A Fresh Look at UBE (TSE:4208) Valuation as Share Price Stays Quiet

Reviewed by Kshitija Bhandaru

See our latest analysis for UBE.

Looking beyond today’s muted activity, UBE’s share price momentum has steadily faded this year, with a 1-year total shareholder return of -0.12% that underscores persistent challenges. The current trend reflects more cautious sentiment as investors weigh long-term growth potential against recent headwinds.

If you’re interested in expanding your search for opportunity, now’s a great time to discover fast growing stocks with high insider ownership

With UBE trading well below analyst price targets but facing lackluster recent returns, the question for investors is clear: does the current valuation signal an undervalued stock, or is future growth already priced in?

Price-to-Sales Ratio of 0.5x: Is it justified?

UBE currently trades at a price-to-sales (P/S) ratio of 0.5x, well below both its industry peers and the wider market. This suggests that the market is attaching a discount relative to others in the chemicals sector. With a last close price of ¥2,246.5 and analysts agreeing that the stock is trading at good value, the multiple points to a cautious yet potentially attractive valuation.

The price-to-sales ratio shows how much investors are willing to pay per yen of sales. For materials and chemicals companies, this ratio is widely used when earnings are volatile or negative. Because UBE is not currently profitable, using sales as a benchmark gives a more stable sense of relative value.

UBE’s P/S of 0.5x is cheaper compared to the peer average of 0.9x and the Japanese Chemicals industry average of 0.6x. It also matches the estimated fair price-to-sales ratio of 0.5x. This implies that the current market price may already reflect realistic expectations and that any upward movement would require a change in outlook or results.

Explore the SWS fair ratio for UBE

Result: Price-to-Sales of 0.5x (UNDERVALUED)

However, revenue growth remains negative and recent returns are subdued. Both of these factors could dampen investor confidence if fundamentals fail to improve.

Find out about the key risks to this UBE narrative.

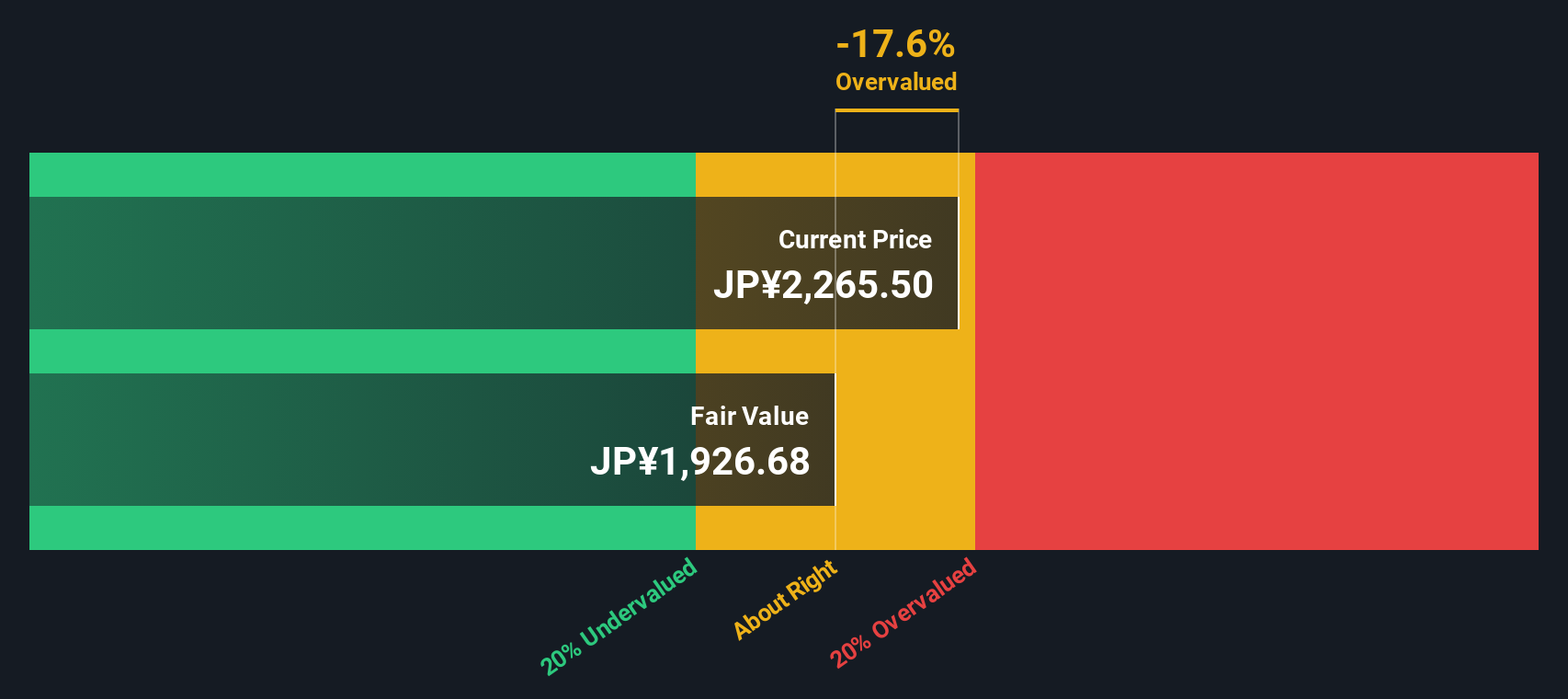

Another View: Discounted Cash Flow Paints a Different Picture

While the price-to-sales ratio hints at fair value, the SWS DCF model suggests UBE may be overvalued, with its current price positioned above our estimate of fair value. This challenges the earlier assessment and highlights how valuation can shift when future cash flows are considered instead of only sales. For investors, does this DCF indicate a need for caution or present another opportunity for new momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UBE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UBE Narrative

If you feel compelled to draw your own conclusions or want to investigate further, you can craft a personalized narrative in just minutes. Do it your way.

A great starting point for your UBE research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on unique opportunities to power up your portfolio with fresh stock ideas using the Simply Wall Street Screener. There’s a world of potential waiting for you.

- Unlock growth potential by targeting companies with consistently high yields through these 19 dividend stocks with yields > 3%.

- Accelerate your search for innovation and tech disruption by browsing these 24 AI penny stocks leading the charge in artificial intelligence breakthroughs.

- Capitalize on undervalued opportunities in the market with these 896 undervalued stocks based on cash flows that stand out for their strong fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4208

UBE

Engages in the materials and machinery businesses in Japan, Asia, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026