As global markets experience a rebound, driven by easing U.S. inflation and robust bank earnings, investors are turning their attention to value stocks that have outperformed growth shares recently. In this environment of cautious optimism, dividend stocks like PC Partner Group offer potential stability and income generation, making them appealing options for those seeking consistent returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.50% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics with a market cap of approximately HK$2.06 billion.

Operations: The company's revenue primarily comes from the design, manufacturing, and trading of electronics and PC parts and accessories, totaling HK$9.94 billion.

Dividend Yield: 7.5%

PC Partner Group's dividend sustainability is supported by a payout ratio of 66.1%, indicating dividends are covered by earnings, and a cash payout ratio of 7.8%, showing strong cash flow coverage. However, the dividend history has been volatile over the past decade, with inconsistent growth patterns. Recent corporate governance changes include adopting new Memorandum and Articles of Association and relocating headquarters to Singapore, which may influence future strategic directions impacting dividends.

- Delve into the full analysis dividend report here for a deeper understanding of PC Partner Group.

- The analysis detailed in our PC Partner Group valuation report hints at an deflated share price compared to its estimated value.

Rasa Industries (TSE:4022)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rasa Industries, Ltd. operates in the chemicals, machinery, and electronic materials sectors both in Japan and internationally, with a market cap of ¥19.79 billion.

Operations: Rasa Industries generates revenue primarily from its Chemical Products Business at ¥35.92 billion, followed by the Machinery Business at ¥5.10 billion, and the Electronic Materials Business at ¥1.74 billion.

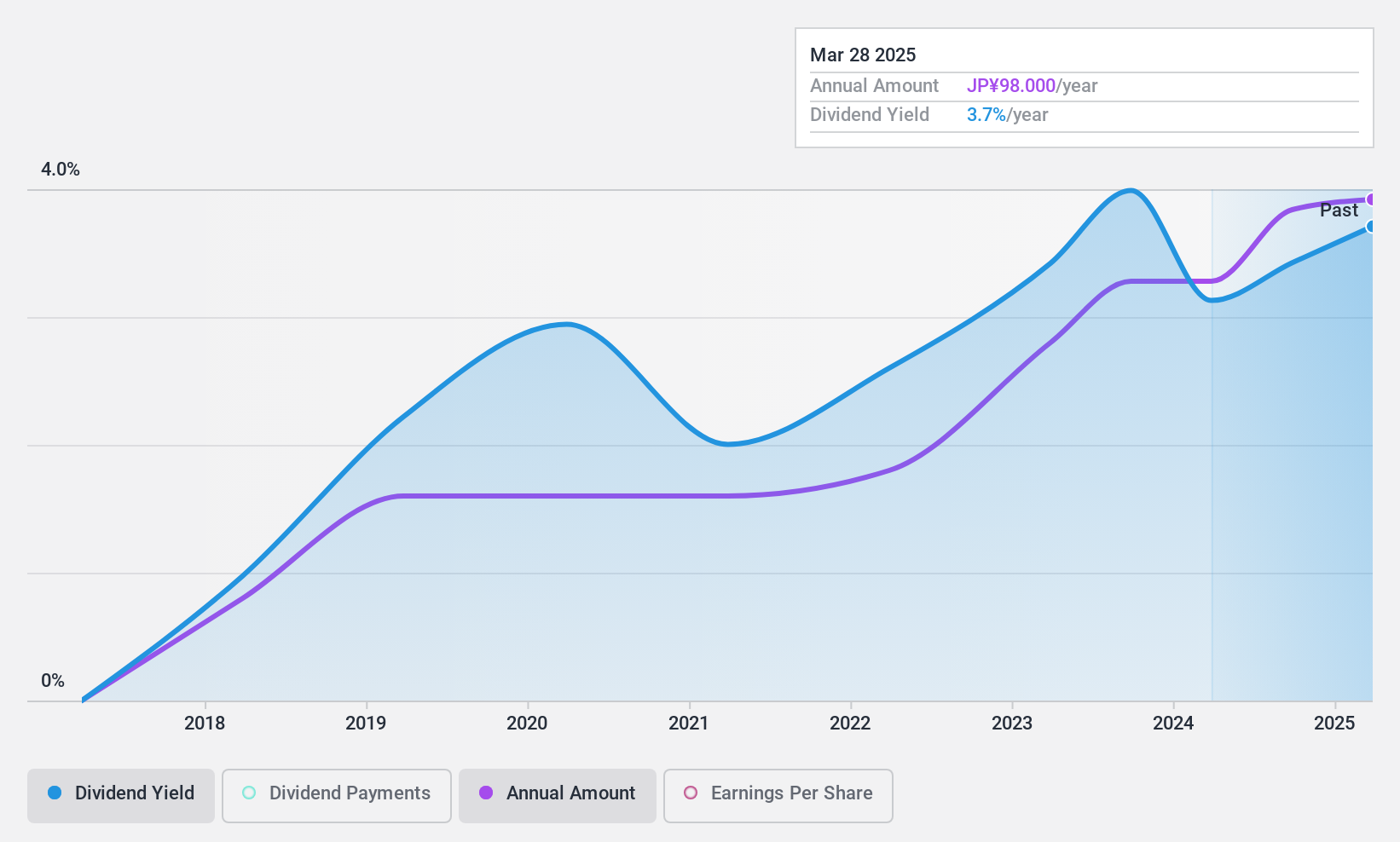

Dividend Yield: 3.8%

Rasa Industries' dividend payments are well-supported, with a low payout ratio of 32.7% and a cash payout ratio of 16.9%, ensuring coverage by both earnings and cash flows. Although dividends have been reliable, the company has only an eight-year history of payments. Trading significantly below estimated fair value, Rasa's recent share buyback aims to enhance shareholder returns and capital efficiency, potentially benefiting dividend investors despite its relatively short dividend track record.

- Navigate through the intricacies of Rasa Industries with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Rasa Industries' current price could be quite moderate.

Tachibana Eletech (TSE:8159)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tachibana Eletech Co., Ltd. is a technology-driven trading company operating in Japan and internationally, with a market cap of ¥59.77 billion.

Operations: Tachibana Eletech Co., Ltd.'s revenue is primarily derived from its FA System Business at ¥113.45 billion and Semiconductor Device Business at ¥83.38 billion, with additional contributions from its Facility Business totaling ¥20.77 million.

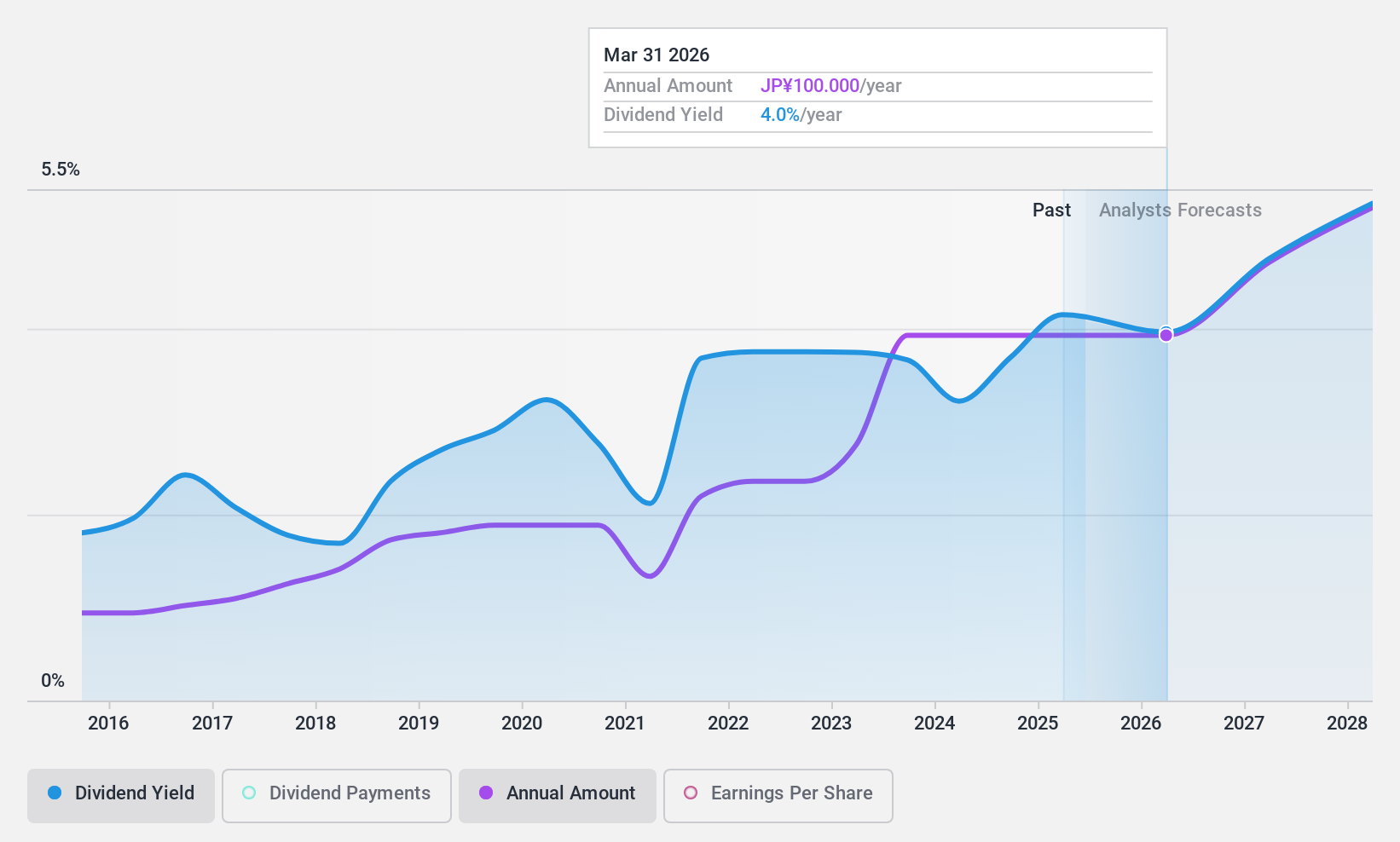

Dividend Yield: 3.8%

Tachibana Eletech's dividends are supported by a low payout ratio of 35.4% and a cash payout ratio of 22.6%, indicating strong coverage by earnings and cash flows. The dividend yield is in the top quartile of the JP market, yet past payments have been volatile over ten years. Recent share buybacks, totaling ¥2.13 billion, may enhance shareholder value despite an unstable dividend history, as shares trade significantly below fair value estimates.

- Unlock comprehensive insights into our analysis of Tachibana Eletech stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Tachibana Eletech shares in the market.

Summing It All Up

- Embark on your investment journey to our 1971 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4022

Rasa Industries

Rasa Industries, Ltd. is involved in the chemicals, machinery, and electronic materials businesses in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives