3 Japanese Stocks Estimated To Be Trading At Discounts Of Up To 46.9%

Reviewed by Simply Wall St

Japan's stock markets have shown positive momentum recently, with the Nikkei 225 Index and TOPIX Index both experiencing gains, supported by a weaker yen that has improved the profit outlook for exporters. As investors navigate these conditions, identifying stocks that are potentially undervalued can offer opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3450.00 | ¥6698.13 | 48.5% |

| Akatsuki (TSE:3932) | ¥2058.00 | ¥3750.52 | 45.1% |

| Densan System Holdings (TSE:4072) | ¥2659.00 | ¥5308.52 | 49.9% |

| Kotobuki Spirits (TSE:2222) | ¥1879.00 | ¥3434.73 | 45.3% |

| Pilot (TSE:7846) | ¥4662.00 | ¥8893.86 | 47.6% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥4150.00 | ¥7814.51 | 46.9% |

| Hibino (TSE:2469) | ¥3510.00 | ¥6917.23 | 49.3% |

| Appier Group (TSE:4180) | ¥1764.00 | ¥3465.26 | 49.1% |

| KeePer Technical Laboratory (TSE:6036) | ¥4195.00 | ¥7826.49 | 46.4% |

| Money Forward (TSE:3994) | ¥6240.00 | ¥11793.89 | 47.1% |

We'll examine a selection from our screener results.

S Foods (TSE:2292)

Overview: S Foods Inc. is a Japanese meat company involved in the manufacture, wholesaling, retailing, and food servicing of meat-related products, with a market cap of ¥89.37 billion.

Operations: The company's revenue segments include ¥406.97 billion from manufacturing and wholesale of meat, ¥24.15 billion from retail business of meat and related products, and ¥8.33 billion from the meat restaurant business.

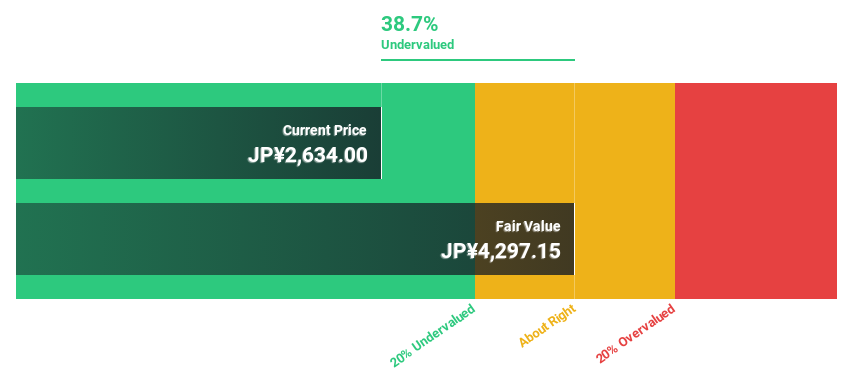

Estimated Discount To Fair Value: 34.3%

S Foods is trading at ¥2,825, significantly below its estimated fair value of ¥4,297.15, making it undervalued based on discounted cash flow analysis. Despite lower profit margins this year (1.4% compared to 2.7% last year), earnings are forecasted to grow at a substantial 22.4% annually over the next three years, outpacing the Japanese market average of 8.8%. However, its dividend yield of 3.15% isn't well covered by free cash flows.

- Our expertly prepared growth report on S Foods implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of S Foods.

Eternal Hospitality GroupLtd (TSE:3193)

Overview: Eternal Hospitality Group Co., Ltd. operates restaurants in Japan and has a market cap of ¥47.84 billion.

Operations: The company's revenue is primarily derived from its Food and Beverage Business, which generated ¥41.91 billion.

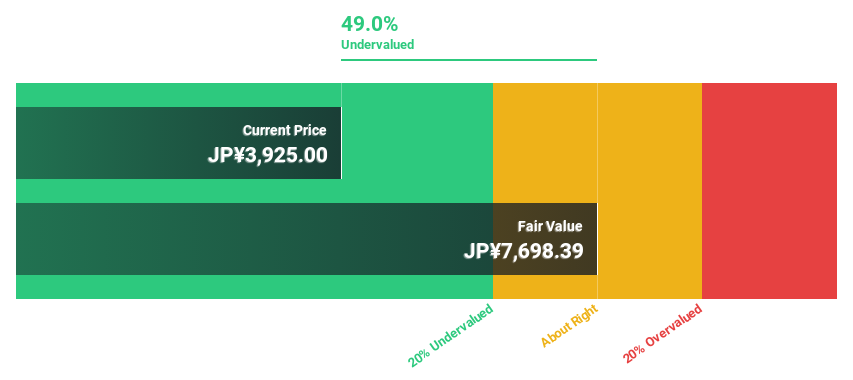

Estimated Discount To Fair Value: 46.9%

Eternal Hospitality Group Ltd. is trading at ¥4,150, significantly below its estimated fair value of ¥7,814.51, highlighting its undervaluation based on discounted cash flows. The company's earnings are projected to grow 14.3% annually, surpassing the Japanese market average of 8.8%, though revenue growth remains modest at 8.7%. Despite recent share price volatility and stable dividend payouts (¥23 per share), the company maintains robust profit forecasts for fiscal year-end July 2025 with anticipated net sales of ¥47.82 billion.

- In light of our recent growth report, it seems possible that Eternal Hospitality GroupLtd's financial performance will exceed current levels.

- Navigate through the intricacies of Eternal Hospitality GroupLtd with our comprehensive financial health report here.

Stella Chemifa (TSE:4109)

Overview: Stella Chemifa Corporation manufactures and sells inorganic fluorine compounds both in Japan and internationally, with a market cap of ¥53.89 billion.

Operations: The company's revenue segments include High-Purity Chemical at ¥27.44 billion and Transportation at ¥7.60 billion.

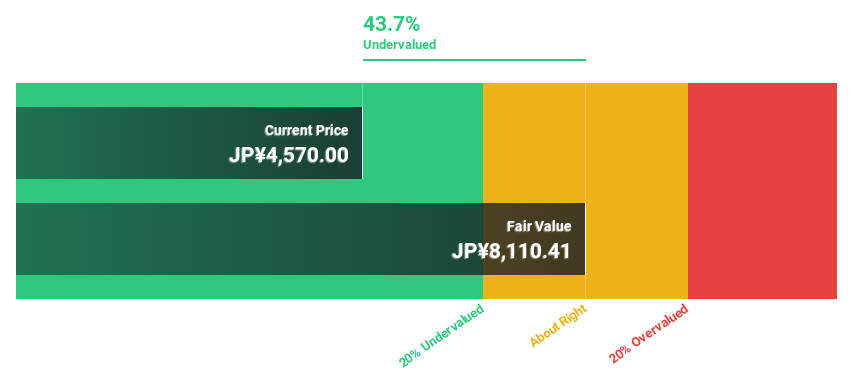

Estimated Discount To Fair Value: 44.8%

Stella Chemifa is trading at ¥4,475, considerably below its estimated fair value of ¥8,100.17, suggesting significant undervaluation based on cash flows. Earnings are forecast to grow 23.5% annually over the next three years, outpacing the Japanese market's 8.8% growth rate. Despite a recent dividend reduction from ¥94 to an expected ¥85 per share for fiscal year-end March 2025, revenue is anticipated to increase by 9.6% annually, surpassing market expectations.

- The analysis detailed in our Stella Chemifa growth report hints at robust future financial performance.

- Click here to discover the nuances of Stella Chemifa with our detailed financial health report.

Taking Advantage

- Take a closer look at our Undervalued Japanese Stocks Based On Cash Flows list of 80 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4109

Stella Chemifa

Manufactures and sells inorganic fluorine compounds in Japan and internationally.

Flawless balance sheet with solid track record.