How Zeon’s Treasury Share Cancellation Could Influence Capital Efficiency for Zeon (TSE:4205) Investors

Reviewed by Sasha Jovanovic

- Zeon Corporation’s board has resolved to cancel 6,000,600 treasury shares, or 2.79% of its issued stock, with the cancellation scheduled for January 7, 2026, reducing the total share count to 209,251,256.

- This reduction of treasury shares is intended to tighten the share float and may improve capital efficiency by lifting per-share financial measures over time.

- We’ll now examine how Zeon’s decision to cancel treasury shares could shape the company’s investment narrative and long-term appeal.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Zeon's Investment Narrative?

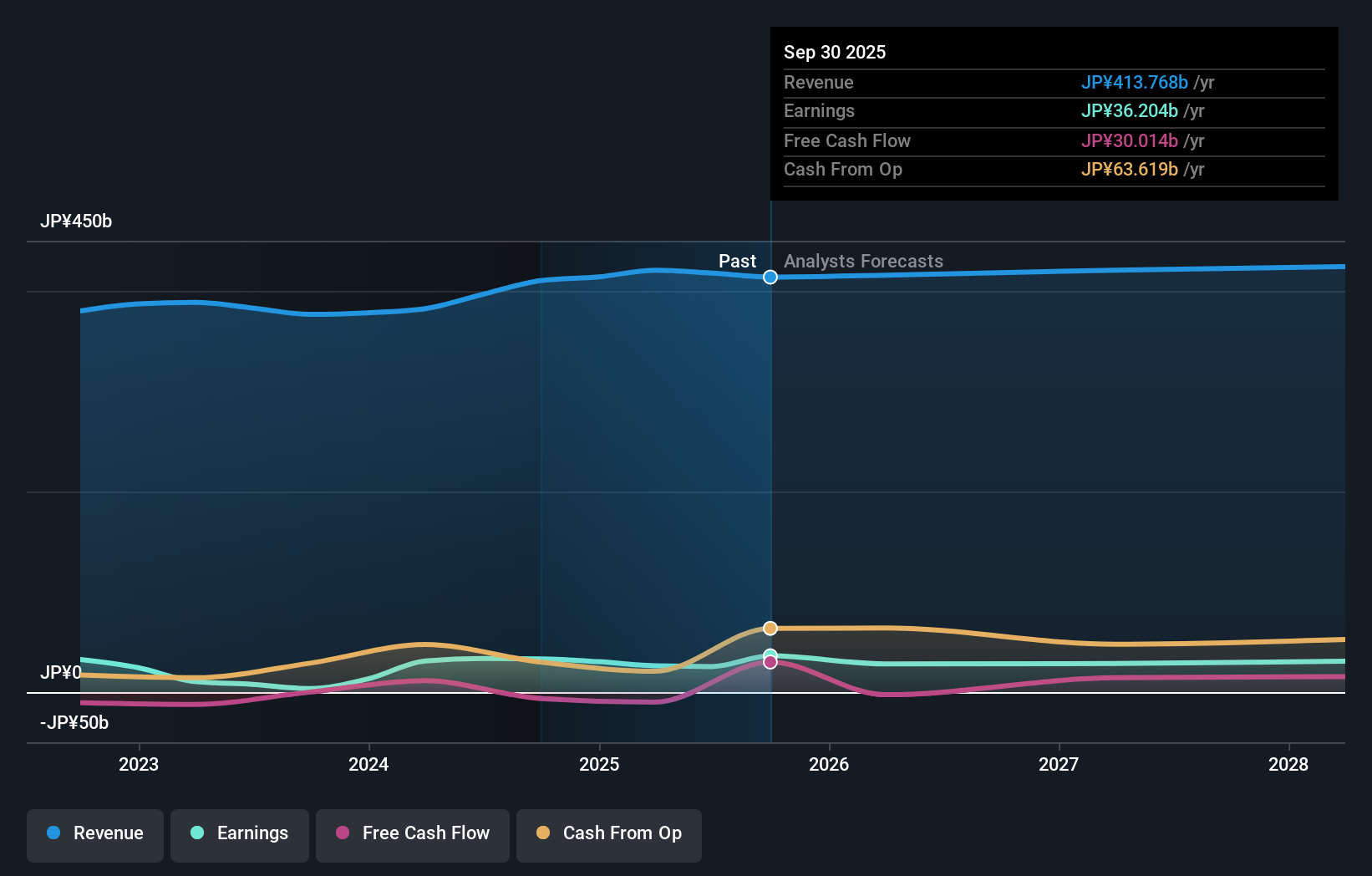

To own Zeon, you really need to believe the core chemicals business can keep generating steady cash flows while management allocates that cash sensibly through capex, buybacks and dividends. Recent guidance still points to modest revenue growth and a solid dividend, even as consensus expects earnings to soften in the coming years and one-off gains cloud the quality of recent results. The upcoming Q3 FY2026 earnings and progress on the new production plant remain key near term catalysts, with any sign of cost overruns or weaker margins likely to matter more to the share price than this latest treasury share cancellation. The 2.79% reduction in share count should slightly support per share metrics, but on its own it does not radically change the risk profile.

However, the new plant’s execution risk is something investors should not ignore. Zeon's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community clusters at ¥1,835.56, close to current consensus. You are weighing this against risks like potential earnings pressure and project execution, which could influence how comfortably Zeon meets its own guidance and sustains shareholder returns over time.

Explore another fair value estimate on Zeon - why the stock might be worth as much as ¥1836!

Build Your Own Zeon Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zeon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeon's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zeon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4205

Zeon

Engages in the elastomer materials, specialty materials, and other businesses in Japan, North America, Europe, and Asia.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion