19.27 billion.

Operations: Neway Valve (Suzhou) Co., Ltd.'s revenue from the valve industry segment amounts to CN¥5.76 billion.

Dividend Yield: 3%

Neway Valve (Suzhou) offers a dividend yield of 3.03%, placing it in the top 25% of dividend payers in the Chinese market. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 92.1%. Although earnings cover dividends with a reasonable payout ratio of 71.4%, past payments have been unreliable and volatile despite increasing over the last decade. The stock's price-to-earnings ratio is attractively lower than the market average at 20x compared to 34.9x.

- Delve into the full analysis dividend report here for a deeper understanding of Neway Valve (Suzhou).

- According our valuation report, there's an indication that Neway Valve (Suzhou)'s share price might be on the expensive side.

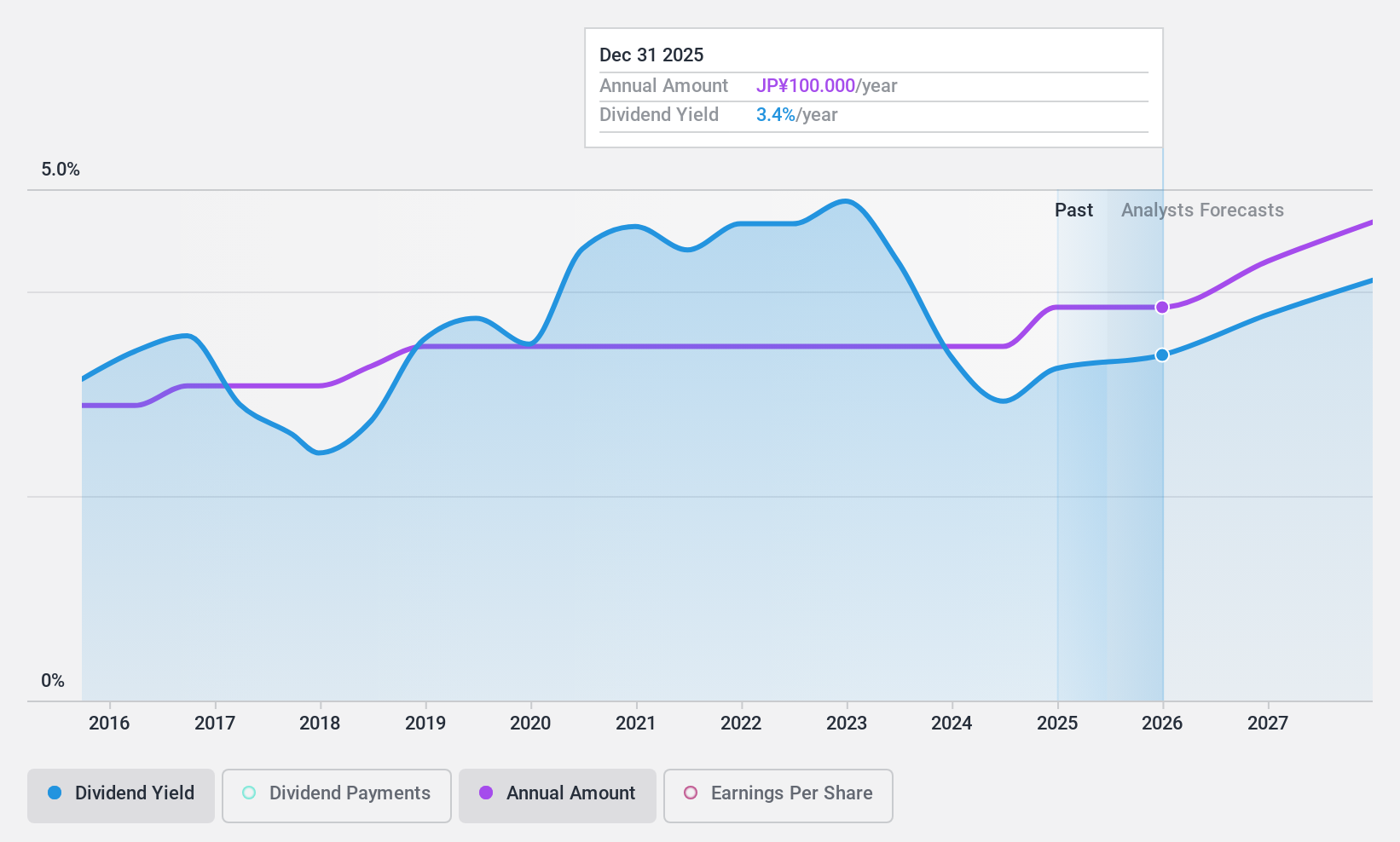

artience (TSE:4634)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: artience Co., Ltd. operates in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials sectors across Japan, China, Europe, Africa, Asia, the Americas, and internationally with a market cap of ¥159.09 billion.

Operations: artience Co., Ltd.'s revenue is derived from its Packaging Materials Related Business (¥89.02 billion), Polymers and Coatings Related Business (¥85.51 billion), Printing and Information Related Business (¥82.75 billion), and Colorants and Functional Materials Related Business (¥85.52 billion).

Dividend Yield: 3.2%

Artience offers a reliable dividend yield of 3.19%, though it falls short of the top 25% in Japan. Dividends have been stable and growing over the past decade, supported by low payout ratios—33.2% from earnings and 40.8% from cash flows—indicating sustainability. Recent share buybacks totaling ¥7,498.45 million may enhance shareholder value further, but recent high volatility could concern investors seeking price stability despite strong earnings growth last year at ¥16,500 million profit forecasted for FY2024.

- Click here to discover the nuances of artience with our detailed analytical dividend report.

- Our expertly prepared valuation report artience implies its share price may be lower than expected.

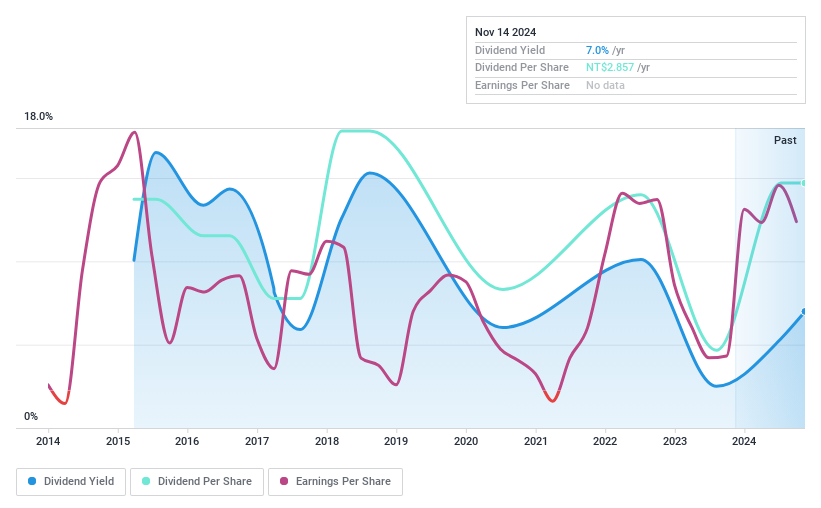

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, engages in the construction business in Taiwan and the United States, with a market capitalization of NT$18.10 billion.

Operations: Da-Li Development Co., Ltd.'s revenue is primarily derived from its Construction Segment, which generated NT$4.36 billion, and its Construction Department, contributing NT$14.61 billion.

Dividend Yield: 6.8%

Da-Li Development Ltd. offers a high dividend yield of 6.77%, placing it in the top 25% of Taiwan's market, with dividends covered by earnings and cash flows (payout ratios: 63.5% and 21.8%). Despite past volatility, dividends have grown over ten years but remain unreliable. Recent financials show declining sales and profits, with Q3 net income dropping significantly year-on-year to TWD 11.65 million amid a follow-on equity offering for additional capital raising.

- Unlock comprehensive insights into our analysis of Da-Li DevelopmentLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Da-Li DevelopmentLtd is trading behind its estimated value.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1973 more companies for you to explore.Click here to unveil our expertly curated list of 1976 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4634

artience

Engages in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials businesses in Japan, Europe, Asia, the Americas, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in