Will AgeTech and PetTech Advances Redefine Asahi Kasei's Healthcare Strategy for TSE:3407 Investors?

Reviewed by Sasha Jovanovic

- Asahi Kasei recently announced several product advancements, including plans to showcase new health and pet monitoring sensing technologies at CES 2026 and confirmation of Nefecon’s (marketed as TARPEYO in the U.S.) inclusion in the 2025 global KDIGO guidelines for treating IgA nephropathy.

- These initiatives underscore Asahi Kasei’s effort to address demographic trends in health and wellness, with innovative solutions targeting both aging populations and the growing market for pet health technologies.

- We'll explore how the spotlight on AgeTech and PetTech innovations may enhance Asahi Kasei's investment narrative in the evolving healthcare technology sector.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Asahi Kasei's Investment Narrative?

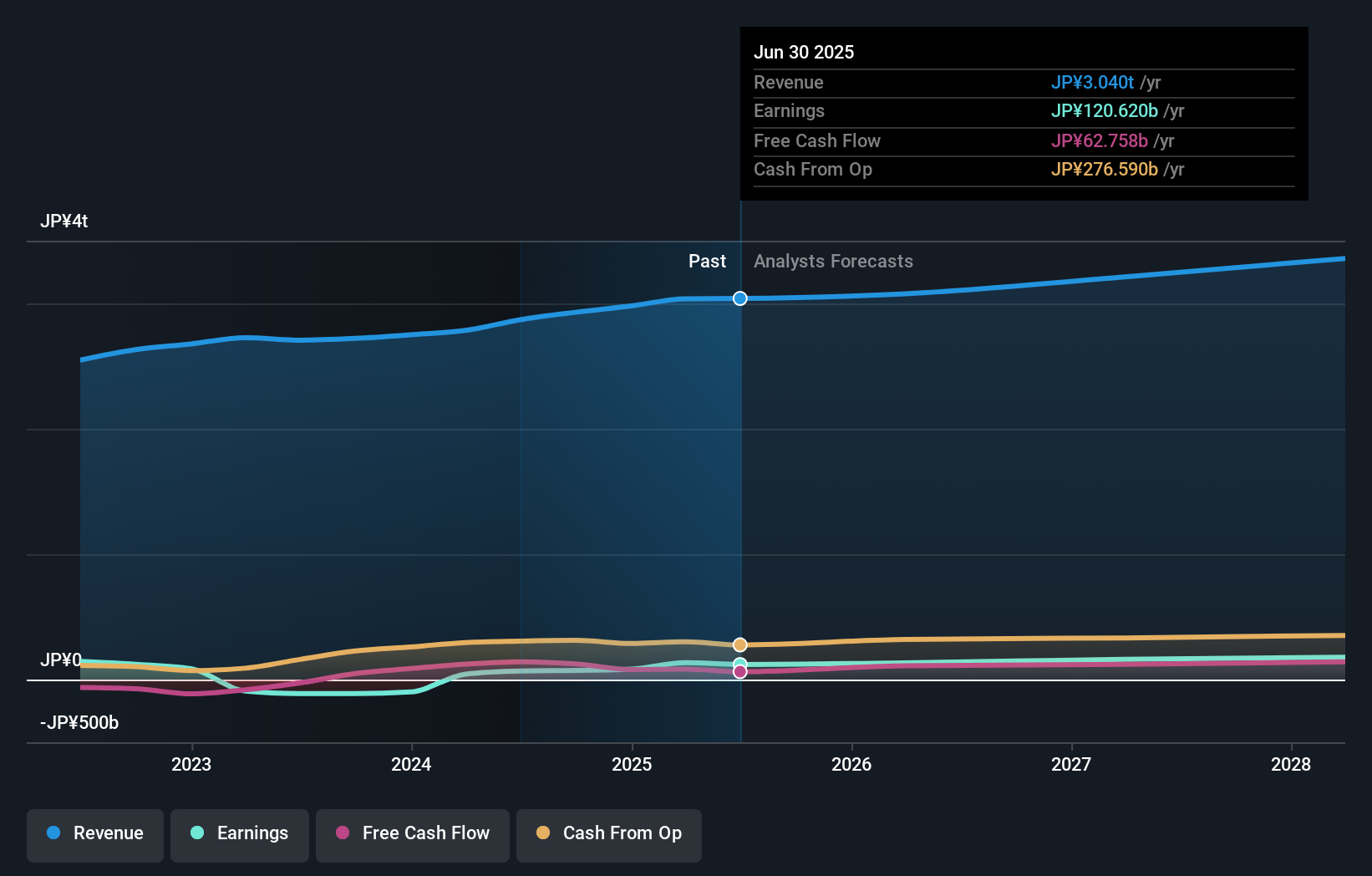

To believe in Asahi Kasei right now, you’d need to see promise in its expanding innovation pipeline and ongoing push into healthcare technology, eco-friendly manufacturing, and advanced materials. The latest announcements, including major AgeTech and PetTech launches at CES 2026 and the headline inclusion of Nefecon in KDIGO’s 2025 guidelines, amplify the company’s profile in growth sectors where demographic trends signal lasting demand. In the short term, these innovations help build the case for Asahi Kasei’s ability to retool its portfolio and offset slower growth in its mature materials businesses, particularly as sector-wide competition and input costs remain visible risks. Share buybacks and steady dividends support near-term returns, but the most important catalysts will likely hinge on how swiftly the new sensing and pharmaceutical products convert attention into meaningful revenue streams. Investors now have to weigh if these advances significantly change the outlook or if much rides on longer lead times for adoption.

Yet, as new healthcare projects ramp up, market adoption timelines could present hurdles investors need to weigh. Asahi Kasei's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Asahi Kasei - why the stock might be worth over 2x more than the current price!

Build Your Own Asahi Kasei Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asahi Kasei research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Asahi Kasei research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asahi Kasei's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives