- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

Global's May 2025 Select Stocks Priced Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions and U.S. equities experience a rebound, investors are keenly observing the economic landscape marked by fluctuating consumer sentiment and mixed business activity indicators. In this environment, identifying undervalued stocks becomes particularly appealing as they offer potential for growth when priced below their estimated fair value, especially amid ongoing economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Maire (BIT:MAIRE) | €9.50 | €18.84 | 49.6% |

| Alexander Marine (TWSE:8478) | NT$142.00 | NT$280.34 | 49.3% |

| LPP (WSE:LPP) | PLN15400.00 | PLN30325.39 | 49.2% |

| Stille (OM:STIL) | SEK186.00 | SEK370.12 | 49.7% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.76 | 49.4% |

| China Ruyi Holdings (SEHK:136) | HK$2.04 | HK$4.07 | 49.9% |

| Bactiguard Holding (OM:BACTI B) | SEK31.70 | SEK62.66 | 49.4% |

| Everest Medicines (SEHK:1952) | HK$49.25 | HK$96.84 | 49.1% |

| Expert.ai (BIT:EXAI) | €1.31 | €2.58 | 49.2% |

| Longino & Cardenal (BIT:LON) | €1.34 | €2.66 | 49.6% |

Let's review some notable picks from our screened stocks.

Taiwan Union Technology (TPEX:6274)

Overview: Taiwan Union Technology Corporation manufactures and sells copper foil substrates, adhesive sheets, and multi-layer laminated boards both in Taiwan and internationally, with a market cap of NT$37.57 billion.

Operations: The company's revenue is derived from two main segments: Foreign Sales and Manufacturing Sector, contributing NT$14.81 billion, and Domestic Sales and Manufacturing Sector, contributing NT$8.26 billion.

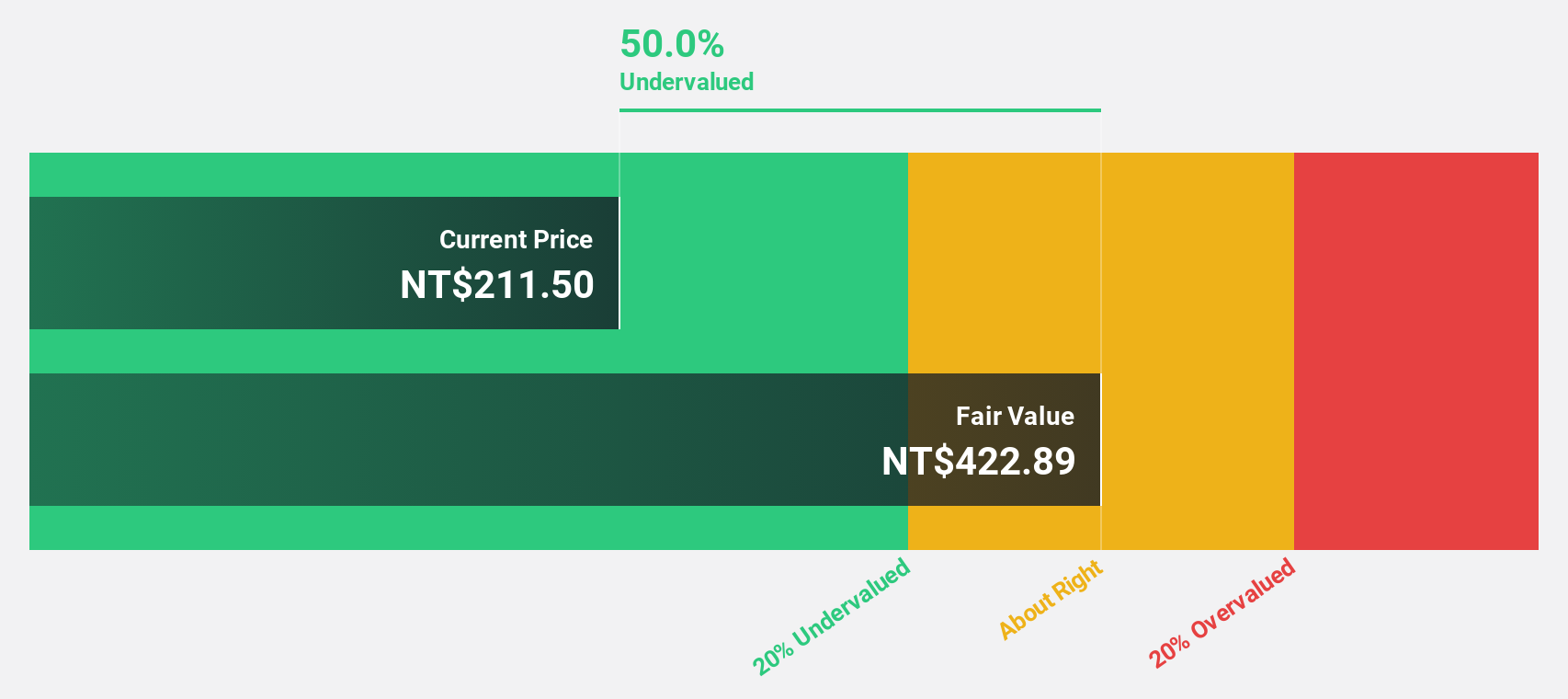

Estimated Discount To Fair Value: 47.8%

Taiwan Union Technology is trading significantly below its estimated fair value of NT$260.36, with a current price of NT$136. The company's revenue and earnings are expected to grow faster than the Taiwan market, with earnings forecasted to increase by 20.8% annually over the next three years. Despite robust profit growth of 216.3% last year, its dividend yield of 4.78% isn't well-supported by free cash flows, highlighting potential sustainability concerns.

- According our earnings growth report, there's an indication that Taiwan Union Technology might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Taiwan Union Technology.

Taiyo Holdings (TSE:4626)

Overview: Taiyo Holdings Co., Ltd. operates in the electronics materials sector globally through its subsidiaries and has a market capitalization of approximately ¥295.63 billion.

Operations: Taiyo Holdings generates revenue through its global operations in the electronics materials business.

Estimated Discount To Fair Value: 12%

Taiyo Holdings is trading at ¥5,180, approximately 12% below its estimated fair value of ¥5,886.55. Earnings are expected to grow significantly by 22.1% annually over the next three years, outpacing the JP market's growth rate. However, recent impairment losses have impacted profitability forecasts for fiscal year 2025, with profit attributable to owners revised downwards due to extraordinary losses in their pharmaceutical segment. Despite volatility and lowered guidance, revenue growth remains above market expectations.

- Insights from our recent growth report point to a promising forecast for Taiyo Holdings' business outlook.

- Navigate through the intricacies of Taiyo Holdings with our comprehensive financial health report here.

Fujikura (TSE:5803)

Overview: Fujikura Ltd. operates in the energy, telecommunications, electronics, automotive, and real estate sectors across Japan, the United States, China, and internationally with a market cap of approximately ¥1.45 trillion.

Operations: The company's revenue is primarily derived from its information and communication business division at ¥386.30 billion, followed by the automotive business division at ¥180.62 billion, electronics business division at ¥179.31 billion, power systems business division at ¥147.19 billion, and real estate business sector at ¥10.74 billion.

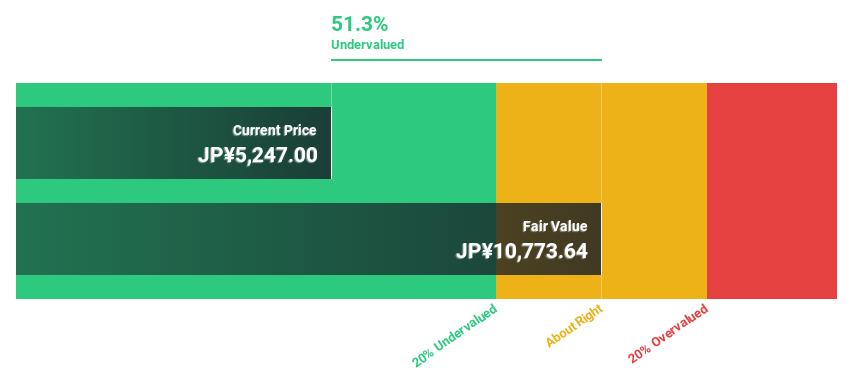

Estimated Discount To Fair Value: 48.6%

Fujikura is trading at ¥5,552, significantly below its estimated fair value of ¥10,802.93. Earnings are forecast to grow 14.81% annually, surpassing the JP market's 7.6% growth rate. Despite a volatile share price and a recent ¥4.8 billion settlement with Mitsubishi Electric Corporation impacting cash flow, Fujikura has strengthened its financial position through a ¥10 billion green bond offering and inclusion in major indices like S&P TOPIX and S&P Global 1200.

- Our earnings growth report unveils the potential for significant increases in Fujikura's future results.

- Get an in-depth perspective on Fujikura's balance sheet by reading our health report here.

Where To Now?

- Click this link to deep-dive into the 465 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Engages in the manufacture and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives