- China

- /

- Oil and Gas

- /

- SHSE:601001

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. indices closing a strong year despite recent slumps and European inflationary pressures prompting cautious monetary policies, investors are increasingly focused on strategies that offer stability and income potential. In this context, dividend stocks emerge as appealing options due to their ability to provide regular income streams while potentially benefiting from capital appreciation in fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Jinneng Holding Shanxi Coal Industryltd (SHSE:601001)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jinneng Holding Shanxi Coal Industry Co., Ltd., along with its subsidiaries, is involved in the production and sale of coal and related chemical products in China, with a market capitalization of CN¥22.43 billion.

Operations: Jinneng Holding Shanxi Coal Industry Co., Ltd. generates revenue primarily through the production and sale of coal and related chemical products in China.

Dividend Yield: 5.9%

Jinneng Holding Shanxi Coal Industry Ltd. offers a compelling dividend profile with dividends well-covered by earnings (payout ratio: 40.1%) and cash flows (cash payout ratio: 30.4%). Although dividends have been stable, they have only been issued for two years, limiting historical reliability. The stock trades at 66.4% below its estimated fair value and offers a competitive dividend yield of 5.9%, placing it in the top quartile of CN market payers despite recent flat earnings performance.

- Click here to discover the nuances of Jinneng Holding Shanxi Coal Industryltd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Jinneng Holding Shanxi Coal Industryltd is trading behind its estimated value.

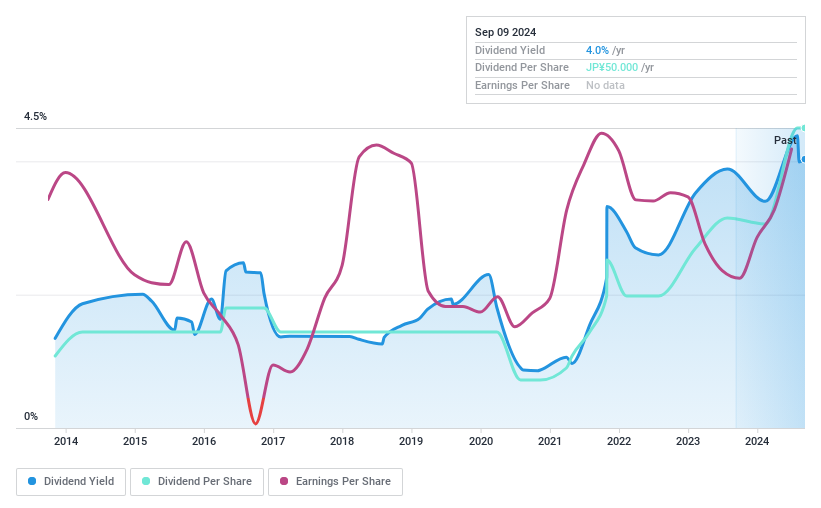

Nicca ChemicalLtd (TSE:4463)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nicca Chemical Co., Ltd. is a company that produces and distributes surfactants for various industries including textiles, metals, pulp and paper, paints, dyes, synthetic resins, and cleaning agents both in Japan and globally, with a market capitalization of approximately ¥17.97 billion.

Operations: Nicca Chemical Co., Ltd. generates revenue primarily from its Chemicals segment at ¥38.33 billion and its Cosmetics segment at ¥13.44 billion.

Dividend Yield: 4.4%

Nicca Chemical Ltd. offers a competitive dividend yield of 4.41%, ranking in the top 25% of JP market payers, with dividends well-covered by earnings and cash flows, evidenced by low payout ratios (25.7% and 23.8%). However, its dividend history is marked by volatility over the past decade despite recent increases in payments. The stock trades significantly below its estimated fair value, but investors should be cautious due to its unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Nicca ChemicalLtd.

- Our comprehensive valuation report raises the possibility that Nicca ChemicalLtd is priced lower than what may be justified by its financials.

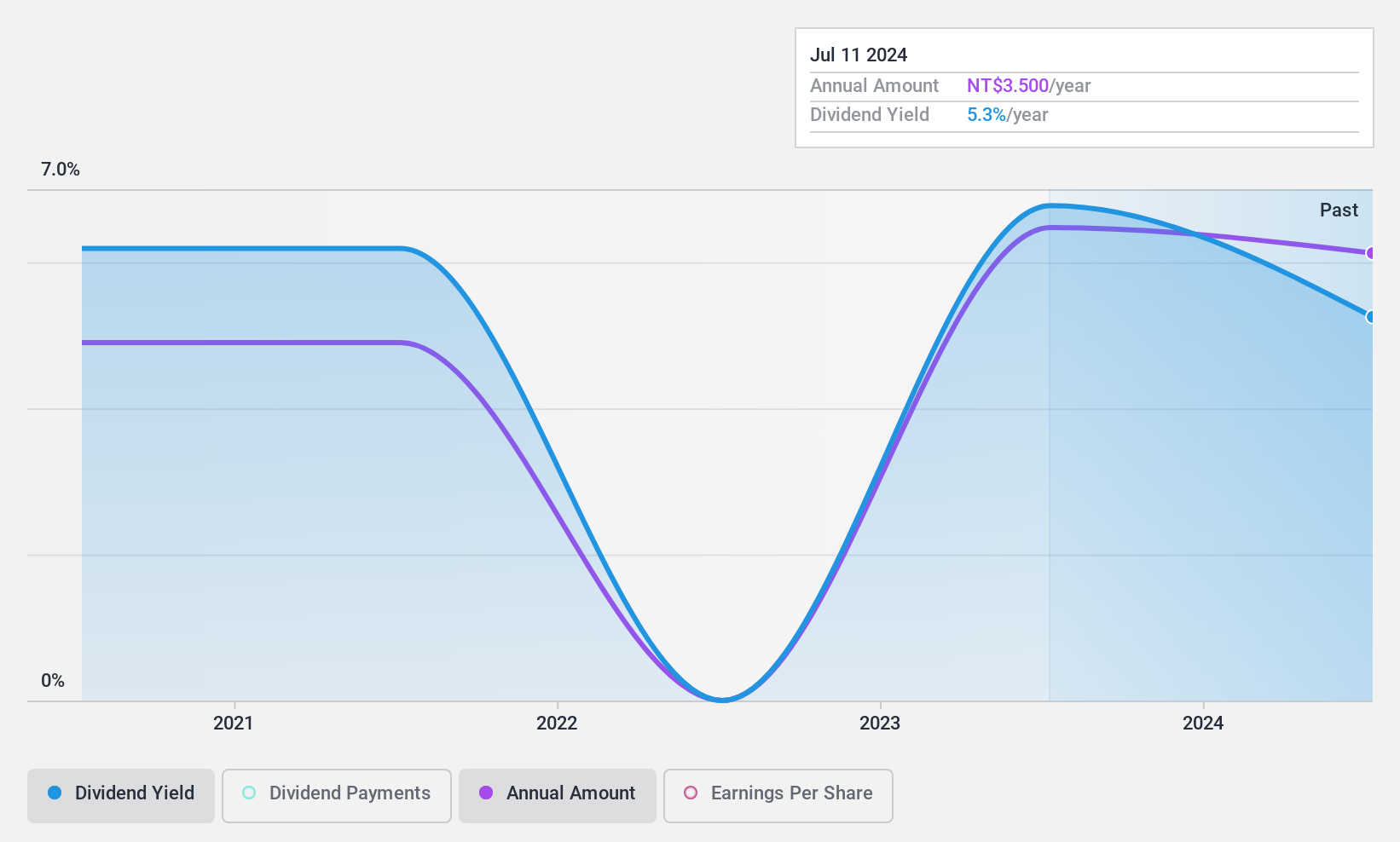

Rich Honour International Designs (TWSE:6754)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rich Honour International Designs Co., Ltd. operates in the design industry and has a market capitalization of NT$4.30 billion.

Operations: Rich Honour International Designs Co., Ltd. generates its revenue primarily from its Decoration Engineering Business, amounting to NT$5.44 billion.

Dividend Yield: 5.4%

Rich Honour International Designs Co., Ltd. maintains a strong position among dividend payers in Taiwan, with a yield of 5.37% and payments well-supported by earnings (56% payout ratio) and cash flow (33.1% cash payout ratio). Despite only five years of dividend history, payments have been stable and growing, reflecting solid earnings growth of 23.5%. The stock trades at a significant discount to its estimated fair value, enhancing its appeal for income-focused investors.

- Navigate through the intricacies of Rich Honour International Designs with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Rich Honour International Designs shares in the market.

Next Steps

- Navigate through the entire inventory of 1982 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601001

Jinneng Holding Shanxi Coal Industryltd

Engages in the production and sales of coal and related chemical products in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives