The Market Lifts Kodama Chemical Industry Co.,Ltd. (TSE:4222) Shares 31% But It Can Do More

Despite an already strong run, Kodama Chemical Industry Co.,Ltd. (TSE:4222) shares have been powering on, with a gain of 31% in the last thirty days. The annual gain comes to 186% following the latest surge, making investors sit up and take notice.

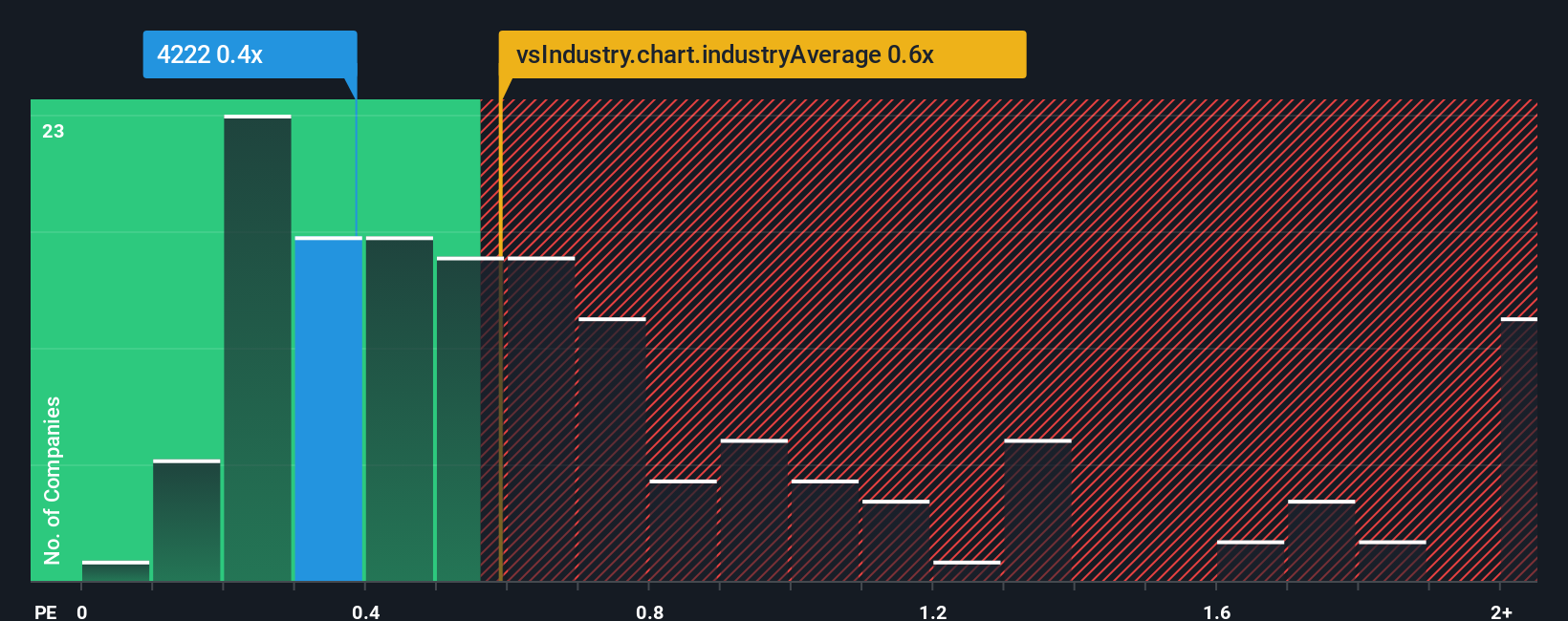

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Kodama Chemical IndustryLtd's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in Japan is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Kodama Chemical IndustryLtd

How Kodama Chemical IndustryLtd Has Been Performing

Recent times have been quite advantageous for Kodama Chemical IndustryLtd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Kodama Chemical IndustryLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Kodama Chemical IndustryLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Kodama Chemical IndustryLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 116% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 116% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 2.9% shows it's noticeably more attractive.

With this information, we find it interesting that Kodama Chemical IndustryLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Kodama Chemical IndustryLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Kodama Chemical IndustryLtd revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Kodama Chemical IndustryLtd (2 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Kodama Chemical IndustryLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kodama Chemical IndustryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4222

Kodama Chemical IndustryLtd

Manufactures and sells plastic products in Japan and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives