Could Air Water’s (TSE:4088) New Committee Reveal Shifts in Governance Culture?

Reviewed by Sasha Jovanovic

- On October 9, 2025, Air Water Inc. convened a board meeting where the establishment of a Special Investigating Committee was discussed as a key agenda item.

- The formation of such a committee typically signals the company is addressing important internal matters, often related to governance or compliance, which can influence stakeholder perceptions.

- We'll now explore how the creation of a Special Investigating Committee could reshape Air Water’s investment story and risk profile.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Air Water's Investment Narrative?

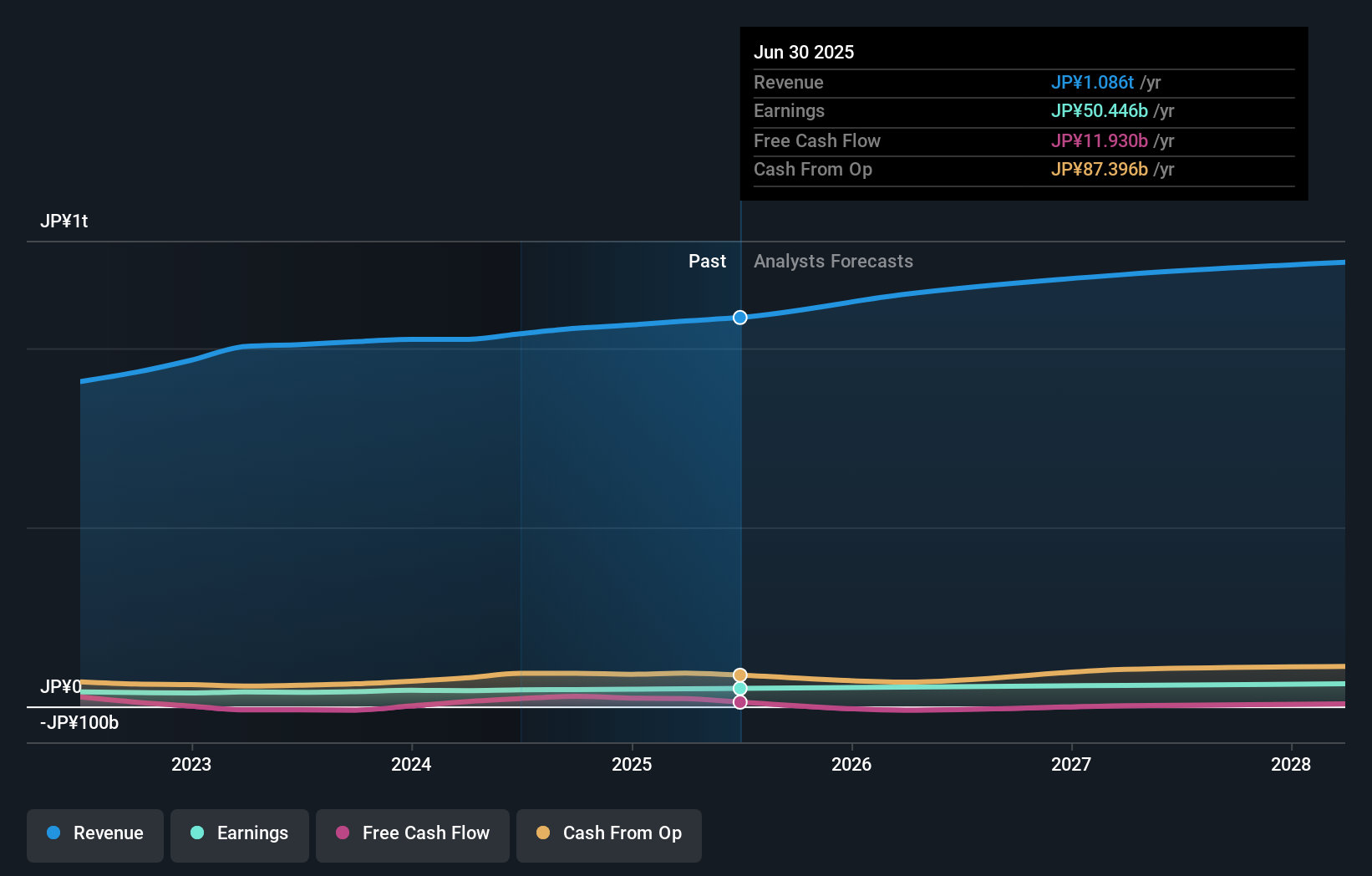

For investors considering Air Water, the main appeal has long centered around stable earnings growth, attractive relative valuation, and a consistent dividend policy, even as growth has slowed below market averages. With the board now forming a Special Investigating Committee, the near-term investment thesis may need a fresh look. This move introduces new uncertainty, as such committees are usually set up in response to compliance or governance inquiries, areas already flagged given the board's turnover and limited director experience. In the short run, the key catalysts have included upcoming earnings and dividend stability, both of which could face more scrutiny or shifting sentiment if the committee's formation is linked to any material findings. For now, early analysis and recent share price stability suggest the immediate impact is limited, but the risk profile has shifted, and investors will be watching for further developments.

However, with board experience still a question, this new committee adds an additional layer of uncertainty for shareholders.

Exploring Other Perspectives

Explore another fair value estimate on Air Water - why the stock might be worth 21% less than the current price!

Build Your Own Air Water Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Water research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Water's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4088

Air Water

Engages in manufacturing selling products and services related to industrial gas, chemical, medical, energy, agriculture and food products, logistics, seawater, and other businesses in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives