How a Dividend Hike at Sumitomo Bakelite (TSE:4203) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 31, 2025, Sumitomo Bakelite Company Limited announced a second-quarter dividend increase to ¥50.00 per share, up from ¥45.00 per share a year earlier, with a total payout of ¥4.38 billion effective December 1, 2025.

- This dividend hike stands out as a clear signal of the company's positive outlook and management's confidence in ongoing financial strength.

- We’ll explore how this increased dividend payout shapes Sumitomo Bakelite’s investment narrative through its implications for stability and growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sumitomo Bakelite's Investment Narrative?

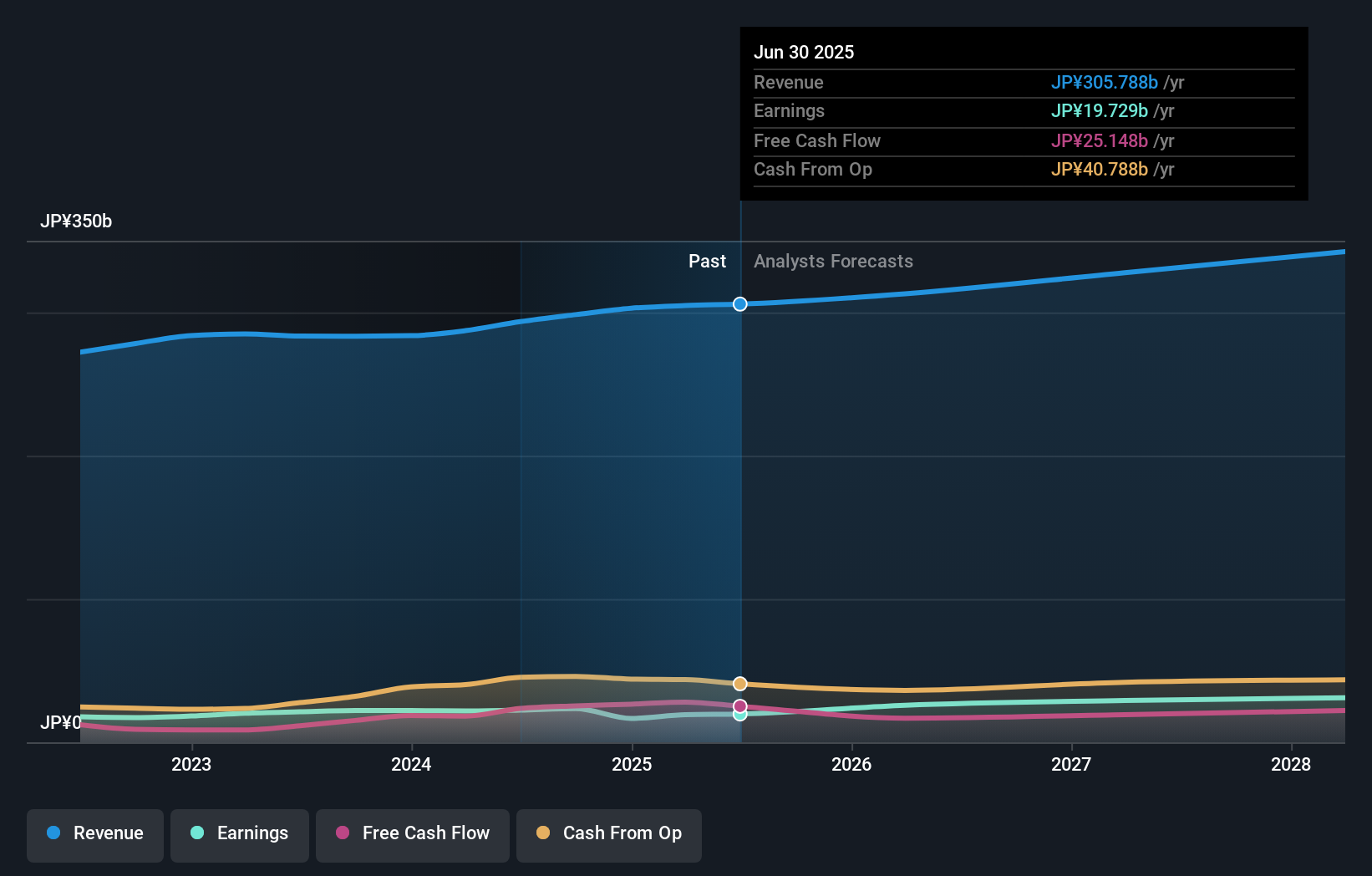

To be comfortable as a Sumitomo Bakelite shareholder, you typically want to believe in the company’s ability to deliver both steady returns and prudent financial management, even as growth has recently moderated and the stock appears richly priced compared to industry peers. The latest dividend hike to ¥50.00 per share, following a year with both special and reduced dividends, certainly signals management’s emphasis on rewarding shareholders and projecting confidence after a period of less robust earnings growth and compressed profit margins. While the increased payout is likely welcome for those focused on cash flows, its direct impact on near-term catalysts may be limited by existing concerns about valuation and profit margins that remain below last year’s level. If anything changes, it might be in investor sentiment, with the dividend move potentially tempering risk perceptions. However, it is just as important to continue watching how the balance between earnings consistency and payout ambitions unfolds given recent margin trends.

But the company's profitability pressures could remain a caution signal for new investors. Despite retreating, Sumitomo Bakelite's shares might still be trading 45% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Sumitomo Bakelite - why the stock might be worth as much as 7% more than the current price!

Build Your Own Sumitomo Bakelite Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo Bakelite research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sumitomo Bakelite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo Bakelite's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4203

Sumitomo Bakelite

Engages in the research and development, manufacture, and sale of semiconductor materials, plastic products, and life products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives