- Japan

- /

- Professional Services

- /

- TSE:6088

Asian Dividend Stocks Yielding Up To 3.8% For Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of easing U.S.-China trade tensions and cautious optimism in Asian markets, investors are increasingly looking towards stable income sources like dividend stocks. In this environment, selecting stocks that offer consistent dividend yields can be a prudent strategy for those seeking to balance potential growth with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.23% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.91% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.97% | ★★★★★★ |

| NCD (TSE:4783) | 4.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.83% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.55% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1019 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

China Resources Beer (Holdings) (SEHK:291)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Beer (Holdings) Company Limited is an investment holding company that manufactures, distributes, and sells alcoholic beverages in Mainland China, with a market cap of HK$94.21 billion.

Operations: China Resources Beer (Holdings) Company Limited generates revenue from its operations in Mainland China through its Baijiu segment (CN¥1.76 billion), Central Region (CN¥9.94 billion), Eastern Region (CN¥18.61 billion), and Southern Region (CN¥10.30 billion).

Dividend Yield: 3.5%

China Resources Beer (Holdings) offers a mixed dividend profile. Trading at 47.1% below its estimated fair value, it presents good relative value compared to peers. The dividend yield of 3.5% is below the top tier in Hong Kong, but dividends are well-covered by earnings and cash flows with payout ratios of 47.4% and 60.2%, respectively. Despite recent increases, the dividend track record has been unstable over the past decade due to volatility and unreliability in payments. Recent executive changes include new appointments for key positions like president and CFO, which might influence future strategic directions impacting dividends indirectly.

- Click here to discover the nuances of China Resources Beer (Holdings) with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China Resources Beer (Holdings) shares in the market.

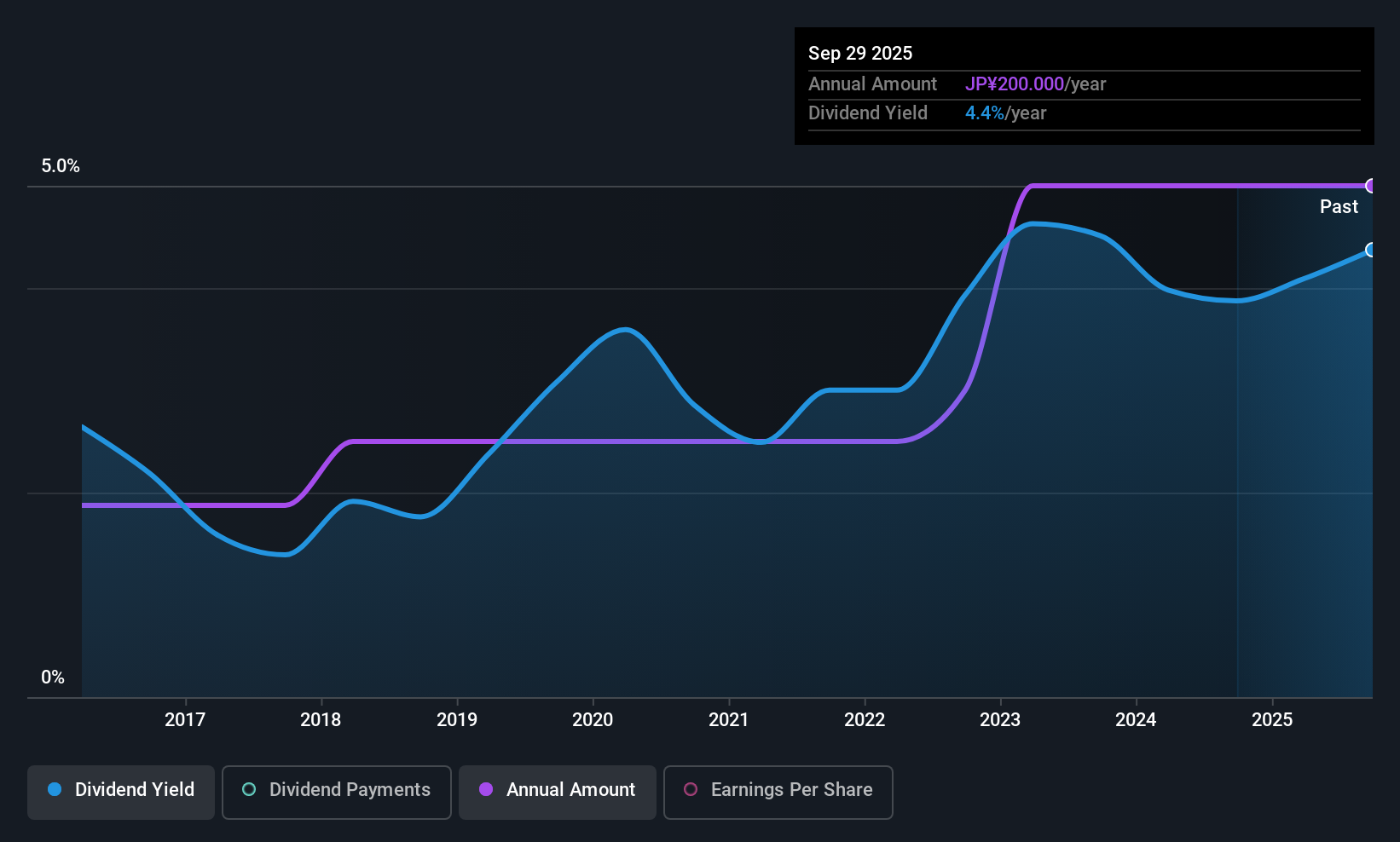

Sumitomo Seika Chemicals Company (TSE:4008)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Seika Chemicals Company, Limited operates in the chemical industry and has a market cap of approximately ¥68.68 billion.

Operations: Sumitomo Seika Chemicals Company generates revenue primarily from its Super Absorbent Polymers segment, which accounts for ¥115.08 billion, and its Function Material segment, contributing ¥30.97 billion.

Dividend Yield: 3.8%

Sumitomo Seika Chemicals Company has maintained stable and reliable dividend payments over the past decade, with a reasonable payout ratio of 58.8%. However, its current dividend yield of 3.82% is not supported by free cash flows, raising sustainability concerns despite being in the top 25% in Japan. Recent board discussions on revising financial forecasts may affect future dividends, particularly as profit margins have declined from last year.

- Unlock comprehensive insights into our analysis of Sumitomo Seika Chemicals Company stock in this dividend report.

- Our valuation report unveils the possibility Sumitomo Seika Chemicals Company's shares may be trading at a premium.

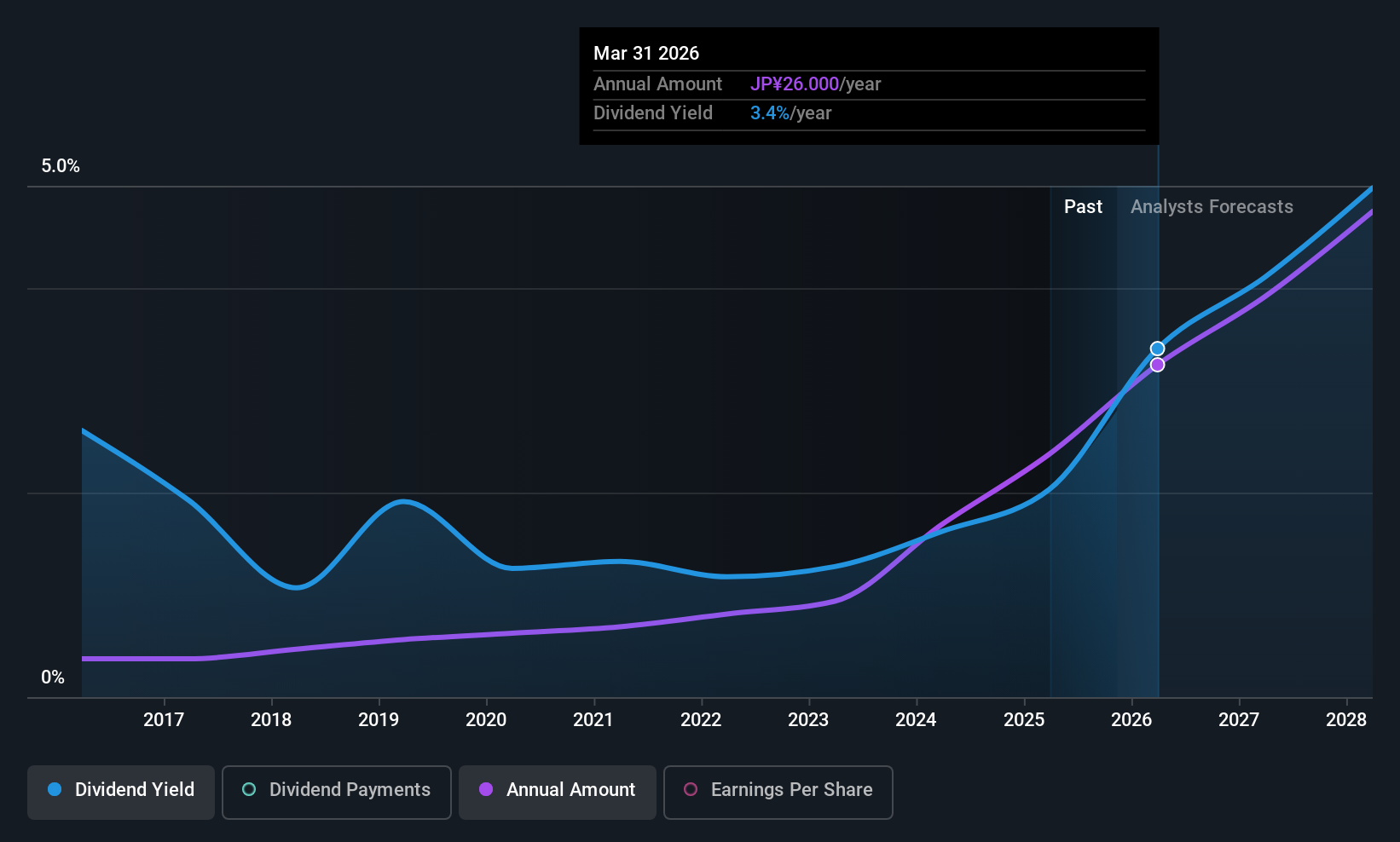

SIGMAXYZ Holdings (TSE:6088)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SIGMAXYZ Holdings Inc. operates in Japan, providing consulting, investment, and M&A advisory services with a market cap of ¥64.12 billion.

Operations: SIGMAXYZ Holdings Inc. generates revenue through its consulting, investment, and M&A advisory operations in Japan.

Dividend Yield: 3.4%

SIGMAXYZ Holdings offers a stable dividend history with a payout ratio of 40.5%, supported by earnings and cash flows. The dividend yield of 3.39% is reliable but below the top tier in Japan. Recent share buybacks, totaling ¥694.58 million, indicate capital flexibility, though lowered earnings guidance due to project delays and subsidiary divestment may impact future dividends despite steady past growth rates and valuations trading below fair value estimates.

- Click to explore a detailed breakdown of our findings in SIGMAXYZ Holdings' dividend report.

- Upon reviewing our latest valuation report, SIGMAXYZ Holdings' share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 1019 Top Asian Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6088

SIGMAXYZ Holdings

Engages in the consulting, investment, and M&A advisory businesses in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives