Assessing Zeon (TSE:4205)’s Valuation After a Steady 27% One-Year Shareholder Return

Reviewed by Simply Wall St

Zeon (TSE:4205) has quietly delivered a solid run this year, with the stock climbing about 19% year-to-date and roughly 27% over the past year, even as earnings growth has been mixed.

See our latest analysis for Zeon.

With the latest share price at ¥1,754, Zeon’s steady 1 month share price return of around 5 percent builds on an 18 percent year to date gain and a robust 1 year total shareholder return of about 27 percent, suggesting momentum is gradually firming as investors reassess its growth and risk profile.

If Zeon’s steady climb has you rethinking your watchlist, this could be a good moment to widen the lens and explore fast growing stocks with high insider ownership.

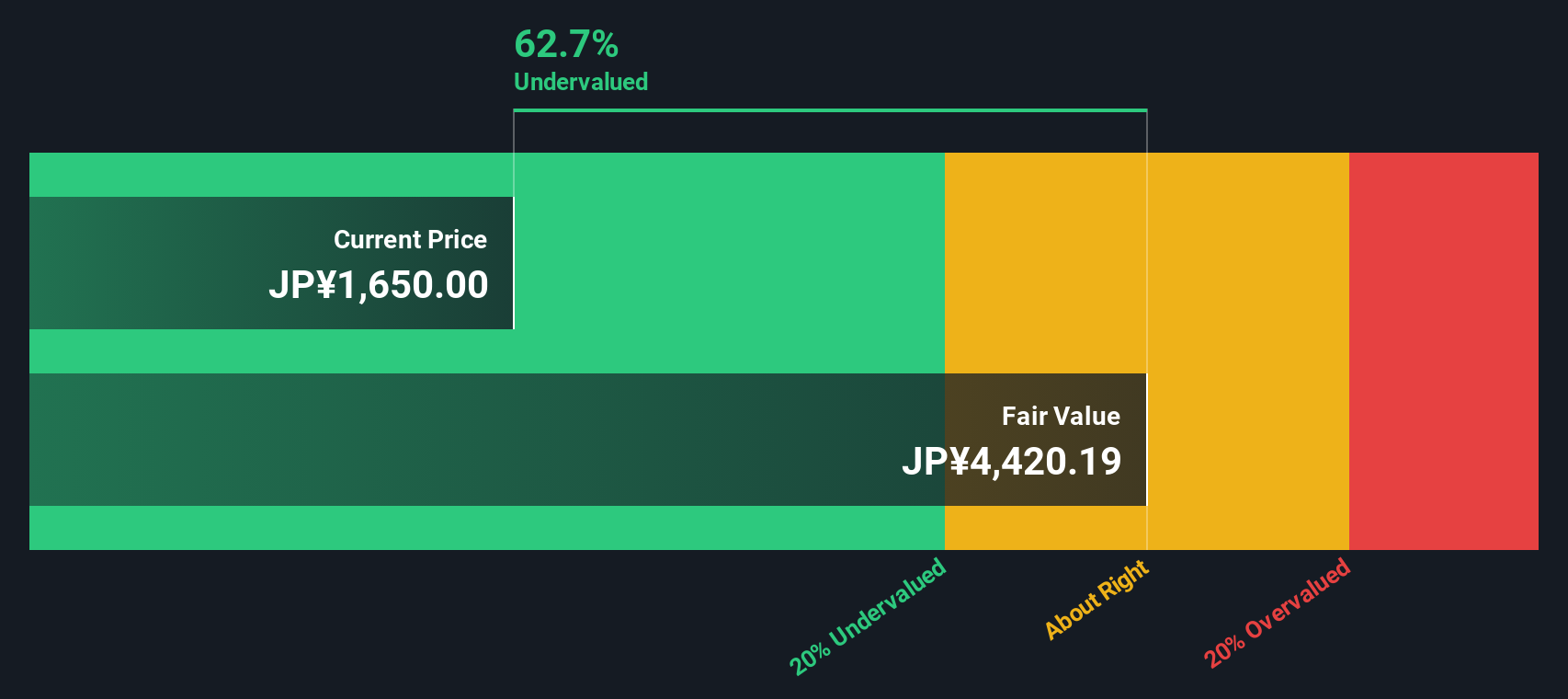

Yet with Zeon trading only slightly below analyst targets but at a hefty intrinsic discount estimate, the key question is whether investors are overlooking value or whether the market is already pricing in its next growth phase.

Price-to-Earnings of 9.3x: Is it justified?

On a price-to-earnings ratio of 9.3x at the last close of ¥1,754, Zeon screens as materially undervalued versus both its peers and the broader chemicals industry.

The price-to-earnings multiple compares what investors pay for each unit of current earnings, a key yardstick for a mature, cash-generative materials and chemicals group like Zeon. For businesses with relatively steady demand across transportation, electronics and industrial applications, this measure helps indicate how much future earning power the market is willing to recognise today.

Zeon’s 9.3x multiple looks restrained when set against the peer average of 27x and the Japan chemicals industry average of 12.5x. This implies the market is pricing in more modest prospects than for rivals. Compared with an estimated fair price-to-earnings ratio of 12.7x, there appears to be room for the valuation to move closer to levels suggested by fundamentals if earnings resilience and dividend support remain intact.

Explore the SWS fair ratio for Zeon

Result: Price-to-Earnings of 9.3x (UNDERVALUED)

However, softer net income trends and a modest annual revenue growth rate could signal that operational challenges, or weaker end-demand, may limit any valuation re-rating.

Find out about the key risks to this Zeon narrative.

Another Angle on Value

Our DCF model paints an even starker picture than the earnings multiple, suggesting Zeon trades at a steep discount to its estimated fair value, despite already looking cheap on price to earnings. Is the market flagging real long term risks, or overlooking a patient opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zeon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zeon Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your Zeon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready to uncover your next move?

Do not stop with a single stock. Use the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy before the market catches on.

- Explore potential income streams by analysing these 13 dividend stocks with yields > 3% that may complement your portfolio with consistent payouts and resilient business models.

- Seek exposure to secular trends by targeting these 26 AI penny stocks involved in automation, data intelligence and next generation software.

- Focus on your margin of safety by reviewing these 910 undervalued stocks based on cash flows that appear attractively priced relative to their long term cash flow characteristics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zeon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4205

Zeon

Engages in the elastomer materials, specialty materials, and other businesses in Japan, North America, Europe, and Asia.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion