A Fresh Look at Mitsubishi Chemical Group (TSE:4188) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

For anyone who’s been keeping an eye on Mitsubishi Chemical Group (TSE:4188), the latest moves in its stock are bound to spark some questions. There is no headline-grabbing event behind the recent activity, but sometimes a subtle shift is all it takes to get investors wondering whether there’s a deeper story at play. When a company this size quietly changes direction, it can signal a recalibration in how the market sees its future potential or risks.

In the past year, Mitsubishi Chemical Group’s share price has only edged up about 2%, a much smaller climb compared to its three- and five-year gains of 35% and 54%. However, momentum has clearly picked up lately, with a 15% jump over the past three months and over 12% just in the last month. While there have been no major events to grab headlines, that kind of short-term acceleration can catch value-focused investors’ attention, especially on the heels of longer periods of quieter performance.

So, is this just a fleeting run or might Mitsubishi Chemical Group be trading below its true value? Are markets underestimating its next phase of growth, or is all the optimism already reflected in the price?

Most Popular Narrative: 4.2% Undervalued

The most widely followed valuation narrative suggests Mitsubishi Chemical Group trades at a discount, with analysts seeing room for upside in the share price based on future growth prospects and margin expansion.

“Mitsubishi Chemical Group's ongoing shift towards specialty and high value-added materials, evidenced by significant structural reforms, business divestitures, and cost reductions, should enhance the product mix, improve net margins, and provide greater earnings stability as global demand for advanced, sustainable materials grows.”

Curious about how this valuation was determined? There is a complex puzzle of earnings growth, margin recovery, and future multiples behind this fair value call. Readers can get a glimpse into the forward-looking projections, sophisticated cost-saving strategies, and the level of ambition in the earnings roadmap. Interested in the calculations and what factors could make or break this investment case? The full narrative uncovers the numbers behind today’s price target.

Result: Fair Value of ¥923.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak demand in key global markets or delays in shifting to higher-value segments could quickly diminish the current optimism around earnings growth.

Find out about the key risks to this Mitsubishi Chemical Group narrative.Another View: Market Comparisons Tell A Different Story

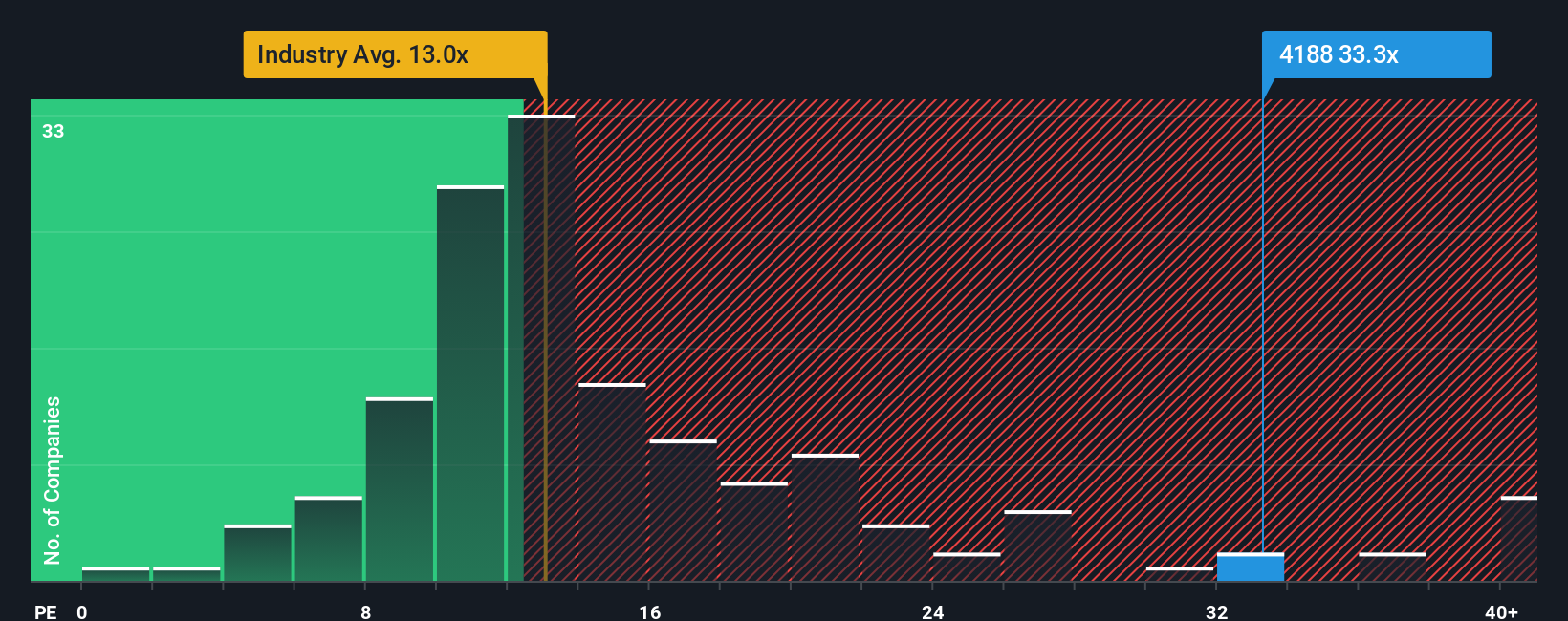

But when we compare Mitsubishi Chemical Group against industry averages using a common earnings measure, things look less favorable. In this comparison, the shares appear pricey compared to sector peers, raising fresh questions about upside from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Chemical Group Narrative

If you see things differently or want to dive into the numbers yourself, it’s easy to uncover your own take in just a few minutes with Do it your way.

A great starting point for your Mitsubishi Chemical Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more standout investment ideas?

Smart investors never settle for just one opportunity. Fresh strategies and untapped potential are always one step away, so don’t miss your chance to act now.

- Uncover high yields and consistent payouts by starting your research with dividend stocks with yields > 3%.

- Catch the early wave in tomorrow’s breakthrough technologies, especially in computing, by checking out quantum computing stocks.

- Spot stocks trading for less than their future cash flows might suggest by investigating undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:4188

Mitsubishi Chemical Group

Provides performance products, industrial materials, industrial gases, and others in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives